IRS 8824 2017 free printable template

Show details

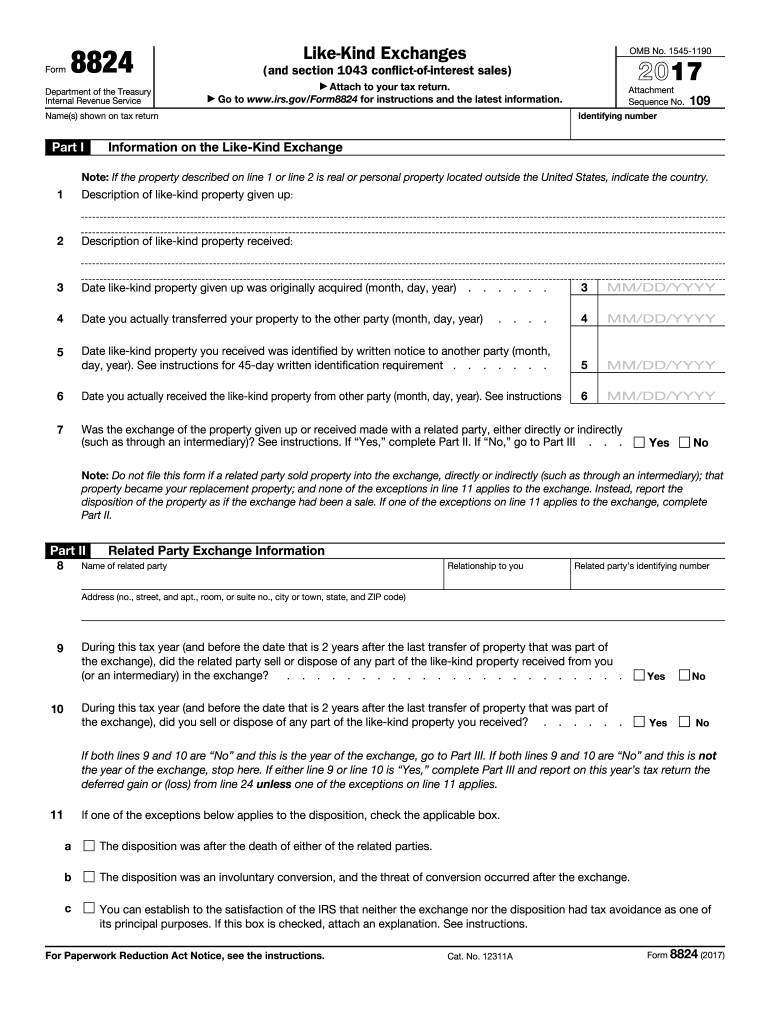

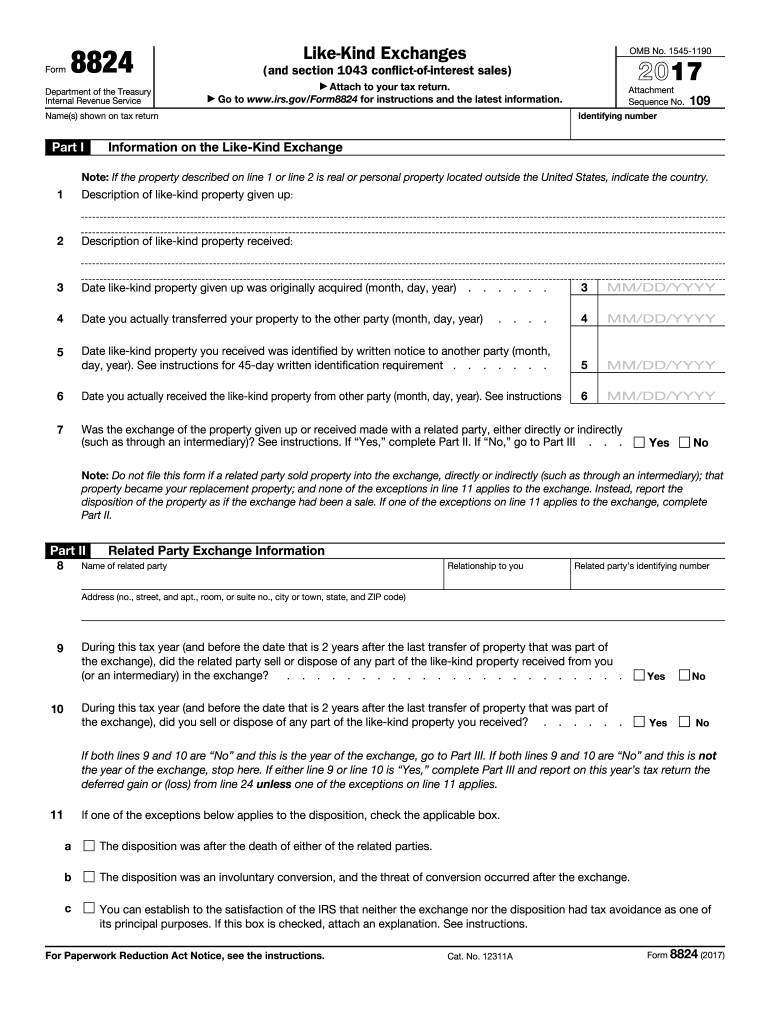

B c You can establish to the satisfaction of the IRS that neither the exchange nor the disposition had tax avoidance as one of its principal purposes. If this box is checked attach an explanation. See instructions. For Paperwork Reduction Act Notice see the instructions. Cat. No. 12311A Form 8824 2017 Page 2 Your social security number Realized Gain or Loss Recognized Gain and Basis of Like-Kind Property Received Caution If you transferred and received a more than one group of like-kind...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8824

Edit your IRS 8824 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8824 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8824 online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 8824. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8824 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8824

How to fill out IRS 8824

01

Obtain IRS Form 8824 from the IRS website or your tax software.

02

Fill out Part I by providing your name, address, and social security number.

03

Complete the sections that detail the like-kind exchange, including the description of the property you are exchanging and the property you are receiving.

04

Fill in the date of the exchange and the fair market value of the properties involved.

05

Indicate any liabilities assumed or relief from liabilities in the transaction.

06

Calculate the gain or loss associated with the exchange and provide the necessary information in Part II.

07

Review your information for accuracy and completeness before submitting it with your tax return.

Who needs IRS 8824?

01

Individuals or businesses that have engaged in a like-kind exchange of property for tax purposes.

02

Taxpayers seeking to defer gains on the sale of business or investment property.

03

Those who have exchanged real estate or other qualifying property.

Fill

form

: Try Risk Free

People Also Ask about

How is depreciation handled in a 1031 exchange?

Types of Depreciation in a 1031 Exchange The adjusted cost basis for the property you sell must be divided by 24.5 years. This rate is your first schedule of depreciation. The remaining cost basis of your replacement property must be divided by 27.5 years — the second schedule.

How do you depreciate property received in a like-kind exchange?

There are two ways to depreciate real estate post 1031 Exchange. Post-1031 exchanges the tax code states that you must split depreciation into two separate schedules as the preferred method. However, investors can opt-out of two schedule depreciation and depreciate the calculated cost basis on a single schedule.

What is the timeline for a 1031 exchange?

Every 1031 exchange is reported to the IRS and must adhere to a specified timeline. The process involves two key deadlines: the first is identifying a new property in written form within 45 days, and the second is obtaining the replacement property within 180 days.

What is the basis of like kind property received?

In the simplest situation, where only like-kind property is exchanged and the taxpayer does not recognize any gain or loss, the basis in the surrendered property carries over to the acquired property. Thus, the basis of the property acquired equals the adjusted basis of the property that was given up.

What is a like kind exchange for depreciation?

Share: A “like-kind exchange,” or “Section 1031 exchange,” allows real estate investors that incur gains on real property sales to reinvest those proceeds and defer the gain—offering an advantageous tax planning strategy for real estate companies.

What is an example of a like-kind exchange depreciation?

For example, a taxpayer sells a commercial building for $500,000 with an adjusted tax basis after depreciation of $150,000. The taxpayer decides to complete a like-kind exchange for this sale. In the like-kind exchange, the taxpayer acquires another commercial building for $550,000, investing an extra $50,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8824 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IRS 8824 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit IRS 8824 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing IRS 8824.

How do I complete IRS 8824 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS 8824. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS 8824?

IRS Form 8824 is used to report Like-Kind Exchanges under Internal Revenue Code Section 1031. This form is necessary when a taxpayer exchanges one property for another property of a similar type.

Who is required to file IRS 8824?

Any taxpayer who engages in a Like-Kind Exchange of real or personal property must file IRS Form 8824 to report the exchange.

How to fill out IRS 8824?

To fill out IRS Form 8824, you need to provide details about the properties exchanged, their fair market values, the dates of the exchanges, and any received or given cash or property.

What is the purpose of IRS 8824?

The purpose of IRS Form 8824 is to report the details of Like-Kind Exchanges that allow taxpayers to defer paying capital gains taxes on the exchange of similar properties.

What information must be reported on IRS 8824?

IRS Form 8824 requires reporting information such as the description of the properties exchanged, the dates of the exchange, the fair market values, and any boot or cash received during the exchange.

Fill out your IRS 8824 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8824 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.