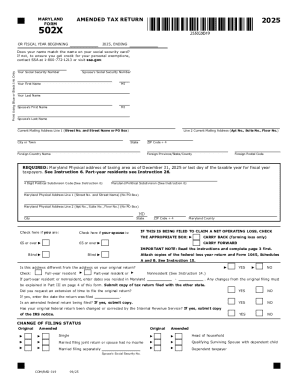

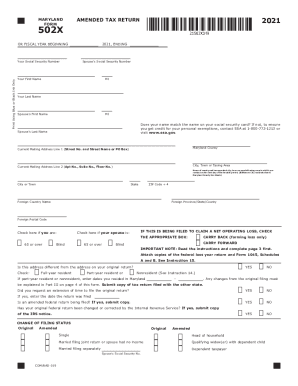

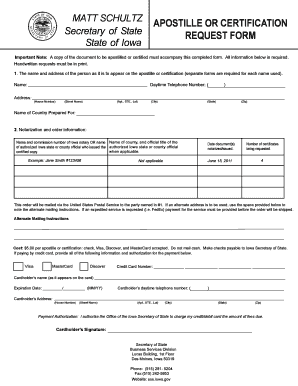

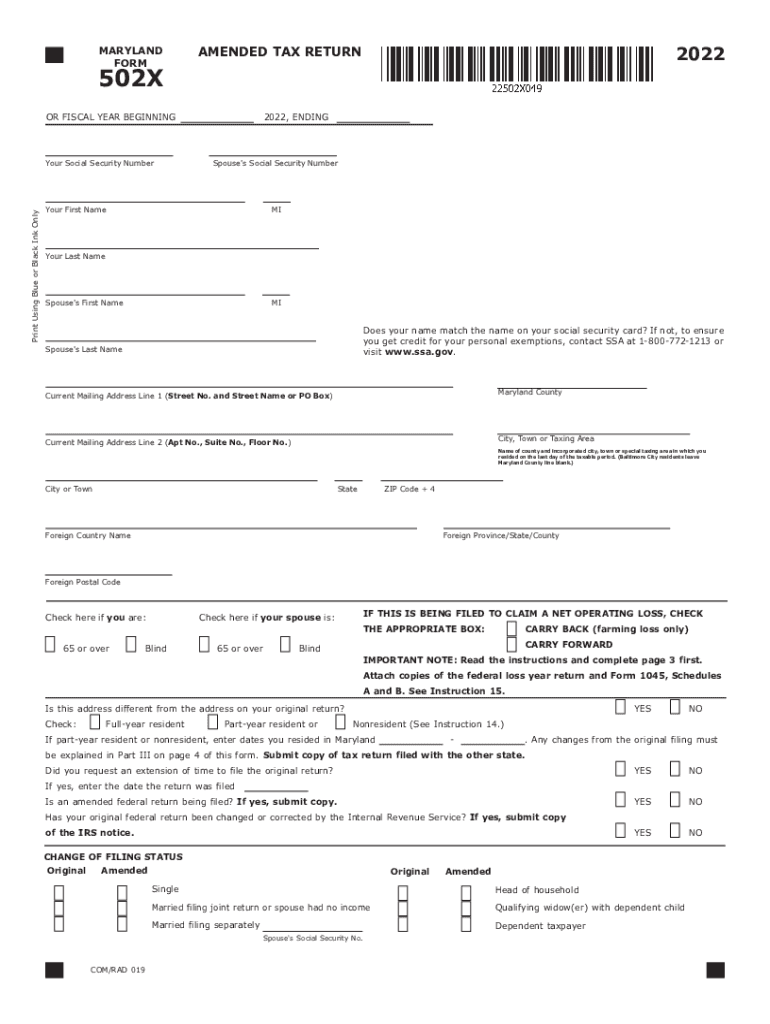

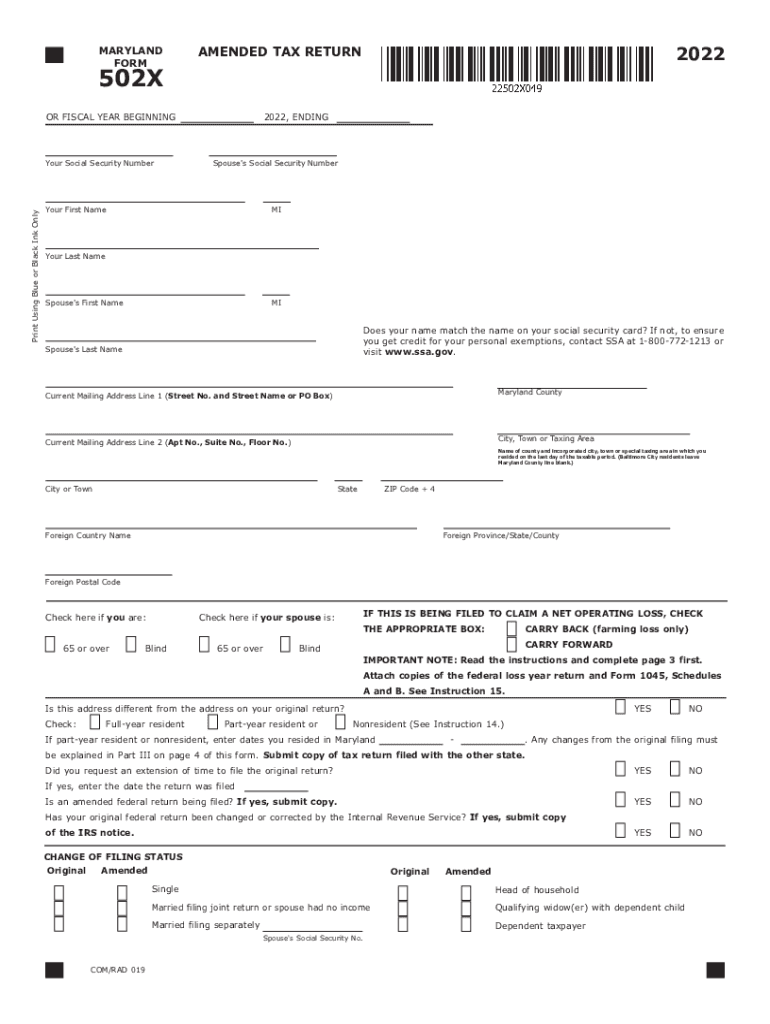

MD Comptroller 502X 2022 free printable template

Show details

Enter a complete explanation in Part III on page 4 of Form 502X. PART II SPECIFIC INSTRUCTIONS COMPLETE PAGE 3 AND 4 OF FORM 502X. If you are amending your federal return attach a photocopy of the federal Form 1040X and any revised schedules to your Maryland Form 502X. Check the appropriate CARRY BACK or CARRY FORWARD box on page 1 of Form 502X. INCOME TAX ASSISTANCE. If you need more information visit www. NOTE Any amount deducted as contributions of Preservation and Conservation Easements...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD Comptroller 502X

Edit your MD Comptroller 502X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD Comptroller 502X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD Comptroller 502X online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MD Comptroller 502X. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD Comptroller 502X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MD Comptroller 502X

How to fill out MD Comptroller 502X

01

Begin by downloading the MD Comptroller 502X form from the official Maryland Comptroller website.

02

Fill in your personal information at the top of the form, including your name, address, and phone number.

03

Indicate the type of adjustment you are making by selecting the appropriate boxes on the form.

04

Provide details for the original return, including the tax year and amounts reported.

05

Clearly outline the adjustments you wish to make, specifying any corrections or additional deductions.

06

Calculate the new total and ensure you have accurate figures before finalizing.

07

Sign and date the form at the bottom to certify the information provided.

08

Submit the completed form to the appropriate office as indicated in the instructions, either by mail or electronically.

Who needs MD Comptroller 502X?

01

Individuals or businesses that need to amend a previously filed tax return in Maryland.

02

Taxpayers who have discovered errors or omissions in their original tax filings.

03

Professionals assisting clients in correcting tax returns for the state of Maryland.

Fill

form

: Try Risk Free

People Also Ask about

What is Maryland Form 506?

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

What is MD form 502?

You must use Form 502 if your federal adjusted gross income is $100,000 or more. All taxpayers may use Form 502. You must use this form if you itemize deductions, if you have any Maryland additions or subtractions, if you have made estimated payments or if you are claiming business or personal income tax credits.

What is Maryland form MW506NRS?

Form MW506NRS is designed to assure the regular and timely collection of Maryland income tax due from nonresident sellers of real property located within the State.

What is Maryland withholding tax for non residents?

A nonresident entity must make an 8.25% payment. See Withholding Requirements for Sales of Real Property by Nonresidents.

What is a md101 form?

What is the md101 form? MD-101: Managing Modern Desktop certification is a great way to get started in your Microsoft 365 Career ! This certification validates your ability to manage and support modern desktop environments, including Windows 10 and Office 365.

What is a MD form 515?

FORM. 515. FOR NONRESIDENTS EMPLOYED IN MARYLAND WHO. RESIDE IN JURISDICTIONS THAT IMPOSE A LOCAL. INCOME OR EARNINGS TAX ON MARYLAND RESIDENTS.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MD Comptroller 502X?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific MD Comptroller 502X and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my MD Comptroller 502X in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MD Comptroller 502X and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the MD Comptroller 502X form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign MD Comptroller 502X and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is MD Comptroller 502X?

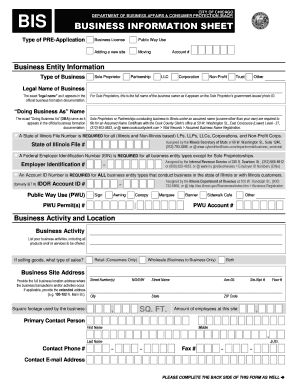

MD Comptroller 502X is a form used by businesses in Maryland to report and amend sales and use tax returns.

Who is required to file MD Comptroller 502X?

Any business that needs to amend a previously filed sales and use tax return in Maryland is required to file MD Comptroller 502X.

How to fill out MD Comptroller 502X?

To fill out MD Comptroller 502X, provide information such as the business's name, address, the period of the original return, the amounts being amended, and the reason for the amendment.

What is the purpose of MD Comptroller 502X?

The purpose of MD Comptroller 502X is to allow businesses to correct mistakes or make updates to their previously filed sales and use tax returns.

What information must be reported on MD Comptroller 502X?

Information that must be reported includes the business identification details, original and amended amounts for sales and use tax, as well as an explanation of changes made.

Fill out your MD Comptroller 502X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD Comptroller 502x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.