IRS 8992 2022-2025 free printable template

Show details

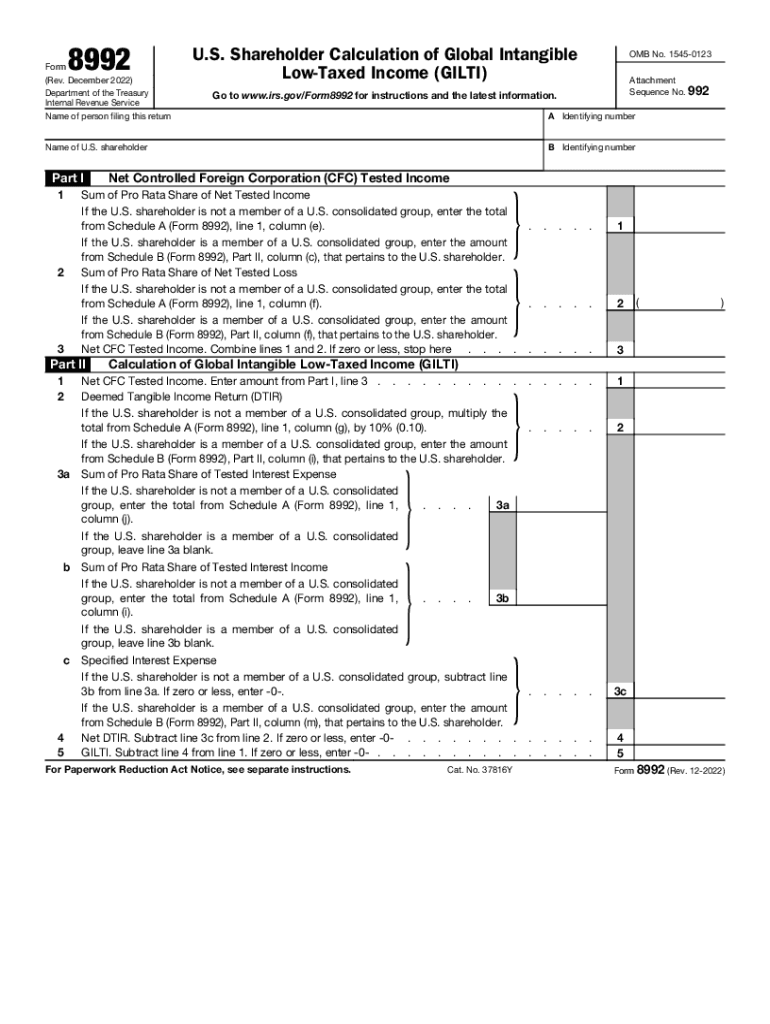

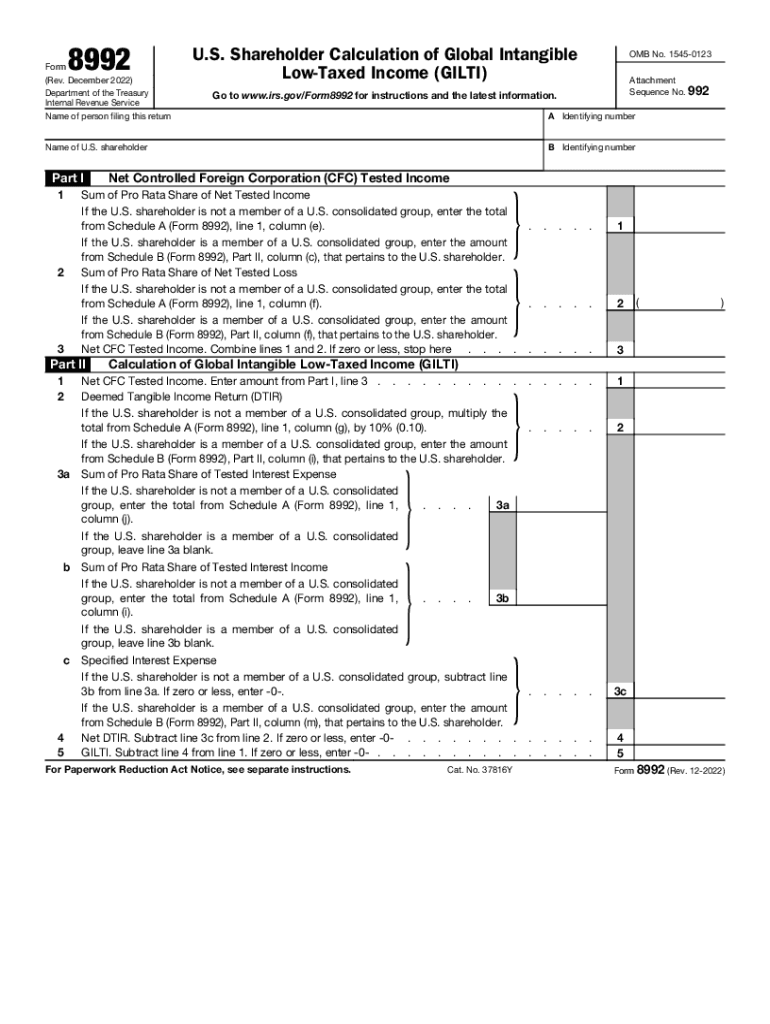

8992Form (Rev. December 2022) Department of the Treasury Internal Revenue Service. S. Shareholder Calculation of Global Intangible Located Income (GILT)OMB No. 15450123 Attachment Sequence No. 992Go

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign calculation gilti form

Edit your irs 8992 2022-2025 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 8992 2022-2025 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs 8992 2022-2025 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs 8992 2022-2025 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8992 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 8992 2022-2025 form

How to fill out IRS 8992

01

Download IRS Form 8992 from the IRS website.

02

Provide your name and the name of your business at the top of the form.

03

Fill in your Employer Identification Number (EIN) in the designated area.

04

Complete Part I to calculate your Global Intangible Low-Taxed Income (GILTI), including information about your controlled foreign corporations (CFCs).

05

In Part II, determine your section 250 deduction related to GILTI.

06

Review the instructions for any specific adjustments that may apply to your situation.

07

Make sure to double-check all details for accuracy before filing.

08

Submit the completed form along with your tax return.

Who needs IRS 8992?

01

U.S. taxpayers who have foreign subsidiaries or controlled foreign corporations (CFCs).

02

Businesses that are subject to GILTI provisions under the Tax Cuts and Jobs Act.

03

Companies looking to claim the section 250 deduction related to foreign income.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Form 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return. For additional information, see the Instructions for Form 1120-S.

Who is required to file Gilti?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Who needs to file 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return.

What income is subject to Gilti?

GILTI is income earned abroad by controlled CFCs—i.e., controlled subsidiaries of U.S. corporations—from easily movable intangible assets, such as IP rights. The tax on GILTI is intended to discourage moving intangible assets and related profits to countries with tax rates below the 21% U.S. corporate rate.

Who picks up Gilti income?

Each U.S. shareholder (10% or more owner) of a CFC will pick up its pro rata share of the GILTI inclusion items (tested income, etc.)

Who must file 1118?

Form 1118 lets foreign corporations report the income they already owe taxes on to a foreign government so that it can be exempted from US taxation. This credit only applies to income taxes, not value-added taxes or sales taxes—even in countries where a value-added tax is used as a substitute for income taxes.

What is Form 8992 for?

More In Forms and Instructions U.S. shareholders of controlled foreign corporations use Form 8992 and Schedule A to figure their global intangible low-taxed income inclusions under section 951A and its related regulations.

Does Gilti tax apply to individuals?

The GILTI rules impact both U.S. individual shareholders and U.S. corporate owners. “In this scenario, a U.S. shareholder is a person who owns directly, indirectly, or constructively 10% or more of the vote or value of a foreign corporation.

Who needs to pay Gilti tax?

GILTI is foreign income your CFC earns on intangible assets, such as patents, copyrights, and trademarks. You're obligated to pay GILTI if you own at least 10% of a CFC, and if your company is a CFC (majority-owned or controlled by US taxpayers).

WHO reports Gilti income?

The GILTI rules (contained in the new section 951A) require a 10 percent U.S. shareholder of a controlled foreign corporation (CFC) to include in current income the shareholder's pro rata share of the GILTI income of the CFC. The GILTI rules apply to C corporations, S corporations, partnerships and individuals.

Who needs to file Form 8992?

An S corporation that elects to be treated as an entity under Notice 2020-69 must complete Form 8992 and Schedule A (Form 8992) and attach them to its Form 1120-S by the due date (including extensions) for that return. For additional information, see the Instructions for Form 1120-S.

Who files Form 8992?

U.S. shareholders of controlled foreign corporations use Form 8992 and Schedule A to figure their global intangible low-taxed income inclusions under section 951A and its related regulations.

Who Must File Gilti tax?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Who needs to file Gilti?

Form 8992 & Schedule A for GILTI It is important to note that not all US shareholders with foreign corporations will have to calculate GILTI as part of their U.S. tax return. Rather, it is limited to shareholders who own Controlled Foreign Corporations or CFC — and meet other requirements as well.

Where do I report Gilti income?

U.S. shareholders must file Schedule I-1 (Form 5471), Information for Global Intangible Low-Taxed Income and Form 8992, U.S Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI) , to provide the information needed to determine the U.S. shareholder's GILTI inclusion amount for a tax year.

What is specified interest expense for Gilti?

Specified interest expense includes the interest expense of all CFCs, including those with a tested loss. A U.S. shareholder of a CFC that owns stock of the CFC within the meaning of IRC 958(a) must include in gross income its GILTI for the taxable year.

Do individuals file Form 8992?

Who Needs To File Form 8992. Any U.S. shareholder of one or more CFCs that must take into account its pro rata share of the “tested income” or “tested loss “of the CFC(s) in determining the U.S. shareholder's GILTI inclusion, if any, under section 951A must file the Form 8992.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs 8992 2022-2025 form to be eSigned by others?

When you're ready to share your irs 8992 2022-2025 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the irs 8992 2022-2025 form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign irs 8992 2022-2025 form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit irs 8992 2022-2025 form on an Android device?

You can make any changes to PDF files, like irs 8992 2022-2025 form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is IRS 8992?

IRS 8992, also known as the 'University of Massachusetts Tax Form 8992,' is used by certain foreign corporations to calculate and report their global intangible low-taxed income (GILTI) and the corresponding deductions.

Who is required to file IRS 8992?

Entities that are foreign corporations with U.S. shareholders and income classified as GILTI must file IRS 8992.

How to fill out IRS 8992?

To complete IRS 8992, a corporation must provide information about its income, compute its GILTI, and indicate any relevant deductions based on the prescribed instructions and worksheets.

What is the purpose of IRS 8992?

The purpose of IRS 8992 is to determine the amount of GILTI for U.S. shareholders and to enable corporations to calculate related deductions that affect their U.S. tax liability.

What information must be reported on IRS 8992?

The information that must be reported on IRS 8992 includes details about the foreign corporation's income, deductions, GILTI computation, and any foreign taxes paid or accrued.

Fill out your irs 8992 2022-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 8992 2022-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.