IRS Instructions 7202 2021-2026 free printable template

Show details

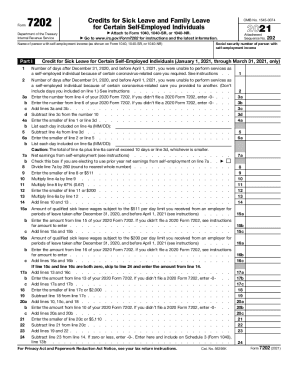

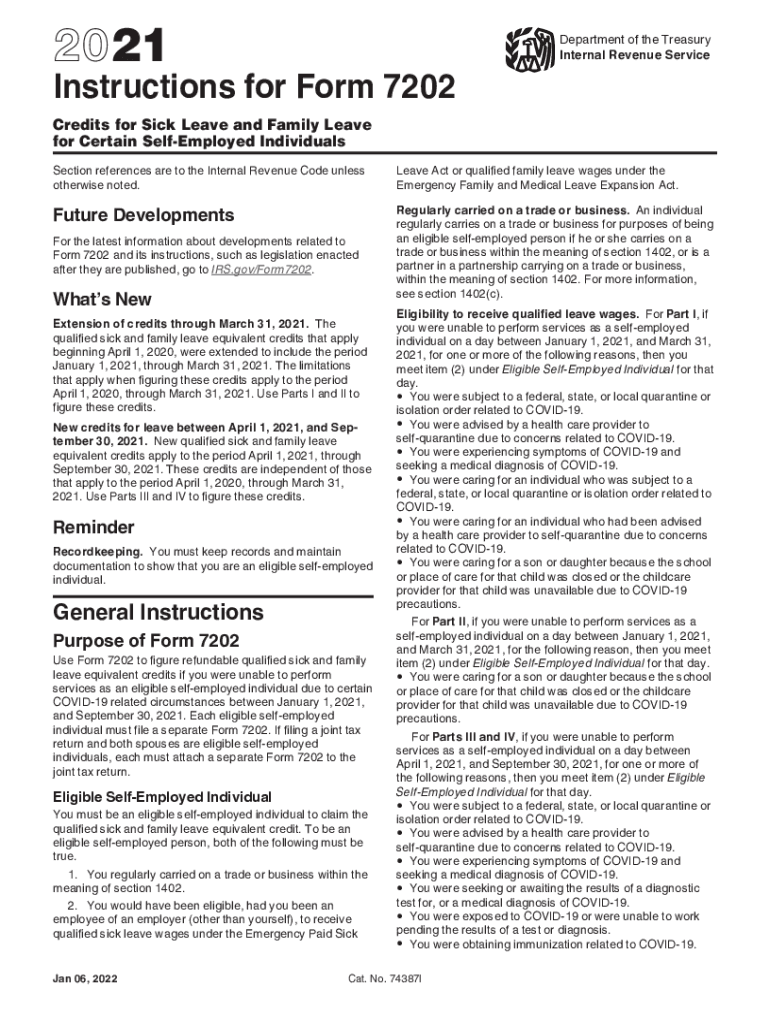

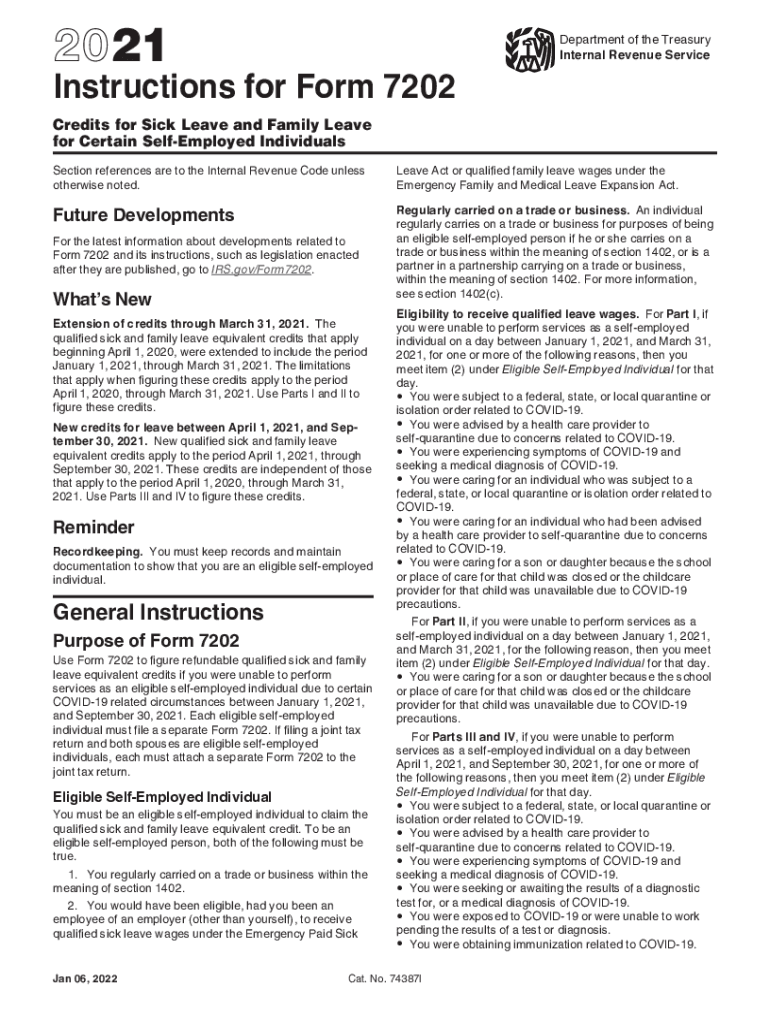

2021Instructions for Form 7202Department of the Treasury Internal Revenue ServiceCredits for Sick Leave and Family Leave for Certain Reemployed Individuals Section references are to the Internal Revenue

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 7202

Edit your IRS Instructions 7202 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 7202 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instructions 7202 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Instructions 7202. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 7202 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 7202

How to fill out IRS Instructions 7202

01

Read the IRS Instructions 7202 thoroughly to understand the purpose of the form.

02

Gather necessary documentation such as your business records and any applicable COVID-19 relief information.

03

Complete your personal information, including your name, address, and Social Security number (or EIN if applicable).

04

Indicate the specific periods for which you are claiming the credits.

05

Calculate the eligible amount of credits based on your covered wages and qualified health plan expenses.

06

Follow the instructions carefully for each line on the form, ensuring all figures are accurate.

07

Review your completed form for any errors or missing information.

08

Submit the completed IRS Instructions 7202 according to the guidelines provided, ensuring it's sent to the correct address.

Who needs IRS Instructions 7202?

01

Self-employed individuals who are unable to work due to COVID-19.

02

Employers claiming credits for qualified sick and family leave wages.

03

Business owners looking to claim the Employee Retention Credit.

04

Any taxpayer needing to report their illnesses or affected work periods related to COVID-19.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as self-employed for IRS?

Generally, you are self-employed if any of the following apply to you. You carry on a trade or business as a sole proprietor or an independent contractor. You are a member of a partnership that carries on a trade or business. You are otherwise in business for yourself (including a part-time business or a gig worker).

What qualifies for tax form 7202?

To be an eligible self-employed person, you must be: Conducting a trade or business within the meaning of section 1402, and. Eligible to receive paid sick leave under the Emergency Paid Sick Leave Act if you were an employee of an employer (other than yourself), and/or.

Can you file form 7202 electronically?

Because this form is required to be attached to your income tax return, you will not be able to electronically file your income tax return. It must be mailed to the IRS.

How to fill out form 7202?

2:44 20:00 IRS Form 7202 Line-by-Line Instructions 2023 - YouTube YouTube Start of suggested clip End of suggested clip And in the scenario. That if both spouses let's say both spouses are eligible self-employedMoreAnd in the scenario. That if both spouses let's say both spouses are eligible self-employed individuals. So each must file a separate form 7202. So each must follow a separate form 7202.

How much can I get back with Form 7202?

Maximum $200 family leave credit per day and $2,000 in the aggregate. Maximum 50 days family leave credit allowed, up to $200 per day and $10,000 in the aggregate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS Instructions 7202 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IRS Instructions 7202 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit IRS Instructions 7202 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IRS Instructions 7202 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit IRS Instructions 7202 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS Instructions 7202 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS Instructions 7202?

IRS Instructions 7202 provides guidance for taxpayers who are claiming the Employee Retention Credit (ERC) under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Who is required to file IRS Instructions 7202?

Employers who retained employees and are claiming the Employee Retention Credit for wages paid during specific quarters of 2020 and 2021 are required to file IRS Instructions 7202.

How to fill out IRS Instructions 7202?

To fill out IRS Instructions 7202, taxpayers need to gather necessary information about qualifying wages, the number of retained employees, and complete the form as outlined in the instructions, ensuring all relevant fields are accurately filled.

What is the purpose of IRS Instructions 7202?

The purpose of IRS Instructions 7202 is to provide instructions for claiming the Employee Retention Credit, including eligibility requirements and calculation methods for credits on employee wages.

What information must be reported on IRS Instructions 7202?

Information required on IRS Instructions 7202 includes the total number of employees, the amount of qualified wages paid, the credit amount being claimed, and other related details necessary for processing the tax credit.

Fill out your IRS Instructions 7202 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 7202 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.