FL DR-908 2022 free printable template

Show details

DR908

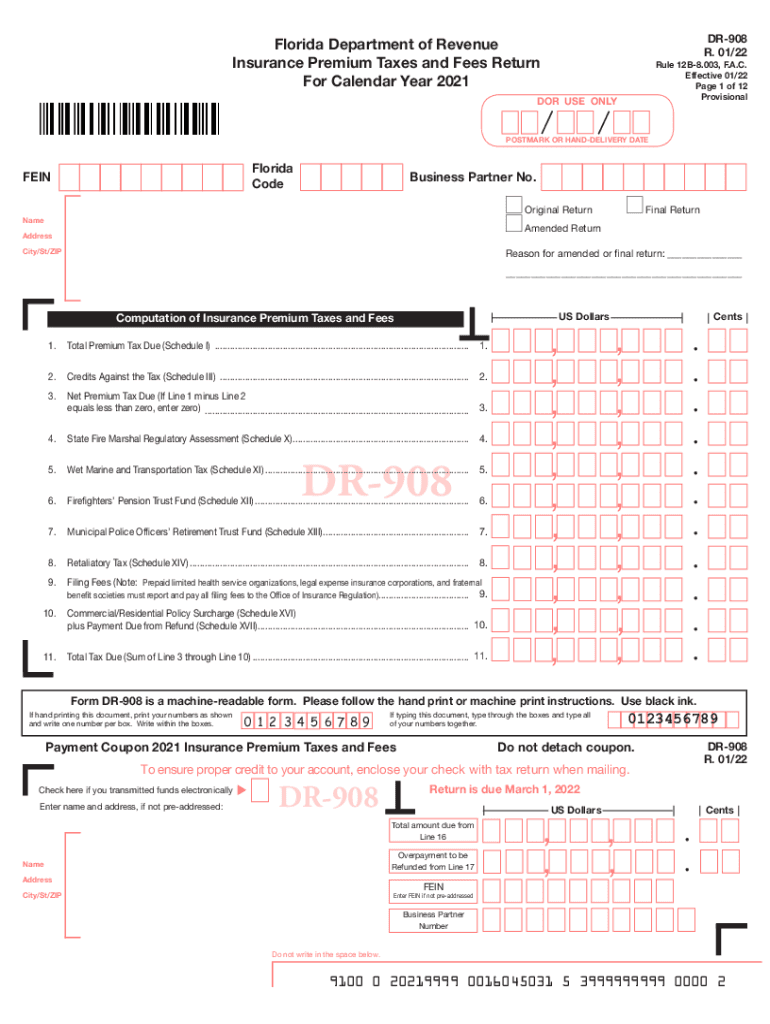

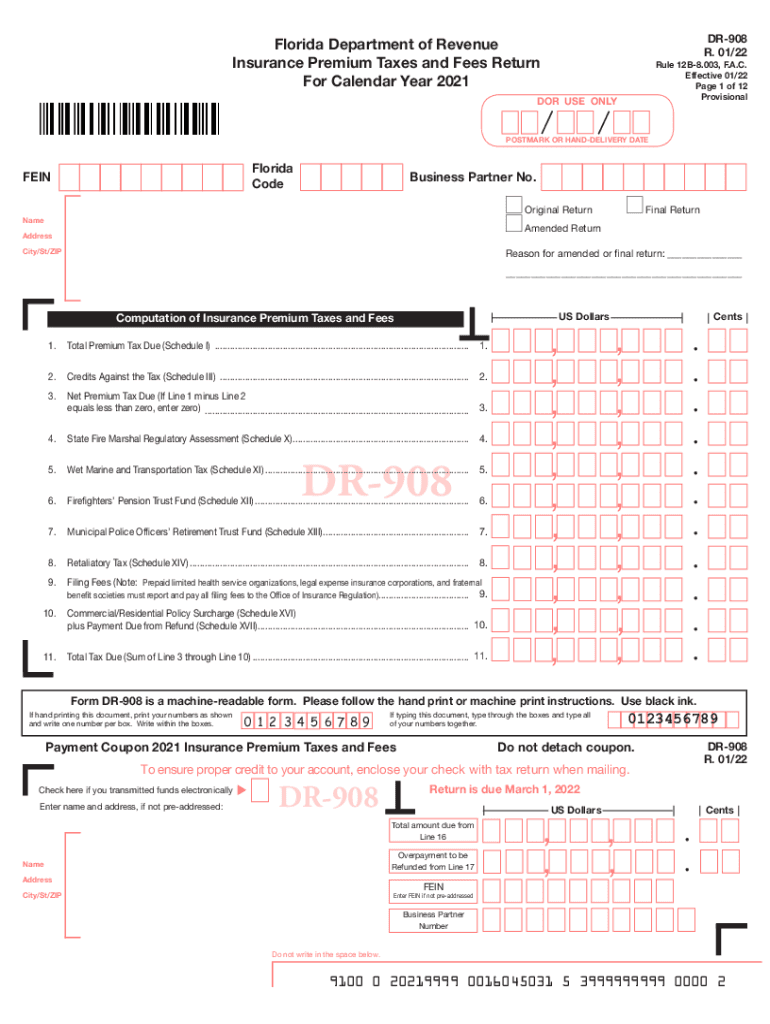

R. 01/22Florida Department of Revenue

Insurance Premium Taxes and Fees Return

For Calendar Year 2021Rule 12B8.003, F.A.C.

Effective 01/22-Page 1 of 12

Provisional USE ONLYPOSTMARK OR NONDELIVERY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-908

Edit your FL DR-908 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-908 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DR-908 online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DR-908. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-908 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-908

How to fill out FL DR-908

01

Begin by downloading the FL DR-908 form from the official Florida Department of Revenue website.

02

Fill in the top section with your name, address, and contact information.

03

Specify the type of application by checking the appropriate box.

04

Provide detailed information regarding your income and assets as required on the form.

05

If applicable, include information about any previous filings that are relevant to your application.

06

Review the form for completeness and accuracy to ensure that all required fields are filled out.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate office as instructed on the form.

Who needs FL DR-908?

01

Individuals seeking property tax exemptions in Florida, such as homestead exemptions, may need to fill out FL DR-908.

Fill

form

: Try Risk Free

People Also Ask about

How much is health insurance a month for one person in Florida?

How much does health care cost in Florida? For major medical plans, the cheapest individual monthly premium starts at $177, but the average monthly cost of health insurance in Florida is approximately $467 per person. The actual prices will vary depending on your age, gender, medical history, and zipZIP code.

How much is auto insurance a month in Florida?

The average cost of car insurance in Florida is $91 per month for liability-only coverage, or $238 per month for full coverage.

Is Florida insurance more expensive?

Florida drivers pay higher car insurance premiums than the nationwide average. The state's minimum-liability requirements are also quite low, which means drivers in the state may want to consider purchasing full-coverage policies that include both collision and comprehensive coverage to ensure they're fully protected.

How much is premium in Florida?

How much is car insurance in Florida? Average minimum coverage premium in FloridaAverage annual full coverage premium in Florida$1,128$3,183

What is insurance premium fee?

What Is an Insurance Premium? An insurance premium is the amount of money an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover healthcare, auto, home, and life insurance. Once earned, the premium is income for the insurance company.

What is the Florida state premium tax?

When are state premium taxes due? State Tax on Life Insurance and Annuity Premium As of January 1, 2023FL - Florida1.00% (tax is absorbed by the insurance co.)ME - Maineno premium tax on qualified moniesNV - Nevadano premium tax on qualified moniesSD - South Dakotano premium tax on qualified monies6 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my FL DR-908 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your FL DR-908 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete FL DR-908 online?

Easy online FL DR-908 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in FL DR-908 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your FL DR-908, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is FL DR-908?

FL DR-908 is a Florida Department of Revenue form used for reporting certain tax information, typically concerning transactions and tax liabilities.

Who is required to file FL DR-908?

Entities or individuals engaged in specific taxable activities within Florida, particularly those meeting certain criteria outlined by the Florida Department of Revenue, are required to file FL DR-908.

How to fill out FL DR-908?

To fill out FL DR-908, you need to provide accurate information regarding your taxable transactions, including details like total sales, taxes collected, and any relevant exemptions, ensuring that all required fields are completed.

What is the purpose of FL DR-908?

The purpose of FL DR-908 is to facilitate the reporting of tax-related information to the Florida Department of Revenue, ensuring compliance with state tax laws.

What information must be reported on FL DR-908?

FL DR-908 must include information such as total sales, taxes collected, details of taxable transactions, any applicable exemptions, and the taxpayer's identification information.

Fill out your FL DR-908 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-908 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.