MO DoR 2827 2021 free printable template

Show details

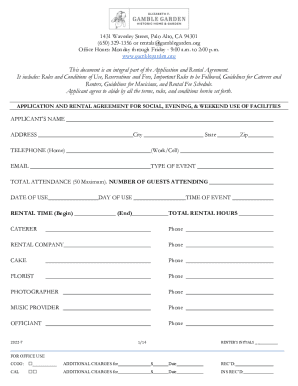

Print Forrest Formulas print on white paper onlyDepartment Use Only (MM/DD/BY)Form2827Power of AttorneyTaxpayer MissouriTaxpayer Federal I.D. NumberEmployer I.D. Number×14504010001* 14504010001Taxpayer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 2827

Edit your MO DoR 2827 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 2827 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR 2827 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO DoR 2827. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 2827 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 2827

How to fill out MO DoR 2827

01

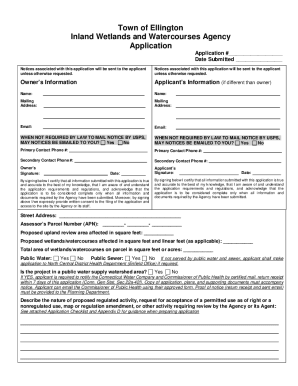

Begin by obtaining the MO DoR 2827 form from the official Department of Revenue website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal details, including name, address, and contact information at the top of the form.

04

Provide your Social Security Number or Tax Identification Number as required.

05

Input the specific tax year for which you are filing the form.

06

Follow the sections to report your income, deductions, and any applicable tax credits.

07

Review the completed sections to ensure accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the form via mail or in-person as instructed to the appropriate department.

Who needs MO DoR 2827?

01

Individuals or businesses that need to report income or deductions for state tax purposes in Missouri.

02

Taxpayers who are applying for tax credits or seek to amend prior tax filings.

03

Residents of Missouri who meet the criteria for filing based on their income levels and tax obligations.

Instructions and Help about MO DoR 2827

Fill

form

: Try Risk Free

People Also Ask about

How does power of attorney work in Missouri?

Under Missouri law, and the law of many other states, a power of attorney with proper wording may be made “durable.” This means that the power of the agent to act on the principal's behalf continues despite the principal's incapacity, whether or not a court decrees the principal to be incapacitated.

Why do I need a Missouri tax ID number?

Missouri businesses must obtain identification numbers to use in their compliance with Missouri tax responsibilities. These numbers and the certificates are used to prove eligibility to make sales tax-exempted purchases allowed under state law.

How much does it cost to get a power of attorney in Missouri?

On average, what would it typically cost for me to get a Power of Attorney form in Missouri? The cost of hiring a law firm to write a Power of Attorney can add up to anywhere from $200 to $500.

Is Missouri tax ID the same as EIN?

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

Is a Missouri tax ID and an EIN the same thing?

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

Do I need a Missouri tax ID number for my business?

Employer Withholding Tax - Every employer maintaining an office or transacting any business within the state of Missouri and making payment of wages to a resident or nonresident individual must obtain a Missouri Employer Tax Identification Number.

What is my Missouri tax ID?

Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes and is included on your sales tax license. Your PIN is a 4 digit number located on the cover of your voucher booklet or return.

Can I do power of attorney myself?

Register a lasting power of attorney If you're the donor and you still have mental capacity, you can apply to register the LPA yourself. The person named as your attorney can also apply to register the LPA. They can do this at any time, whether you have lost mental capacity or not.

Does Missouri require state tax ID number?

Missouri businesses must obtain identification numbers to use in their compliance with Missouri tax responsibilities. These numbers and the certificates are used to prove eligibility to make sales tax-exempted purchases allowed under state law.

Does a power of attorney need to be recorded in Missouri?

A durable power of attorney does not have to be recorded to be valid and binding between the principal and attorney in fact or between the principal and third persons, except to the extent that recording may be required for transactions affecting real estate under sections 442.360 and 442.370.

How long does it take to get a Missouri tax ID number?

Your tax number will be issued within 10 business days from the date we receive your properly completed application; in the case of a Retail Sales Tax or Vendor's Use Tax license the bond is a part of the complete application.

How do I file a power of attorney in Missouri?

Steps for Making a Financial Power of Attorney in Missouri Create the POA Using a Form, Software or an Attorney. Sign the POA in the Presence of a Notary Public. Store the Original POA in a Safe Place. Give a Copy to Your Agent or Attorney-in-Fact. File a Copy With the Recorder of Deeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MO DoR 2827 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign MO DoR 2827 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out the MO DoR 2827 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MO DoR 2827 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out MO DoR 2827 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MO DoR 2827. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MO DoR 2827?

MO DoR 2827 is a form used for reporting specific financial or operational information by businesses in Missouri.

Who is required to file MO DoR 2827?

Businesses operating in Missouri that meet certain criteria are required to file MO DoR 2827.

How to fill out MO DoR 2827?

To fill out MO DoR 2827, businesses should gather required information, complete all sections of the form accurately, and submit it by the designated deadline.

What is the purpose of MO DoR 2827?

The purpose of MO DoR 2827 is to collect data for regulatory and statistical purposes, ensuring transparency and compliance within the business sector.

What information must be reported on MO DoR 2827?

The information required on MO DoR 2827 typically includes business identification details, financial information, and operational metrics.

Fill out your MO DoR 2827 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 2827 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.