FL DR-908 2013 free printable template

Show details

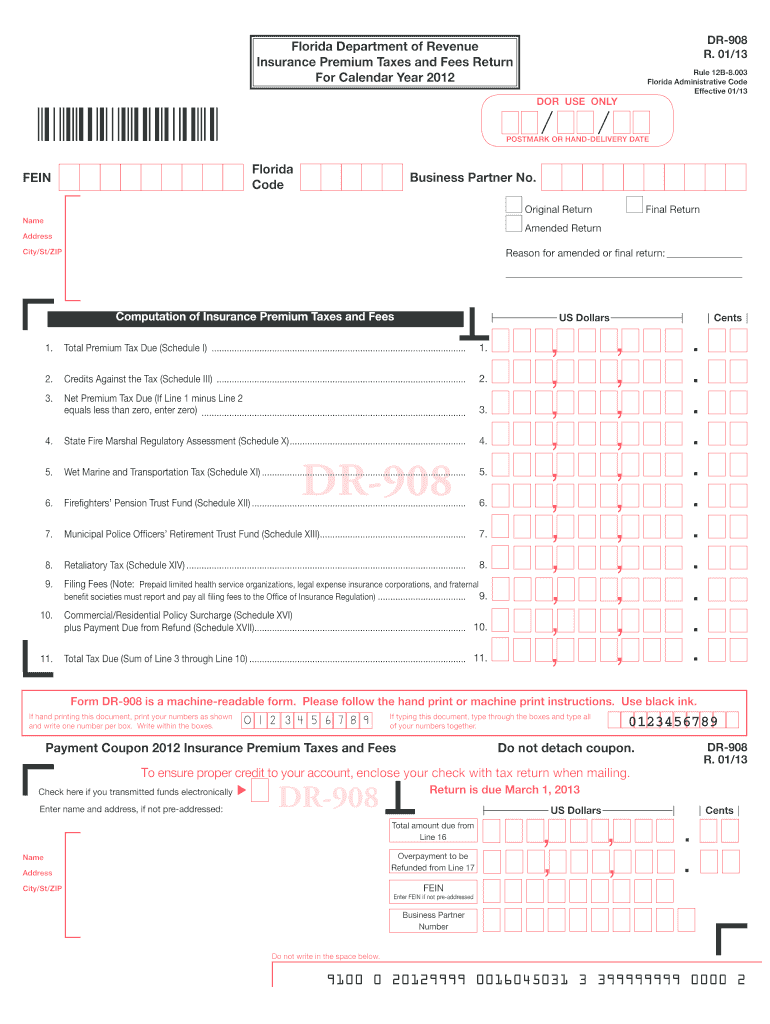

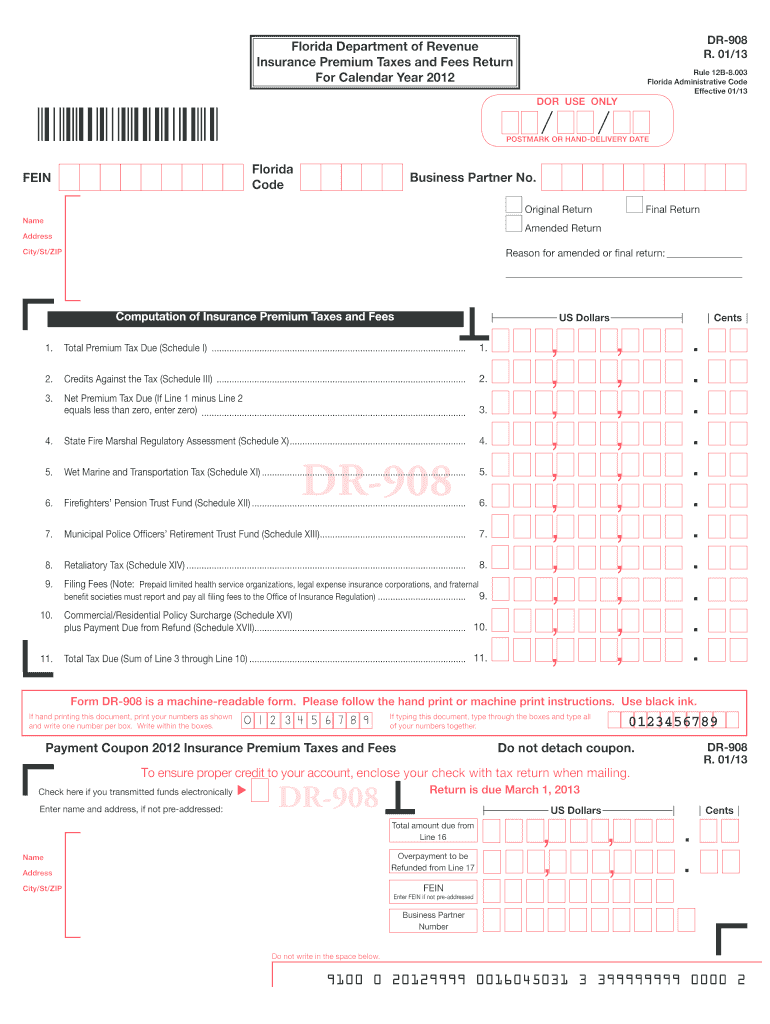

DR-908 R. 01/13 Florida Department of Revenue Insurance Premium Taxes and Fees Return For Calendar Year 2012 Rule 12B-8.003 Florida Administrative Code Effective 01/13 DO RUSE ONLY POSTMARK OR HAND-DELIVERY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DR-908

Edit your FL DR-908 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DR-908 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DR-908 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL DR-908. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-908 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DR-908

How to fill out FL DR-908

01

Begin by downloading the FL DR-908 form from the official website.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Provide information about the property, such as the address and parcel number.

04

Indicate the reason for the filing, selecting the appropriate checkbox.

05

If applicable, list any previous exemptions you may have received.

06

Confirm your eligibility by providing any required documentation and signatures.

07

Review the form for accuracy and completeness before submission.

08

Submit the completed form to the appropriate local government office.

Who needs FL DR-908?

01

Any property owner in Florida who is seeking to apply for or renew a property tax exemption.

Fill

form

: Try Risk Free

People Also Ask about

How much is health insurance a month for one person in Florida?

How much does health care cost in Florida? For major medical plans, the cheapest individual monthly premium starts at $177, but the average monthly cost of health insurance in Florida is approximately $467 per person. The actual prices will vary depending on your age, gender, medical history, and zipZIP code.

How much is auto insurance a month in Florida?

The average cost of car insurance in Florida is $91 per month for liability-only coverage, or $238 per month for full coverage.

Is Florida insurance more expensive?

Florida drivers pay higher car insurance premiums than the nationwide average. The state's minimum-liability requirements are also quite low, which means drivers in the state may want to consider purchasing full-coverage policies that include both collision and comprehensive coverage to ensure they're fully protected.

How much is premium in Florida?

How much is car insurance in Florida? Average minimum coverage premium in FloridaAverage annual full coverage premium in Florida$1,128$3,183

What is insurance premium fee?

What Is an Insurance Premium? An insurance premium is the amount of money an individual or business pays for an insurance policy. Insurance premiums are paid for policies that cover healthcare, auto, home, and life insurance. Once earned, the premium is income for the insurance company.

What is the Florida state premium tax?

When are state premium taxes due? State Tax on Life Insurance and Annuity Premium As of January 1, 2023FL - Florida1.00% (tax is absorbed by the insurance co.)ME - Maineno premium tax on qualified moniesNV - Nevadano premium tax on qualified moniesSD - South Dakotano premium tax on qualified monies6 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify FL DR-908 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your FL DR-908 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit FL DR-908 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your FL DR-908, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the FL DR-908 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your FL DR-908 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is FL DR-908?

FL DR-908 is a tax form used in Florida for the reporting of certain types of income and deductions for individuals and businesses, specifically for those involved in tangible personal property.

Who is required to file FL DR-908?

All individuals and entities that own tangible personal property in Florida and who are required to report and pay taxes on that property must file FL DR-908.

How to fill out FL DR-908?

To fill out FL DR-908, taxpayers must provide details about their tangible personal property, including a description of the property, its location, and its assessed value, along with any applicable deductions.

What is the purpose of FL DR-908?

The purpose of FL DR-908 is to ensure proper assessment and taxation of tangible personal property in Florida, allowing the state to collect revenue from property owners.

What information must be reported on FL DR-908?

The information that must be reported on FL DR-908 includes the type of tangible personal property, its location, the value of the property, and any applicable exemptions or deductions.

Fill out your FL DR-908 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DR-908 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.