IRS 1041 - Schedule K-1 2021 free printable template

Show details

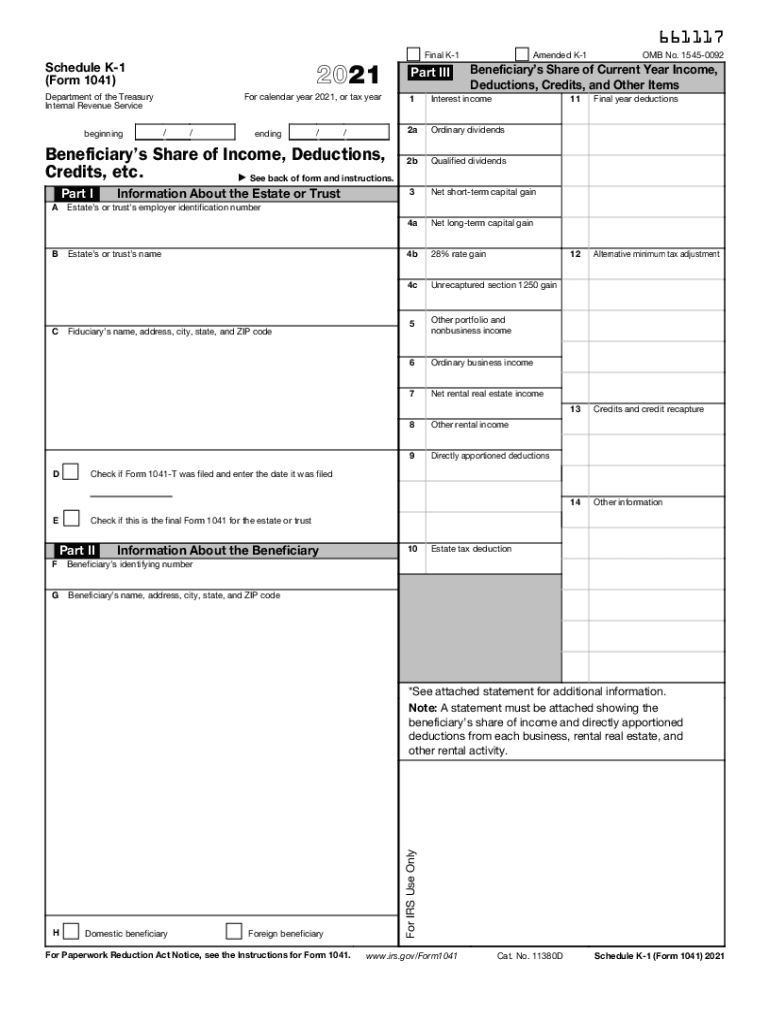

6611172021Schedule K1 (Form 1041) Department of the Treasury Internal Revenue Service beginning calendar year 2021, or tax year//ending//Beneficiaries Share of Income, Deductions, Credits, etc. See

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

How to fill out IRS 1041 - Schedule K-1

Instructions and Help about IRS 1041 - Schedule K-1

How to edit IRS 1041 - Schedule K-1

To edit the IRS 1041 - Schedule K-1 tax form, use tools that support PDF editing, such as pdfFiller. Upload the form to the platform, make your necessary changes, and save the updated document. Once edited, ensure that all information is accurate before proceeding to file or share. Check any related fields that may require adjustment based on your edits.

How to fill out IRS 1041 - Schedule K-1

Filling out the IRS 1041 - Schedule K-1 requires several steps:

01

Obtain the form from the IRS website or a trusted source.

02

Provide the name, address, and Tax Identification Number (TIN) of the estate or trust.

03

Input the beneficiary's information, including their percentage of the income and any deductions.

04

Include any income, deductions, and credits applicable to the beneficiary in the appropriate sections.

05

Sign and date the form before submission.

It is essential to review all instructions associated with the form to ensure compliance with IRS regulations before submission.

About IRS 1041 - Schedule K-1 2021 previous version

What is IRS 1041 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041 - Schedule K-1 2021 previous version

What is IRS 1041 - Schedule K-1?

IRS 1041 - Schedule K-1 is a tax form used to report income, deductions, and credits allocated to beneficiaries of estates and trusts. This form is issued by the fiduciary responsible for managing the estate or trust, providing beneficiaries with necessary information for their individual tax returns. The form ensures that each beneficiary accurately reports their share of income earned from the estate or trust.

What is the purpose of this form?

The purpose of IRS 1041 - Schedule K-1 is to detail each beneficiary’s portion of the estate or trust's income and deductions. The information reported on this form is crucial for beneficiaries to complete their individual income tax returns accurately. Failure to report this income correctly can lead to penalties and interest for underreporting income.

Who needs the form?

Individuals who are beneficiaries of an estate or trust need IRS 1041 - Schedule K-1. This includes anyone who receives distributions from a trust or estate wherein they are entitled to a share of the income. Executors and trustees are responsible for providing this form to the beneficiaries and ensuring its accuracy.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1041 - Schedule K-1 if you do not receive any distributions from the estate or trust during the tax year. Additionally, if the estate or trust had no taxable income or deductions during the year, the form might not be required. Always verify with IRS guidelines or a tax professional to confirm your specific situation.

Components of the form

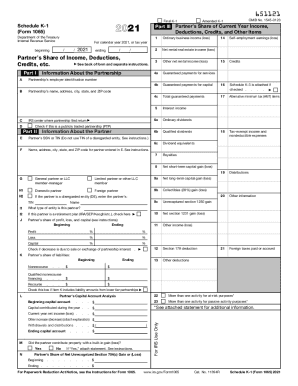

The IRS 1041 - Schedule K-1 includes several key components:

01

Identification information for the estate or trust and the beneficiary.

02

Income details, categorized by different types (e.g., ordinary income, capital gains).

03

Deductions and credits allocated to the beneficiary.

04

Instructions for the beneficiary on reporting income on their personal tax returns.

Understanding these components is essential for accurate completion and filing.

What are the penalties for not issuing the form?

Failure to issue IRS 1041 - Schedule K-1 can result in penalties for the fiduciary responsible for the estate or trust. The IRS may impose fines for late filing or for failing to furnish accurate forms to beneficiaries. Moreover, beneficiaries may face difficulties in completing their tax returns if they do not receive the appropriate K-1 documentation.

What information do you need when you file the form?

When filing IRS 1041 - Schedule K-1, you will need the following information:

01

Your personal details, including name, address, and Social Security Number or TIN.

02

Information about the estate or trust, including its name and identification number.

03

Details of the income, deductions, and credits allocated to you.

04

Any relevant tax documents related to the estate or trust.

Collecting all necessary information ahead of time can streamline the filing process.

Is the form accompanied by other forms?

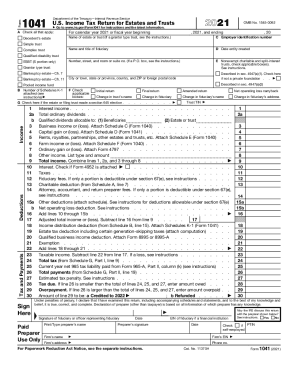

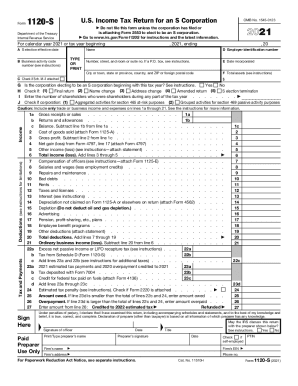

IRS 1041 - Schedule K-1 may be submitted alongside Form 1041, the U.S. Income Tax Return for Estates and Trusts. It is necessary to include this form as part of the overall tax filing for the estate or trust to ensure accurate reporting and compliance with tax regulations.

Where do I send the form?

After completing IRS 1041 - Schedule K-1, it should be sent to each beneficiary for their records. The fiduciary must also retain copies for their records and send Form 1041 to the IRS. Refer to the IRS instructions for the specific mailing address, as it may vary based on the state and whether payments are included.

See what our users say