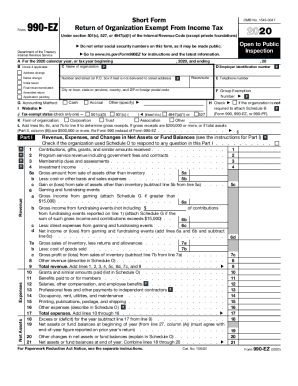

IRS 990-EZ 2021 free printable template

Show details

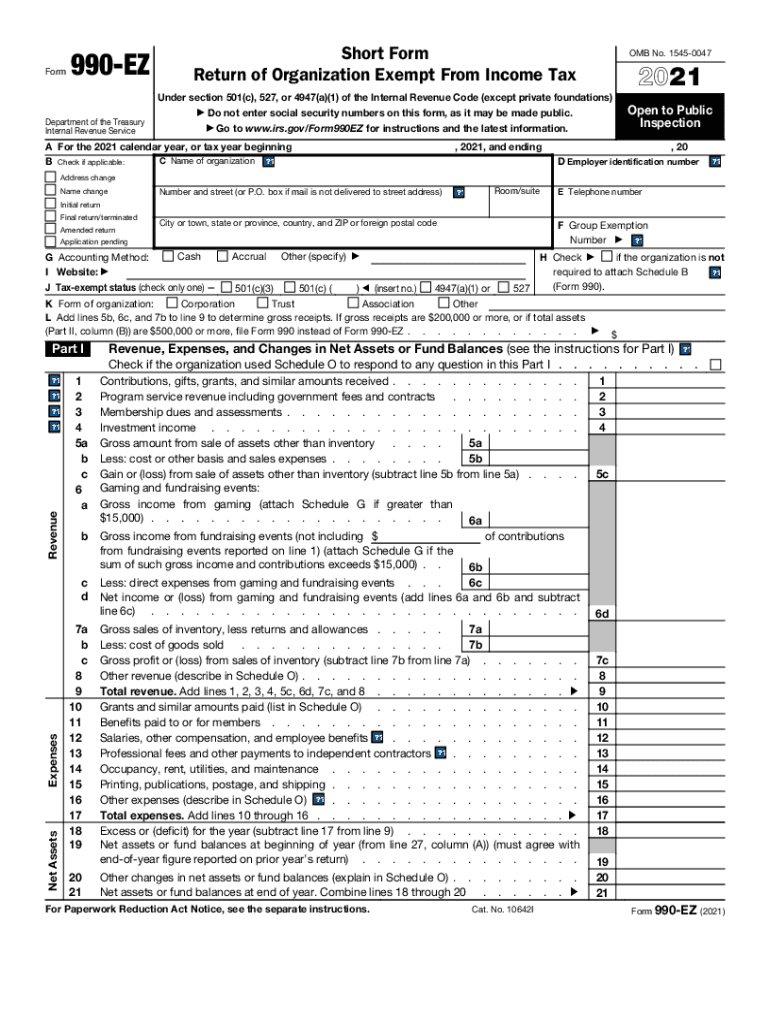

Click on the question mark icons to display help windows. The information provided will enable you to file a more complete return and reduce the chances the IRS will need to contact you. Form990EZShort

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990-EZ

How to edit IRS 990-EZ

How to fill out IRS 990-EZ

Instructions and Help about IRS 990-EZ

How to edit IRS 990-EZ

To edit the IRS 990-EZ form, start by downloading the form from the IRS website or accessing it through a tax preparation platform. Once you have the form, you can fill in the required fields with accurate information. To ensure the form meets IRS standards, check for completeness and clarity. If you are using pdfFiller, you can easily edit, sign, and store your form securely for future reference.

How to fill out IRS 990-EZ

Filling out the IRS 990-EZ form involves a series of steps that require accurate information about your organization. First, gather all financial data and relevant paperwork, such as income statements and balance sheets. Then, follow these steps:

01

Visit the IRS website to download the 990-EZ form or access it through a tax preparation platform.

02

Identify the organizational information needed, including EIN and address.

03

Input financial data accurately under the appropriate sections.

04

Review each section for accuracy before submitting.

Utilize the guidance provided with the form, paying close attention to the instructions for each section to avoid common errors.

About IRS 990-EZ 2021 previous version

What is IRS 990-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990-EZ 2021 previous version

What is IRS 990-EZ?

IRS 990-EZ is a simplified tax form used by certain tax-exempt organizations to report their financial information to the IRS. This form is suitable for organizations that have gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the tax year.

What is the purpose of this form?

The purpose of IRS 990-EZ is to provide the IRS with necessary financial information about tax-exempt organizations. This helps the IRS determine compliance with tax regulations and assess the financial health of these entities. Additionally, it promotes transparency in the grant-making process and ensures that funds are used for intended charitable purposes.

Who needs the form?

Organizations that qualify as tax-exempt under section 501(c)(3) of the Internal Revenue Code and meet the threshold of income and total assets should file IRS 990-EZ. This typically includes smaller charitable organizations, foundations, and certain non-profits that do not exceed the specified financial limits.

When am I exempt from filling out this form?

Organizations are exempt from filing IRS 990-EZ if their gross receipts are normally less than $50,000. Additionally, churches, government entities, and certain other organizations described in the tax code may also be exempt from this filing requirement.

Components of the form

IRS 990-EZ includes several key components, such as organizational information, revenue details, expenses, and a summary of activities. Key sections consist of:

01

Basic organizational details, including name and address.

02

Financial summary reflecting total revenue and expenses.

03

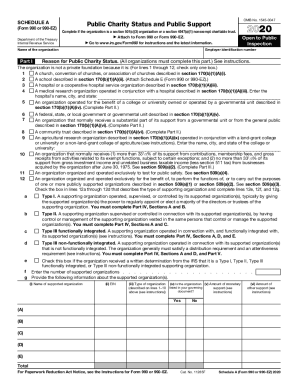

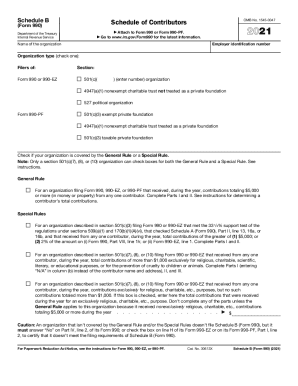

Schedule A, which provides more specific details about an organization's activities and governance.

Due date

The due date for filing IRS 990-EZ is the 15th day of the 5th month after the organization's accounting period ends. Organizations that operate on a calendar year basis must submit the form by May 15. Extensions may be requested, but it is essential to follow IRS guidelines regarding timely filing to avoid penalties.

What payments and purchases are reported?

On IRS 990-EZ, organizations must report various financial transactions, including total revenue, expenses, and net assets. Payments made for services, salaries, and any other significant expenditures should be detailed. Proper record-keeping is crucial to ensure compliance and accurate reporting of financial data.

How many copies of the form should I complete?

Organizations typically need to submit one copy of the IRS 990-EZ form to the IRS. However, it is advisable to retain a copy for their records, as well as provide copies to stakeholders as necessary. Maintaining accurate documentation ensures better compliance and easier access to financial information for future needs.

What are the penalties for not issuing the form?

Failing to file IRS 990-EZ can lead to severe penalties, including fines starting at $20 per day, up to a maximum of $10,500 or 5% of the organization's gross receipts, whichever is less. In addition, prolonged failure to file can result in the loss of tax-exempt status. Organizations should prioritize compliance to avoid these financial repercussions.

What information do you need when you file the form?

When filing IRS 990-EZ, organizations should prepare several key pieces of information, including:

01

EIN (Employer Identification Number) and basic organizational details.

02

Total revenue and detailed expense breakdowns.

03

Details pertaining to any fundraising efforts and contributions received.

Gathering this information beforehand will streamline the filing process and reduce the likelihood of errors.

Is the form accompanied by other forms?

The IRS 990-EZ form may need to be accompanied by additional schedules, such as Schedule A, to provide detailed explanations of the organization’s activities and governance structures. Depending on the nature of the organization's operations, other IRS schedules may also be required to ensure complete reporting.

Where do I send the form?

Organizations must send the completed IRS 990-EZ form to the appropriate address as specified by the IRS based on their location. The instructions included with the form indicate the correct submission address. Ensure that the form is mailed in a timely manner to avoid penalties associated with late filing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to use and the confirmation of reciept when sending a document via email is perfect for sending important documents

allowed me to come back to edit easily, but did not see a e-file or address yet. Thank you

See what our users say