IRS 8824 2005 free printable template

Show details

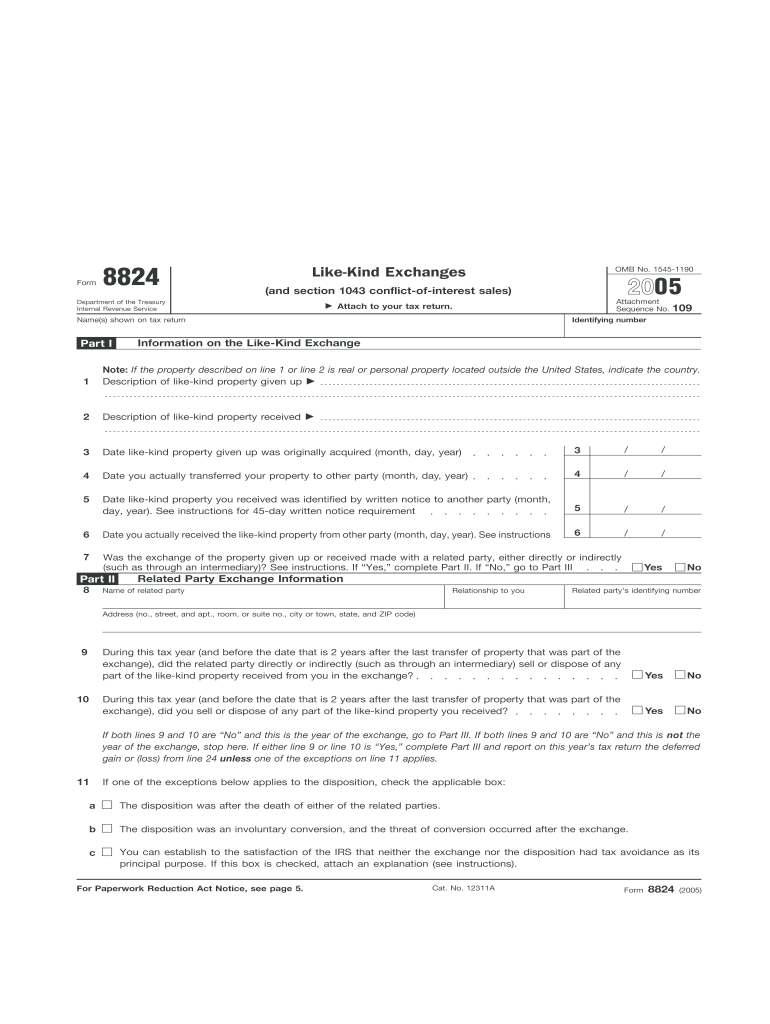

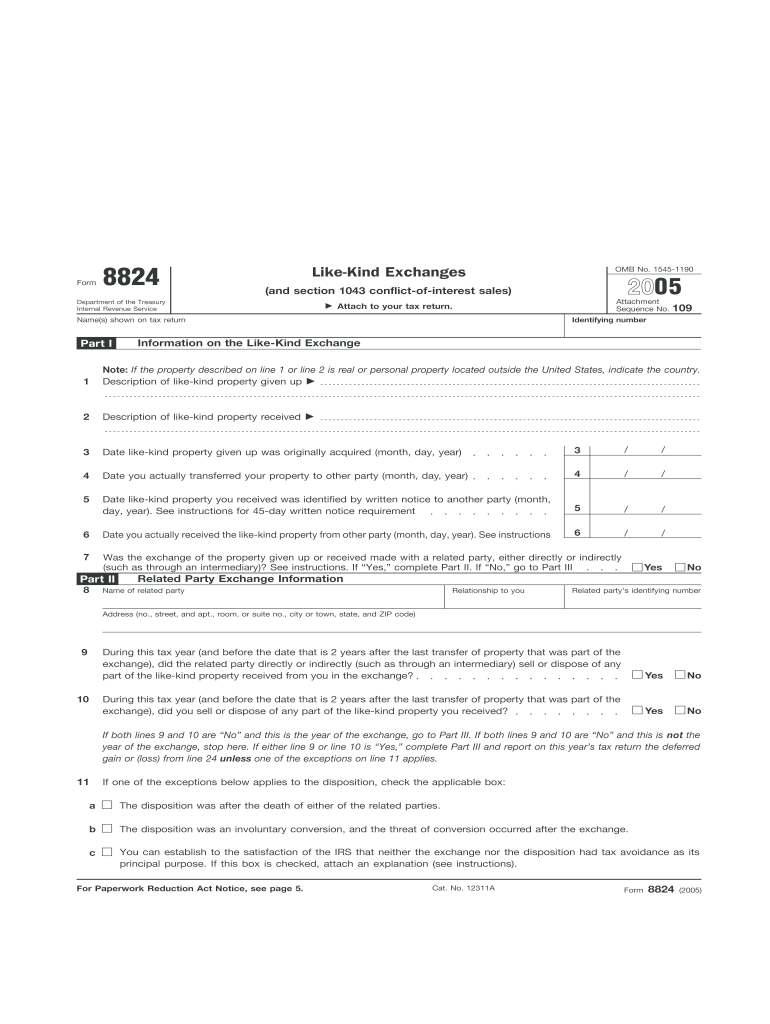

Form

8824

Like-Kind Exchanges

(and section 1043 conflict-of-interest sales)

Attach to your tax return.

OMB No. 1545-1190

2005

Attachment Sequence No. Identifying number

Department of the Treasury

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8824

Edit your IRS 8824 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8824 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8824 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8824

How to fill out IRS 8824

01

Download IRS Form 8824 from the IRS website.

02

Enter your name and taxpayer identification number (TIN) at the top of the form.

03

Fill out Part I to provide information about the like-kind exchange, including details of the property you exchanged and the property you received.

04

Complete Part II to detail the calculation of the gain or loss on the exchange.

05

If you received boot (cash or other property) in the exchange, fill out Part III to report it.

06

Include any additional attachments or supporting documents as required.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submitting it with your tax return.

Who needs IRS 8824?

01

Individuals or businesses that have engaged in a like-kind exchange of real or personal property.

02

Taxpayers who are deferring capital gains taxes by exchanging properties instead of selling them outright.

03

Anyone wanting to report the details of their property exchanges to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I record a 1031 exchange?

Your 1031 exchange must be reported by completing Form 8824 and filing it along with your federal income tax return. If you completed more than one exchange, a different form must be completed for each exchange.

What is the 95% rule in a 1031 exchange?

The 95 Percent Rule The total value of the properties identified CAN exceed 200 percent of the relinquished property's value, BUT you have to close 95% of the aggregate value of all the properties that have been identified.

Does a 1031 get a stepped up basis?

If you are holding investment property that had been part of a 1031 Exchange, upon your death, your heirs get the Stepped-Up Basis. All of the built in gain disappears upon the taxpayer's death. What that means is the value of the property at the date of your death would pass through your estate to your heirs.

Which of the following qualifies as a like-kind exchange?

The correct answer is d) A Dodge Ram pickup truck used in business traded in for a new Ford 250 pickup truck also intended for business use. A like-kind exchange is used to save tax liability in a similar kind of exchange.

Which of the following would not qualify as a 1031 exchange?

Examples of property that does not qualify for tax-deferral treatment under Section 1031: Personal use properties. Property held for sale, such as spec homes, building lots and “flips” Partnership interests.

How do you calculate basis for a new 1031 property?

An Example Calculating the Basis in 1031 Exchange In this case, you calculate your new basis by taking the original property's adjusted basis ($170,000), adding your new mortgage ($250,000), and subtracting the original property's outstanding mortgage ($150,000). This gives you a new tax basis of $270,000.

What qualifies as a like kind exchange?

Properties are of like-kind if they're of the same nature or character, even if they differ in grade or quality. Real properties generally are of like-kind, regardless of whether they're improved or unimproved. For example, an apartment building would generally be like-kind to another apartment building.

How do you calculate adjusted basis for a 1031 exchange?

New Property's Cost Basis The new or acquired property's cost basis must also be calculated. This is just the purchase price plus commissions. We'll use a purchase price of $400,000 plus $15,000 in closing cost for a cost basis of $415,000.

How to complete 8824?

Line 1: List the address or legal description and type of property relinquished (sold). Line 2: List the address or legal description and type of property received. Line 3: List the month, day, year relinquished property was originally acquired. Line 4: List the date relinquished property was transferred to the buyer.

What happens if you don't use all the money in a 1031 exchange?

When you don't exchange all your proceeds, it's called a “partial 1031 exchange.” The portion of the exchange proceeds that are not reinvested is called “boot,” and are subject to capital gains and depreciation recapture taxes. It's important to note that boot can take different forms.

How do you calculate adjusted basis of property?

Your adjusted basis is generally your cost in acquiring your home plus the cost of any capital improvements you made, less casualty loss amounts and other decreases.

What exchanges are not considered a like-kind exchange?

Securities, stocks, bonds, partnership interests, and other financial assets are excluded from the definition of like-kind property. Many people believe that like-kind properties must be of the same size or type to qualify. But that's not true—different assets can be exchanged as long as they qualify.

What is the new basis in a like-kind exchange?

The basis of the property you acquire in a like-kind exchange is generally the same as the basis of the property you transferred.

Who holds the cash in a 1031 exchange?

The qualified intermediary holds the money until you acquire the replacement property and your qualified intermediary will deliver funds to the closing agent.

How do you calculate adjusted basis of like-kind property given up?

It is calculated by taking the property's original cost, adding the costs for improvements and related expenses and subtracting any deductions taken for depreciation and depletion. It is necessary for determining capital gains taxes owed from the sale.

What can you roll a 1031 exchange into?

A 1031 exchange occurs when real estate investors sell one investment property (the relinquished asset) and roll the proceeds over into a “like-kind” property (the replacement asset). By completing exchanges, investors can defer any capital gains liabilities on their profits.

Do I have to spend all the money in a 1031 exchange?

In a standard 1031 exchange, you need to reinvest 100% of the proceeds from the sale of your relinquished property to defer all capital gains taxes. In a partial 1031 exchange, you can decide to keep a portion of the proceeds. This boot amount is taxable, while the money you reinvest is not.

How do I prepare for a 1031 exchange?

How to do a 1031 exchange Step 1: Identify the property you want to sell. Step 2: Identify the property you want to buy. Step 3: Choose a qualified intermediary. Step 4: Decide how much of the sale proceeds will go toward the new property. Step 5: Keep an eye on the calendar. Step 6: Be careful about where the money is.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS 8824?

IRS 8824 is a tax form used to report like-kind exchanges of real estate or personal property under Internal Revenue Code Section 1031.

Who is required to file IRS 8824?

Taxpayers who engage in like-kind exchanges of property must file IRS 8824 to report the transaction.

How to fill out IRS 8824?

To fill out IRS 8824, you need to provide details of the exchanged properties, dates of the exchange, and any gain or loss realized, along with any additional required information.

What is the purpose of IRS 8824?

The purpose of IRS 8824 is to allow taxpayers to defer recognizing gain or loss on the exchange of like-kind properties as per tax regulations.

What information must be reported on IRS 8824?

The information that must be reported on IRS 8824 includes details of the properties exchanged, dates of acquisition and disposition, fair market values, gain or loss realized, and other relevant specifics.

Fill out your IRS 8824 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8824 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.