MD 502UP 2021 free printable template

Show details

MARYLAND FORM502UP2021UNDERPAYMENT OF ESTIMATED INCOME TAX BY INDIVIDUALSATTACH THIS FORM TO FORM 502, 505 or 515. IMPORTANT: REVIEW THE INSTRUCTIONS BEFORE COMPLETING THIS FORM. SEE SPECIAL INSTRUCTIONS

pdfFiller is not affiliated with any government organization

Instructions and Help about MD 502UP

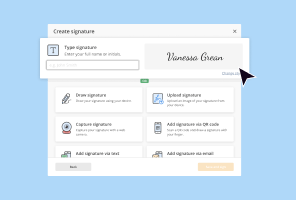

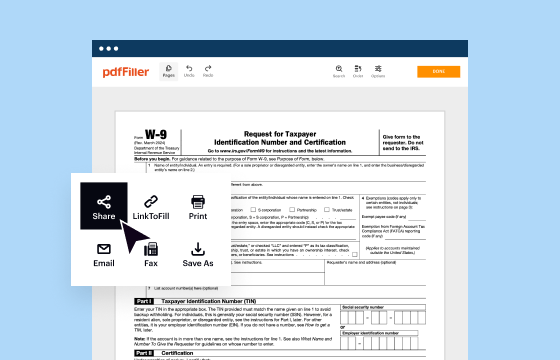

How to edit MD 502UP

How to fill out MD 502UP

Instructions and Help about MD 502UP

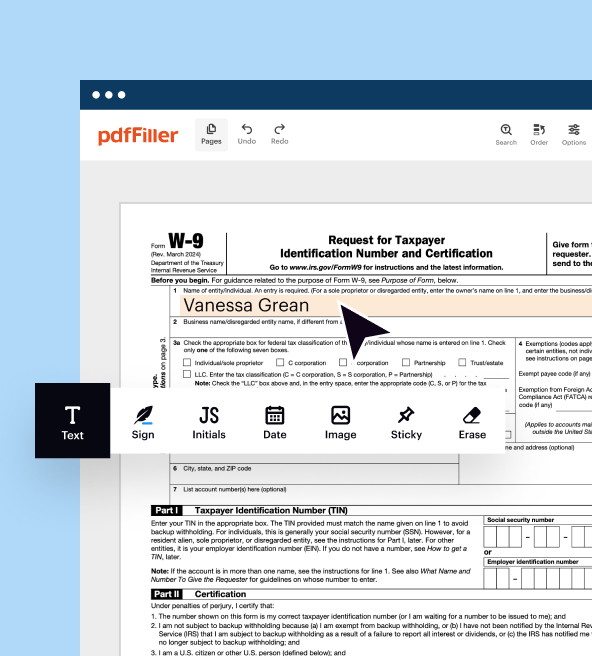

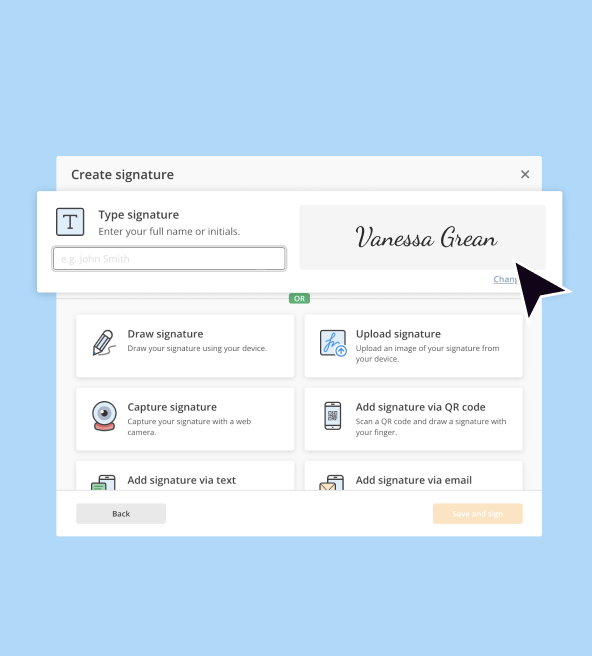

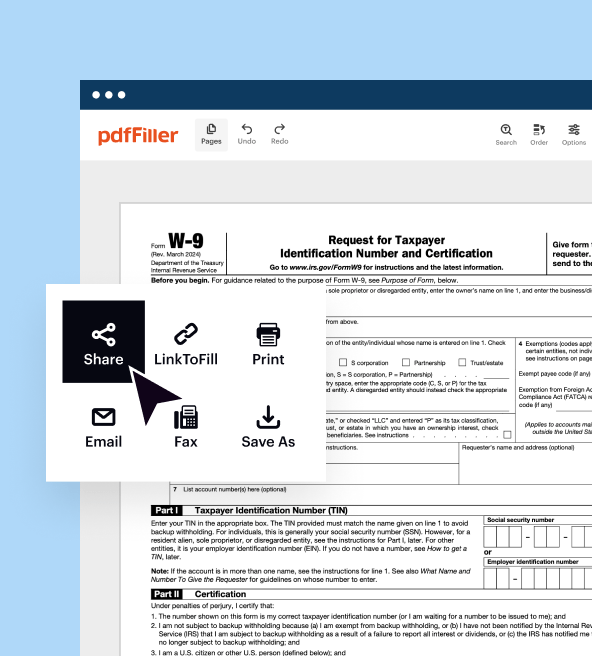

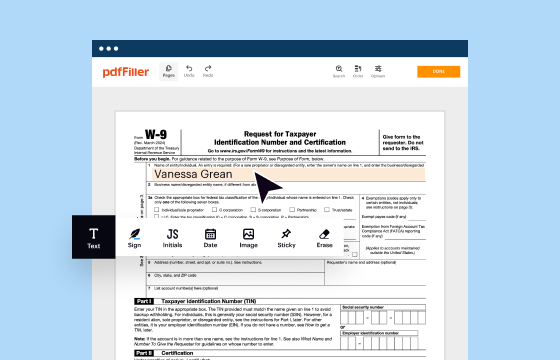

How to edit MD 502UP

To edit the MD 502UP form, you can use online tools like pdfFiller, which allows for easy modification of PDF documents. Open the form in the editor, and you can add or correct any necessary information. Ensure that all edits comply with tax regulations to avoid any issues when filing.

How to fill out MD 502UP

When filling out the MD 502UP form, gather all required information prior to starting. Follow these general steps:

01

Obtain the latest version of the MD 502UP form.

02

Read the instructions carefully to understand the specific requirements.

03

Fill in your personal information accurately, including your name and contact details.

04

Provide the necessary financial information as per the guidelines.

05

Review your entries for accuracy before submission.

About MD 502UP 2021 previous version

What is MD 502UP?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD 502UP 2021 previous version

What is MD 502UP?

MD 502UP refers to the Maryland Unemployment Insurance Employer's Quarterly Reporting Form. This form is essential for employers to report wages and unemployment insurance contributions for their employees in the state of Maryland.

What is the purpose of this form?

The primary purpose of the MD 502UP form is to ensure that employers correctly report their employee wages and contributions to the Maryland Unemployment Insurance program. Accurate reporting aids in the calculation of unemployment benefits and compliance with state laws.

Who needs the form?

All employers in Maryland who have employees must complete the MD 502UP form. This includes businesses of all sizes and types, from corporations to sole proprietorships.

When am I exempt from filling out this form?

Employers may be exempt from filing the MD 502UP form if they are not required to pay unemployment insurance taxes. This typically applies to certain small businesses or those with no employees subject to unemployment tax.

Components of the form

The MD 502UP form includes several key components, such as employer identification information, total wages paid, contributions owed, and employee details. Each section must be filled out accurately to ensure compliance.

Due date

The MD 502UP form is generally due on a quarterly basis. Employers must submit the completed form by the end of the month following the close of each quarter to avoid penalties.

What are the penalties for not issuing the form?

Failure to file the MD 502UP form can result in substantial penalties, including fines and additional liability for unpaid unemployment insurance contributions. It is critical to file on time to avoid these repercussions.

What information do you need when you file the form?

When filing the MD 502UP form, be prepared to provide information such as your business name, identification number, total wages paid to employees, and the amount of contributions due for unemployment insurance. Collecting this information in advance will streamline the filing process.

Is the form accompanied by other forms?

The MD 502UP form may need to be filed along with other employment-related documents, depending on your business structure and payroll practices. Be sure to check state guidelines for any additional required filings.

Where do I send the form?

Completed MD 502UP forms should be sent to the Maryland Division of Unemployment Insurance. You can typically file the form electronically or by mail, depending on your preference and the submission guidelines provided by the state agency.

See what our users say