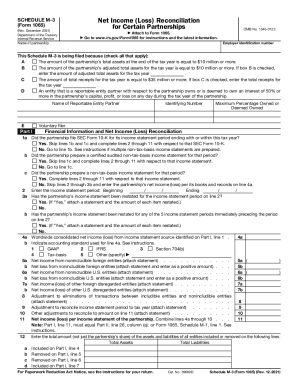

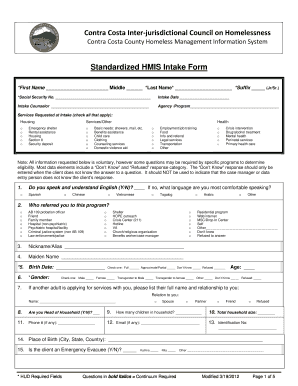

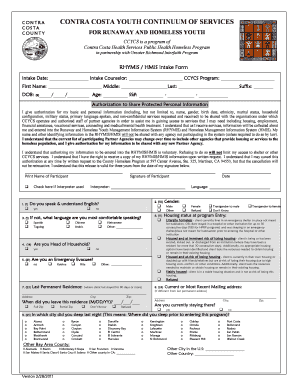

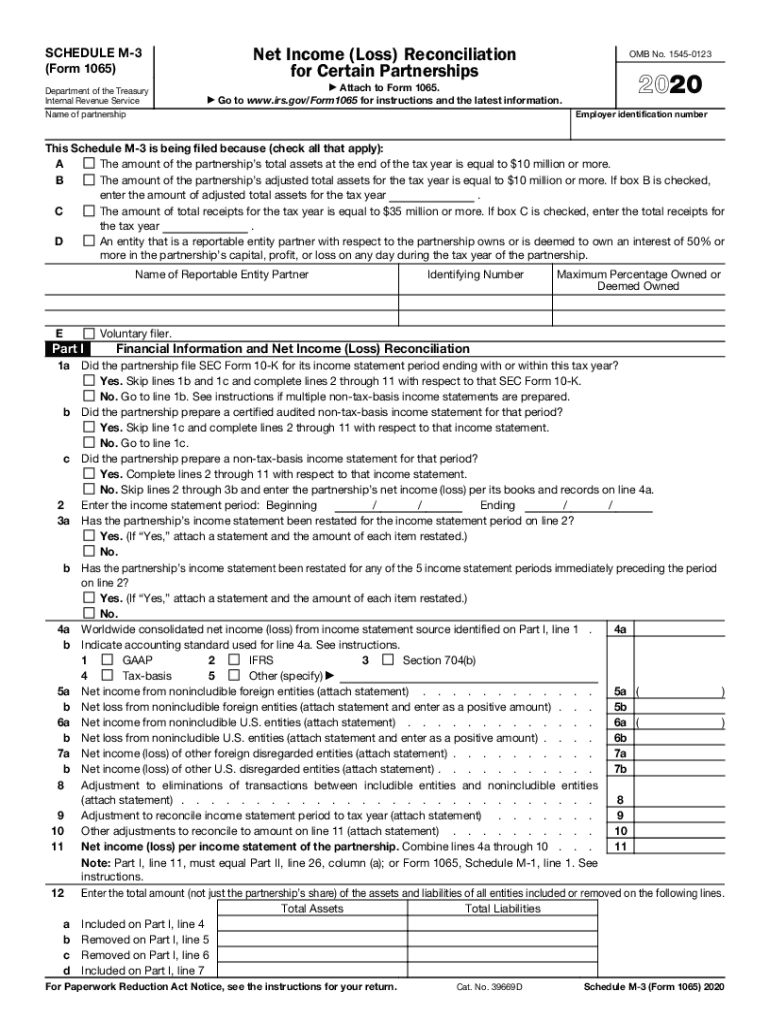

IRS 1065 - Schedule M-3 2020 free printable template

Instructions and Help about IRS 1065 - Schedule M-3

How to edit IRS 1065 - Schedule M-3

How to fill out IRS 1065 - Schedule M-3

About IRS 1065 - Schedule M-3 2020 previous version

What is IRS 1065 - Schedule M-3?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS 1065 - Schedule M-3

What should I do if I discover mistakes on my filed 3 schedule irs?

If you find errors after submitting your 3 schedule irs, you can file an amended return to correct these mistakes. It's crucial to clearly mark the form as amended and include any relevant supporting documentation. Additionally, keep copies for your records and track the status of your correction.

How can I verify if my 3 schedule irs has been received and processed?

To check the status of your 3 schedule irs, you can use the IRS e-file status tool or contact the IRS directly. Be prepared with your identification details and the submitted information, as this will expedite the verification process. Monitoring for any notifications about your submission is also recommended.

What are the best practices to prevent common errors while filing 3 schedule irs?

To avoid mistakes when filing your 3 schedule irs, double-check all entries for accuracy and ensure compliance with IRS instructions. Utilizing tax software can also minimize errors through built-in checks and validations. Finally, paying attention to deadlines can prevent filing issues related to timing.

What implications might I face if my 3 schedule irs is rejected when e-filing?

If your e-filed 3 schedule irs is rejected, you will typically receive an error code detailing the issue. You can make the necessary corrections and resubmit the form. Keep in mind that some rejections may affect deadlines, so it's important to act swiftly to avoid potential penalties.

Are electronic signatures accepted for the 3 schedule irs?

Yes, electronic signatures are generally accepted when e-filing your 3 schedule irs. Ensure that your e-file provider is compliant with the IRS requirements for electronic signatures to maintain the validity of your submission. Always keep records of any correspondence related to your e-filed documents.