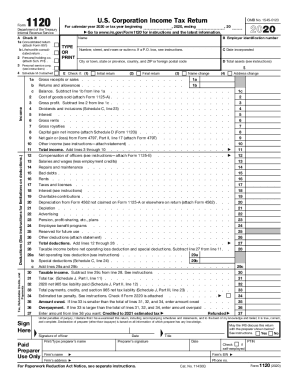

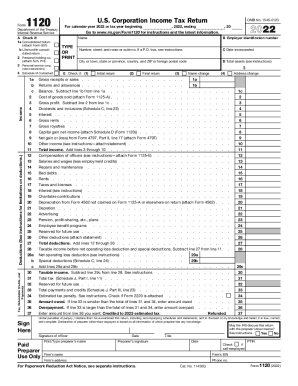

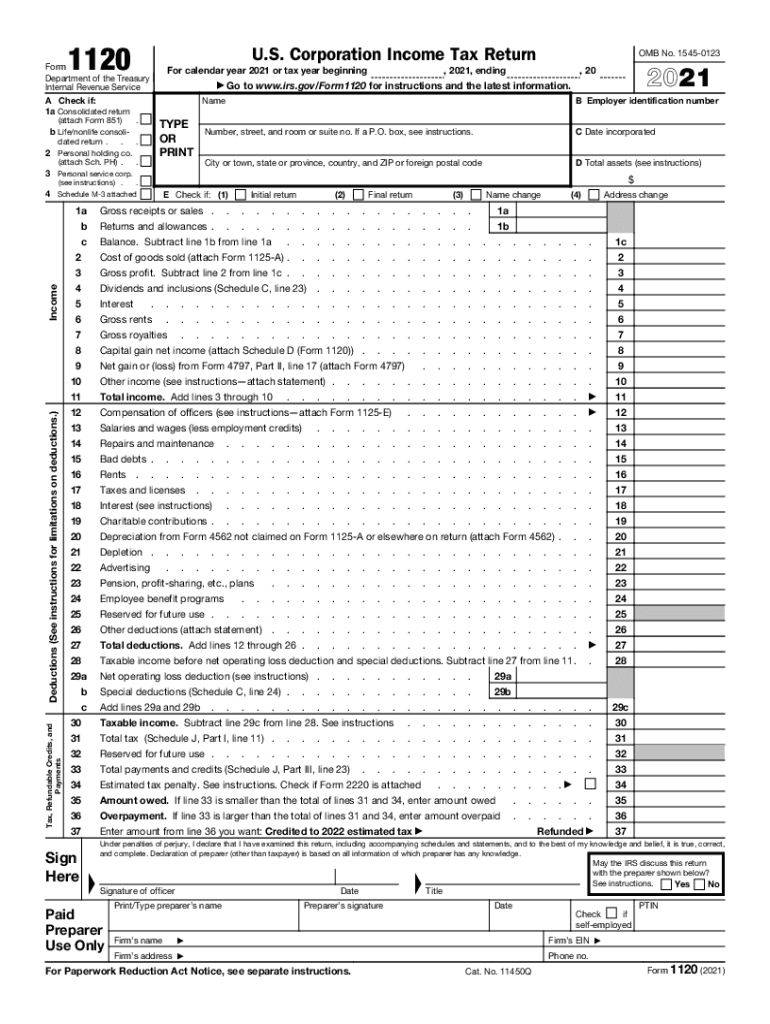

IRS 1120 2021 free printable template

FAQ about IRS 1120

What should you do if you need to amend an IRS 1120?

If you need to correct errors on a previously filed IRS 1120, you should file Form 1120-X, Amended U.S. Corporation Income Tax Return. This form allows you to make necessary updates such as correcting income, deductions, or credits. Be sure to include any supporting documentation that justifies the changes you are making to avoid delays.

How can you track the status of your filed IRS 1120?

Once you've filed your IRS 1120, you can check the status through the IRS online portal or by calling their customer service. Tracking is important, especially if you filed electronically, as you may encounter rejection codes that require action. Always keep your confirmation number handy for smoother inquiries.

What are common errors to avoid when filing IRS 1120?

Common errors when filing IRS 1120 include inaccurate reporting of income, failing to reconcile figures with prior year returns, and missing required signatures. To avoid these mistakes, double-check all calculations and ensure you've included all necessary attachments before submission. Utilizing tax software can also help minimize errors.

Are e-signatures accepted for IRS 1120 submissions?

Yes, e-signatures are accepted for IRS 1120 filings when submitted electronically, provided you're using approved e-file software. Ensure that your digital signature complies with IRS regulations to avoid potential issues. This process secures the legitimacy of your submission while maintaining your privacy.

What steps should be taken if the IRS audits your IRS 1120 filing?

If you receive an audit notice related to your IRS 1120, promptly review the notice for specific items the IRS questions. Gather all relevant documentation and records to substantiate your claims. It's advisable to consult with a tax professional to prepare your response effectively and to understand your rights during the audit process.

See what our users say