Get the free pennsylvania historic preservation tax credit program

Show details

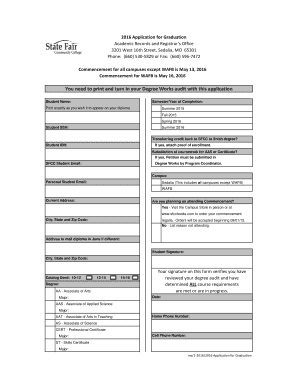

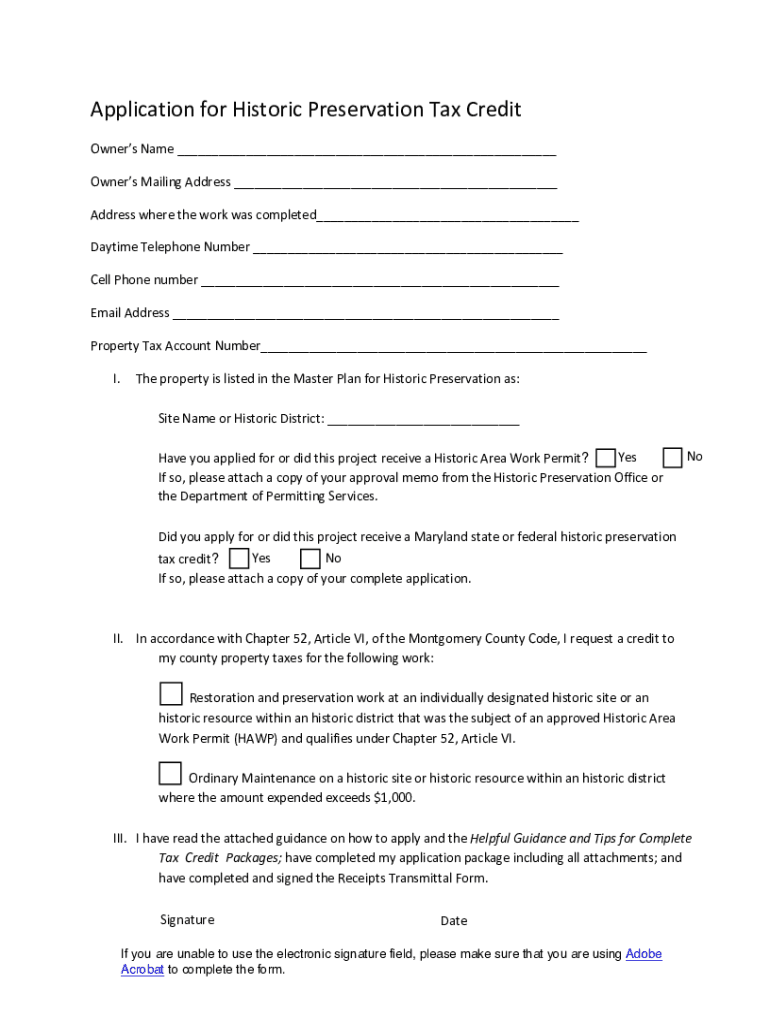

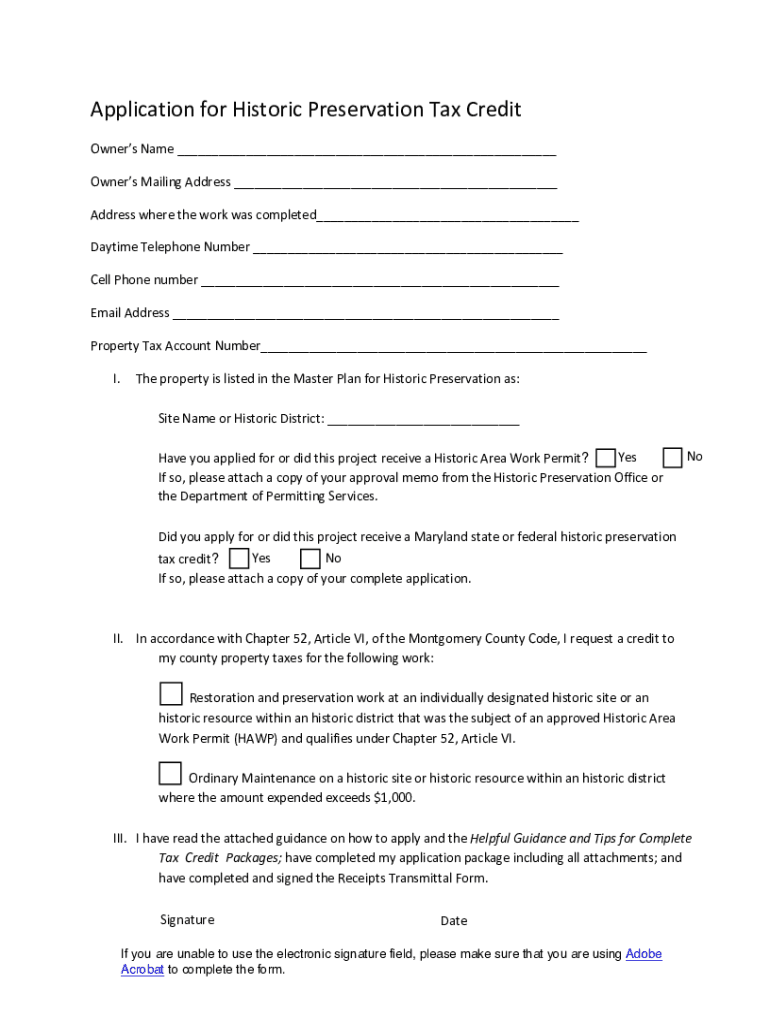

Application for Historic Preservation Tax Credit OwnersName OwnersMailingAddress Addresswheretheworkwascompleted DaytimeTelephoneNumber Cellphone number Misaddress PropertyTaxAccountNumber I. ThepropertyislistedintheMasterPlanforHistoricPreservationas:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pennsylvania historic preservation tax

Edit your pennsylvania historic preservation tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pennsylvania historic preservation tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pennsylvania historic preservation tax online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pennsylvania historic preservation tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pennsylvania historic preservation tax

How to fill out pennsylvania historic preservation tax

01

Obtain the Pennsylvania Historic Preservation Tax Credit Application form from the Pennsylvania Historical and Museum Commission website.

02

Fill out the general information section of the application, including the name of the property, location, owner information, and project description.

03

Provide detailed information about the historic significance of the property and how the proposed project will contribute to its preservation.

04

Submit any supporting documentation, such as photographs, historic research, or architectural plans, that demonstrate the need for the tax credit.

05

Calculate the eligible project costs and the estimated tax credit amount using the guidelines provided in the application form.

06

Attach any necessary financial statements or documents that justify the project costs.

07

Sign and date the application form, and make sure all required fields are completed.

08

Submit the completed application along with the required application fee to the Pennsylvania Historical and Museum Commission.

09

Await the review and evaluation of your application by the Commission.

10

If approved, you will receive a tax credit certificate that can be used to offset your Pennsylvania state tax liability. Make sure to consult with a tax professional to understand how to apply the tax credit correctly.

Who needs pennsylvania historic preservation tax?

01

Property owners in Pennsylvania who own historic properties and are undertaking preservation projects can benefit from the Pennsylvania Historic Preservation Tax Credit.

02

Developers, businesses, and organizations involved in the rehabilitation or renovation of historic properties may also need to apply for this tax credit.

03

Individuals or entities with a vested interest in preserving Pennsylvania's historic resources and heritage may advocate for the use of the tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pennsylvania historic preservation tax?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the pennsylvania historic preservation tax in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit pennsylvania historic preservation tax in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing pennsylvania historic preservation tax and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the pennsylvania historic preservation tax in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your pennsylvania historic preservation tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is pennsylvania historic preservation tax?

The Pennsylvania Historic Preservation Tax provides tax incentives for the restoration and preservation of historic properties in Pennsylvania.

Who is required to file pennsylvania historic preservation tax?

Property owners who plan to rehabilitate a historic property in Pennsylvania may be required to file for the tax credit.

How to fill out pennsylvania historic preservation tax?

To fill out the Pennsylvania Historic Preservation Tax, property owners must provide information about the historic property, rehabilitation costs, and other required details on the tax form.

What is the purpose of pennsylvania historic preservation tax?

The purpose of the Pennsylvania Historic Preservation Tax is to encourage the preservation and restoration of historic properties by providing tax incentives to property owners.

What information must be reported on pennsylvania historic preservation tax?

Property owners must report information such as the historic property's address, rehabilitation costs, project timeline, and any other relevant details on the Pennsylvania Historic Preservation Tax form.

Fill out your pennsylvania historic preservation tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pennsylvania Historic Preservation Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.