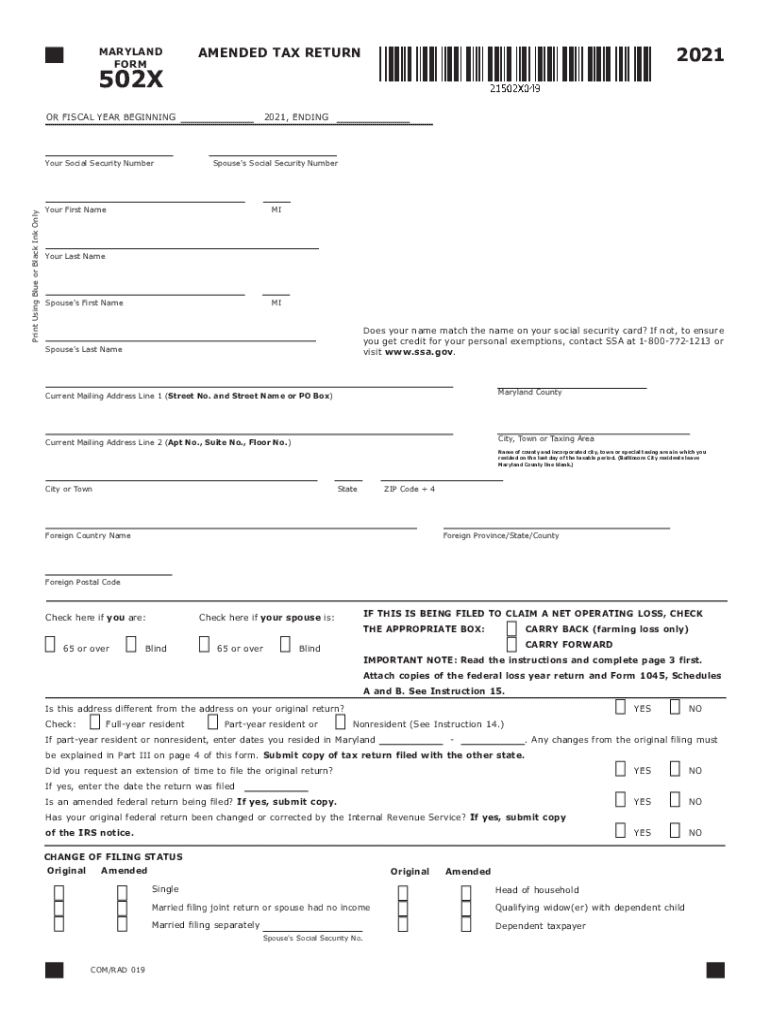

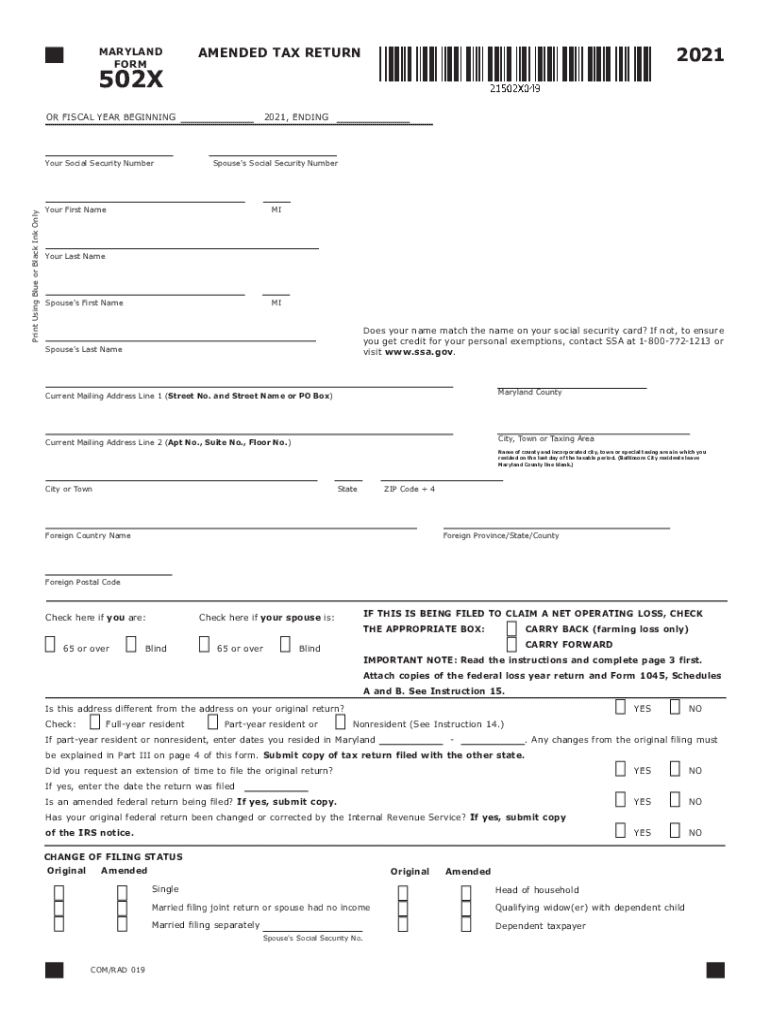

MD Comptroller 502X 2021 free printable template

Get, Create, Make and Sign MD Comptroller 502X

How to edit MD Comptroller 502X online

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller 502X Form Versions

How to fill out MD Comptroller 502X

How to fill out MD Comptroller 502X

Who needs MD Comptroller 502X?

Instructions and Help about MD Comptroller 502X

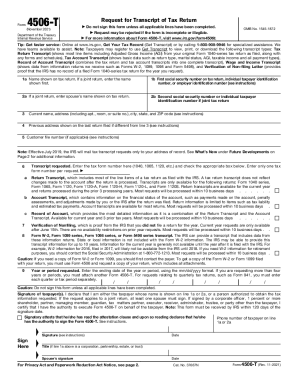

Law.com legal forms guide form 50 2x amended Maryland tax return Maryland residents can amend their income tax return with a form 50 to X this document can be obtained from the website of the Maryland comptroller step one at the top of the page give your name social security number and indicate with a check mark if you are either 65 or older or blind if filing jointly with your spouse give the same information about them step 2 right the year for which you are filing step 3 give your address and a telephone number step 4 on the left side of the top half of the page answer the four questions asked about your filing status with a check mark attach a copy of your amended federal return or one amended by the IRS as applicable step 5 on the right side of the top half of the page indicate your filing status with a check mark step 6 skips to the second page the first table provided concerns income and adjustments enter your originally reported figures in column a the net increase or decrease between the original figure and the corrected figure in column B and the corrected figures in column C transfer the numbers on line 17 to their respective columns on line one of the first page if you are now reporting any changes check the box at the top of the table and complete column a plus line 17 of columns see step 7 complete lines 2 through 5 on the first page step 8 return to the second page complete the table for itemized deductions transfer line 11 to line 6 on the first page step 9 complete lines 7 through 27 on the first page as instructed to determine your total balance do step 10 in section 3 on the second page provide a completed explanation for every change give the line number on which every change was reported attach the additional sheets as necessary step 11 sign and date the bottom of the second page to watch more videos please make sure to visit laws calm

People Also Ask about

What is Maryland Form 506?

What is MD form 502?

What is Maryland form MW506NRS?

What is Maryland withholding tax for non residents?

What is a md101 form?

What is a MD form 515?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MD Comptroller 502X for eSignature?

How do I make changes in MD Comptroller 502X?

How do I edit MD Comptroller 502X on an iOS device?

What is MD Comptroller 502X?

Who is required to file MD Comptroller 502X?

How to fill out MD Comptroller 502X?

What is the purpose of MD Comptroller 502X?

What information must be reported on MD Comptroller 502X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.