MD 502UP 2022 free printable template

Show details

MARYLAND

FORM502UP2022UNDERPAYMENT OF

ESTIMATED INCOME

TAX BY INDIVIDUALSATTACH THIS FORM TO FORM 502, 505 or 515.

IMPORTANT: REVIEW THE INSTRUCTIONS BEFORE COMPLETING THIS FORM.

SEE SPECIAL INSTRUCTIONS

pdfFiller is not affiliated with any government organization

Instructions and Help about MD 502UP

How to edit MD 502UP

How to fill out MD 502UP

Instructions and Help about MD 502UP

How to edit MD 502UP

Edit MD 502UP using pdfFiller to easily make adjustments to your data before submission. Open the form within pdfFiller, use the editing tools to modify any fields, and ensure all information is current and accurate. Remember to save your changes before finalizing the document.

How to fill out MD 502UP

Filling out MD 502UP requires attention to detail and accurate information. Follow these steps to complete the form:

01

Gather all necessary documents, such as receipts or payment records.

02

Fill in personal or business identification information as requested.

03

Complete all applicable sections based on your specific transactions.

04

Review the form for accuracy before submission.

About MD 502UP 2022 previous version

What is MD 502UP?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD 502UP 2022 previous version

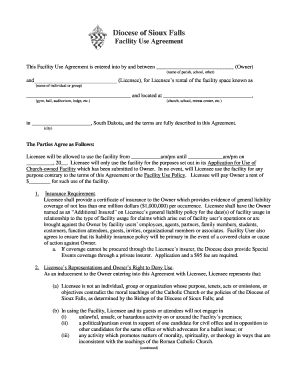

What is MD 502UP?

MD 502UP is a specific tax form used in the state of Maryland for reporting certain payments made to individuals or businesses. This form is essential for maintaining compliance with local tax laws and ensuring accurate reporting of taxable income.

What is the purpose of this form?

The purpose of MD 502UP is to document specific payments that may affect tax obligations. By requiring detailed reporting, the form helps the Maryland State Comptroller’s office to track income and assess state revenues accurately.

Who needs the form?

Individuals or entities making certain types of payments, such as contractors or service providers, may need to complete MD 502UP. Specifically, it is generally required for businesses that have made qualifying payments exceeding a defined threshold in the tax year.

When am I exempt from filling out this form?

You may be exempt from filling out MD 502UP if your total payments to a specific recipient do not exceed the reporting threshold set by the Maryland state tax regulations. Additionally, certain types of payments, such as those to corporations or exempt organizations, may not require this form.

Components of the form

The MD 502UP consists of several key sections that must be completed. This includes information about the payer, the recipient, and a detailed account of the payments made. Ensuring all components are filled out accurately is crucial to avoid penalties or delays in processing.

What are the penalties for not issuing the form?

Failure to issue MD 502UP when required can lead to penalties imposed by the Maryland State Department of Assessments and Taxation. Penalties may include fines or additional scrutiny on future tax returns, highlighting the importance of complying with reporting obligations.

What information do you need when you file the form?

When preparing to file MD 502UP, you will need the following information:

01

Complete payer information, including name and address.

02

Complete recipient details, such as name, address, and Social Security Number or Employer Identification Number.

03

Details of each payment made during the reporting period.

Is the form accompanied by other forms?

MD 502UP may need to be submitted alongside other related documents, depending on specific circumstances. Be sure to consult the Maryland State tax guidelines to determine if additional forms, such as 1099 forms, are required for complete reporting.

Where do I send the form?

Once completed, MD 502UP should be sent to the Maryland State Comptroller's office. Ensure that you check the latest submission address and any accompanying requirements to ensure proper processing of your form.

See what our users say