IRS 1065 - Schedule M-3 2021-2025 free printable template

Show details

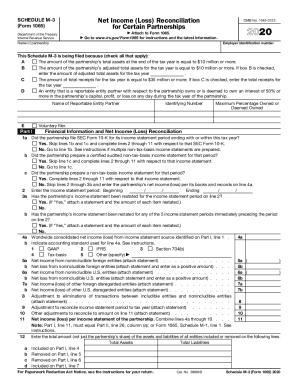

SCHEDULE M3 (Form 1065) (Rev. December 2021) Department of the Treasury Internal Revenue Service Name of partnership Income (Loss) Reconciliation for Certain PartnershipsAttach to Form 1065. Go to

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule M-3

How to edit IRS 1065 - Schedule M-3

How to fill out IRS 1065 - Schedule M-3

Instructions and Help about IRS 1065 - Schedule M-3

How to edit IRS 1065 - Schedule M-3

To edit IRS 1065 - Schedule M-3, download the form from the IRS website or use online form editing tools like pdfFiller. Ensure you have the most recent version to comply with current writing standards. Access the fillable fields to input your information directly, allowing for corrections and adjustments to your entries.

How to fill out IRS 1065 - Schedule M-3

To fill out IRS 1065 - Schedule M-3, follow these steps:

01

Start by entering your partnership's name, address, and Employer Identification Number (EIN).

02

Review and complete Part I, where you must provide information regarding your financial activities.

03

Fill out Part II and Part III to report income, deductions, and other pertinent financial data.

Be meticulous in checking your figures and ensure they match supporting documentation to avoid common errors during review.

Latest updates to IRS 1065 - Schedule M-3

Latest updates to IRS 1065 - Schedule M-3

It is essential to stay informed about any updates to IRS 1065 - Schedule M-3 for accuracy in filing. Recent changes may affect fiscal reporting requirements or data reporting formats. Consult the IRS website for specific updates related to the form each tax year.

All You Need to Know About IRS 1065 - Schedule M-3

What is IRS 1065 - Schedule M-3?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About IRS 1065 - Schedule M-3

What is IRS 1065 - Schedule M-3?

IRS 1065 - Schedule M-3 is an informational tax form used by partnerships to report their financial statements and to reconcile book income with tax income. This form is a component of the IRS Form 1065, which is the standard form for partnerships to report their income, deductions, gains, and losses.

What is the purpose of this form?

The primary purpose of IRS 1065 - Schedule M-3 is to enhance transparency in reporting income and expenses for partnerships with total assets exceeding $10 million. This form ensures that partnerships disclose a reconciliation of their financial statements with their tax returns, thereby minimizing discrepancies between financial reporting and tax reporting.

Who needs the form?

Partnerships with total assets of $10 million or more at the end of the tax year are required to complete IRS 1065 - Schedule M-3. This includes partners in limited liability companies (LLCs) treated as partnerships for tax purposes. Smaller partnerships may not be required to file this schedule, depending on their asset size.

When am I exempt from filling out this form?

Exemptions for filling out IRS 1065 - Schedule M-3 apply to partnerships with total assets below the $10 million threshold as of the end of the tax year. Additionally, partnerships may be exempt if they are not engaged in business or if they are reporting only loss for the entire year without any income.

Components of the form

IRS 1065 - Schedule M-3 consists of three main parts: Part I captures the partnership's financial reporting details; Part II focuses on reconciliation of income computed under generally accepted accounting principles (GAAP) with income reported for tax purposes; Part III reconciles differences in specific account categories.

What are the penalties for not issuing the form?

Failure to file IRS 1065 - Schedule M-3 can result in significant penalties. The IRS imposes a penalty of $200 for each month the partnership fails to file the schedule, up to a maximum of 12 months. Additionally, inaccuracies or omissions can lead to further financial penalties and the potential for an audit.

What information do you need when you file the form?

When filing IRS 1065 - Schedule M-3, partnerships need detailed financial records, including balance sheets, income statements, and a record of assets. Other information needed includes a detailed breakdown of income, deductions, and credits, as well as any relevant supporting documentation.

Is the form accompanied by other forms?

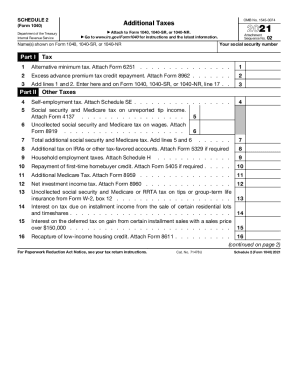

IRS 1065 - Schedule M-3 is typically filed alongside Form 1065. Partnerships also might need to include Schedule K-1, which reports each partner's share of profits, losses, and other tax items, depending on their specific tax situation.

Where do I send the form?

IRS 1065 - Schedule M-3 should be submitted to the address specified in the IRS Form 1065 instructions. This varies based on whether the partnership is making payments or filing without payments. It's recommended to send the forms via certified mail to have proof of submission.

See what our users say