Get the free Credit and Credit Administration LatestPDFEarnings ...

Show details

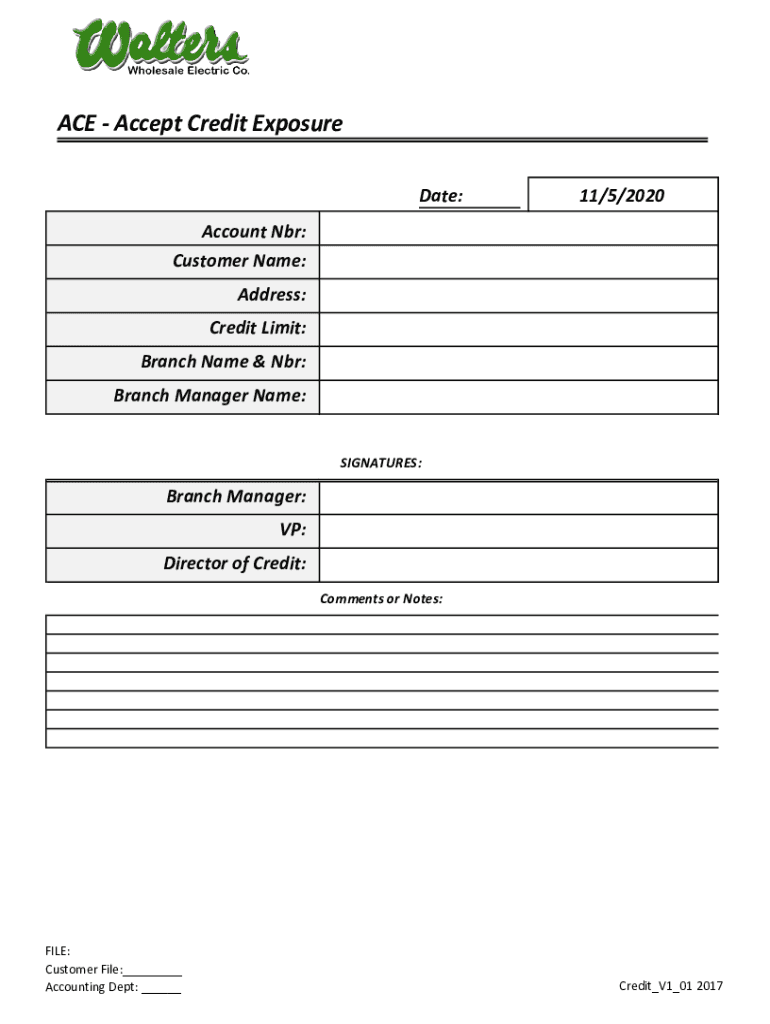

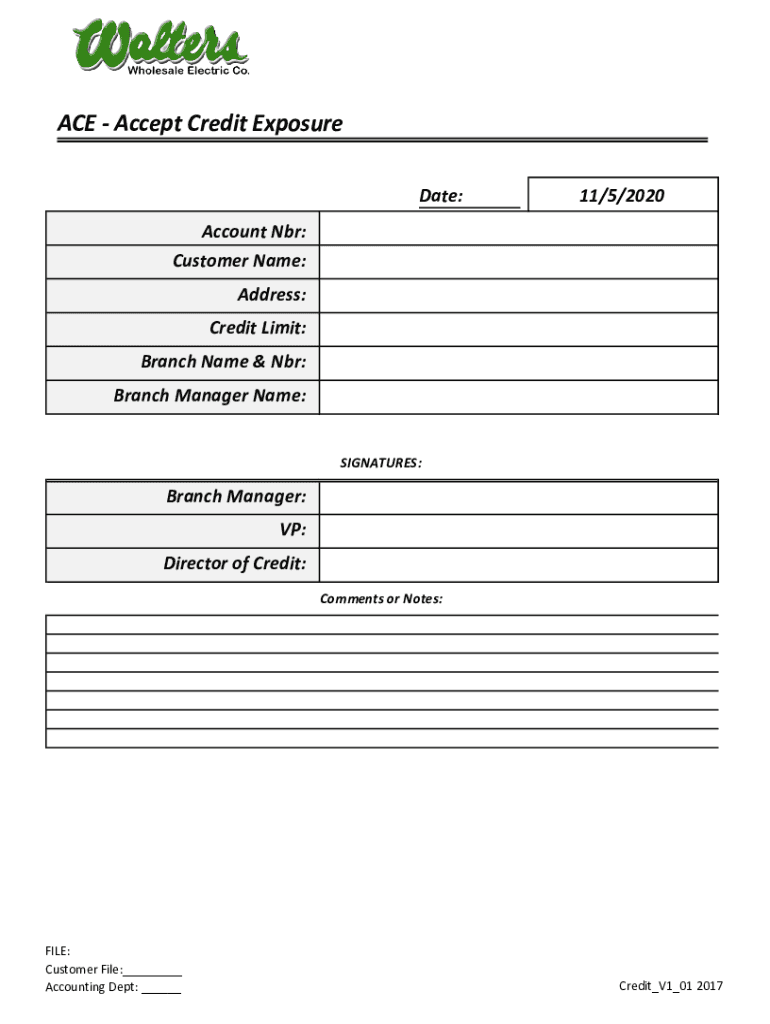

ACE Accept Credit Exposure Date:11/5/2020Account NBR: Customer Name: Address: Credit Limit: Branch Name & NBR: Branch Manager Name: SIGNATURES:Branch Manager: VP: Director of Credit: Comments or Notes:FILE:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and credit administration

Edit your credit and credit administration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and credit administration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit and credit administration online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit and credit administration. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and credit administration

How to fill out credit and credit administration

01

To fill out a credit application, follow these steps:

1. Start by gathering all the necessary documents such as proof of income, identification, and address verification.

02

Visit the website or visit the bank to obtain the credit application form.

03

Carefully fill out the application form with accurate information such as personal details, employment history, and financial information.

04

Attach the required supporting documents along with the application form.

05

Review the application form to ensure all the information is correct and complete.

06

Submit the filled-out application form and supporting documents to the designated authority.

07

To administer credit, follow these steps:

1. Set up a credit administration system to track and manage all credit-related activities.

08

Monitor and assess the creditworthiness of borrowers by reviewing their financial history, credit scores, and repayment records.

09

Analyze and evaluate the credit risk associated with each borrower or potential borrower.

10

Determine the terms and conditions of credit, including interest rates, repayment schedules, and collateral requirements.

11

Disburse the approved credit amount to the borrower.

12

Regularly review and update the credit administration procedures to ensure compliance with regulations and minimize risks.

Who needs credit and credit administration?

01

Credit and credit administration are needed by individuals or businesses who require financial assistance for various purposes such as purchasing a home or car, funding education, starting or expanding a business, or managing cash flow.

02

Credit administration is specifically required by financial institutions, banks, and lending organizations to assess and manage credit risks associated with borrowers and ensure the proper functioning of credit operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit and credit administration from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your credit and credit administration into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute credit and credit administration online?

Filling out and eSigning credit and credit administration is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out credit and credit administration on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your credit and credit administration. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is credit and credit administration?

Credit refers to the ability of a customer to obtain goods or services before payment, based on the trust that payment will be made in the future. Credit administration involves the management of credit policies to ensure timely collection of payments.

Who is required to file credit and credit administration?

Businesses that offer credit to customers or clients are required to file credit and credit administration.

How to fill out credit and credit administration?

Credit and credit administration forms can be filled out online or in person, providing information about the credit policies of a business and the procedures for collecting payments.

What is the purpose of credit and credit administration?

The purpose of credit and credit administration is to ensure that businesses have efficient processes in place for extending credit to customers and collecting payments. This helps to maintain a healthy cash flow.

What information must be reported on credit and credit administration?

Information such as credit policies, credit limits, terms of repayment, payment procedures, and collection practices must be reported on credit and credit administration forms.

Fill out your credit and credit administration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Credit Administration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.