IRS 8992 2021 free printable template

Show details

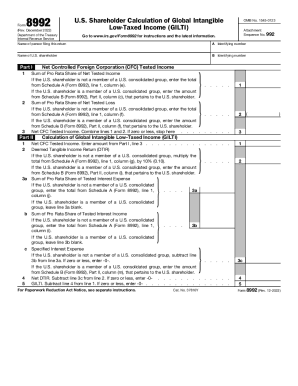

8992Form (Rev. December 2021) Department of the Treasury Internal Revenue Service. S. Shareholder Calculation of Global Intangible Located Income (GILT) OMB No. 15450123 Attachment Sequence No. 992Go

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8992

Edit your IRS 8992 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8992 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8992 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 8992. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8992 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8992

How to fill out IRS 8992

01

Download Form 8992 from the IRS website.

02

Fill out Part I to provide general information about your business.

03

Complete Part II by detailing the amount of the applicable income and verify whether the entity qualifies as a specified foreign corporation.

04

In Part III, calculate the Foreign-Derived Intangible Income (FDII) by completing the required calculations.

05

Review the form for accuracy and completeness.

06

Submit Form 8992 with your tax return.

Who needs IRS 8992?

01

U.S. corporations that have foreign-derived intangible income and want to claim a deduction for it.

02

Entities that want to report income effectively connected with a U.S. trade or business and need to disclose their FDII.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Form 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return. For additional information, see the Instructions for Form 1120-S.

Who is required to file Gilti?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Who needs to file 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return.

What income is subject to Gilti?

GILTI is income earned abroad by controlled CFCs—i.e., controlled subsidiaries of U.S. corporations—from easily movable intangible assets, such as IP rights. The tax on GILTI is intended to discourage moving intangible assets and related profits to countries with tax rates below the 21% U.S. corporate rate.

Who picks up Gilti income?

Each U.S. shareholder (10% or more owner) of a CFC will pick up its pro rata share of the GILTI inclusion items (tested income, etc.)

Who must file 1118?

Form 1118 lets foreign corporations report the income they already owe taxes on to a foreign government so that it can be exempted from US taxation. This credit only applies to income taxes, not value-added taxes or sales taxes—even in countries where a value-added tax is used as a substitute for income taxes.

What is Form 8992 for?

More In Forms and Instructions U.S. shareholders of controlled foreign corporations use Form 8992 and Schedule A to figure their global intangible low-taxed income inclusions under section 951A and its related regulations.

Does Gilti tax apply to individuals?

The GILTI rules impact both U.S. individual shareholders and U.S. corporate owners. “In this scenario, a U.S. shareholder is a person who owns directly, indirectly, or constructively 10% or more of the vote or value of a foreign corporation.

Who needs to pay Gilti tax?

GILTI is foreign income your CFC earns on intangible assets, such as patents, copyrights, and trademarks. You're obligated to pay GILTI if you own at least 10% of a CFC, and if your company is a CFC (majority-owned or controlled by US taxpayers).

WHO reports Gilti income?

The GILTI rules (contained in the new section 951A) require a 10 percent U.S. shareholder of a controlled foreign corporation (CFC) to include in current income the shareholder's pro rata share of the GILTI income of the CFC. The GILTI rules apply to C corporations, S corporations, partnerships and individuals.

Who needs to file Form 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return. For additional information, see the Instructions for Form 1120-S.

Who files Form 8992?

U.S. shareholders of controlled foreign corporations use Form 8992 and Schedule A to figure their global intangible low-taxed income inclusions under section 951A and its related regulations.

Who Must File Gilti tax?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Who needs to file Gilti?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Where do I report Gilti income?

U.S. shareholders must file Schedule I-1 (Form 5471), Information for Global Intangible Low-Taxed Income and Form 8992, U.S Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI) , to provide the information needed to determine the U.S. shareholder's GILTI inclusion amount for a tax year.

What is specified interest expense for Gilti?

Specified interest expense includes the interest expense of all CFCs, including those with a tested loss. A U.S. shareholder of a CFC that owns stock of the CFC within the meaning of IRC 958(a) must include in gross income its GILTI for the taxable year.

Do individuals file Form 8992?

Who Needs To File Form 8992. Any U.S. shareholder of one or more CFCs that must take into account its pro rata share of the “tested income” or “tested loss “of the CFC(s) in determining the U.S. shareholder's GILTI inclusion, if any, under section 951A must file the Form 8992.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8992 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IRS 8992 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an eSignature for the IRS 8992 in Gmail?

Create your eSignature using pdfFiller and then eSign your IRS 8992 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I fill out IRS 8992 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 8992. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS 8992?

IRS Form 8992 is used to report the computation of the foreign-derived intangible income (FDII) and the global intangible low-taxed income (GILTI) for certain U.S. shareholders of controlled foreign corporations (CFCs).

Who is required to file IRS 8992?

U.S. shareholders of controlled foreign corporations (CFCs) who are required to report their foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI) must file IRS Form 8992.

How to fill out IRS 8992?

To fill out IRS Form 8992, gather relevant financial information from the CFC, including income, deductions, and the basis of its assets. Follow the form's instructions to calculate FDII and GILTI, completing the required sections accurately and attaching any necessary statements.

What is the purpose of IRS 8992?

The purpose of IRS Form 8992 is to ensure that U.S. shareholders of CFCs properly report their FDII and GILTI, which are critical components of the U.S. tax code aimed at encouraging multinational corporations to keep their intangible income in the U.S.

What information must be reported on IRS 8992?

Information that must be reported on IRS Form 8992 includes calculations of foreign-derived intangible income (FDII), global intangible low-taxed income (GILTI), the relevant gross income from foreign sources, and any applicable deductions that affect the computations.

Fill out your IRS 8992 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8992 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.