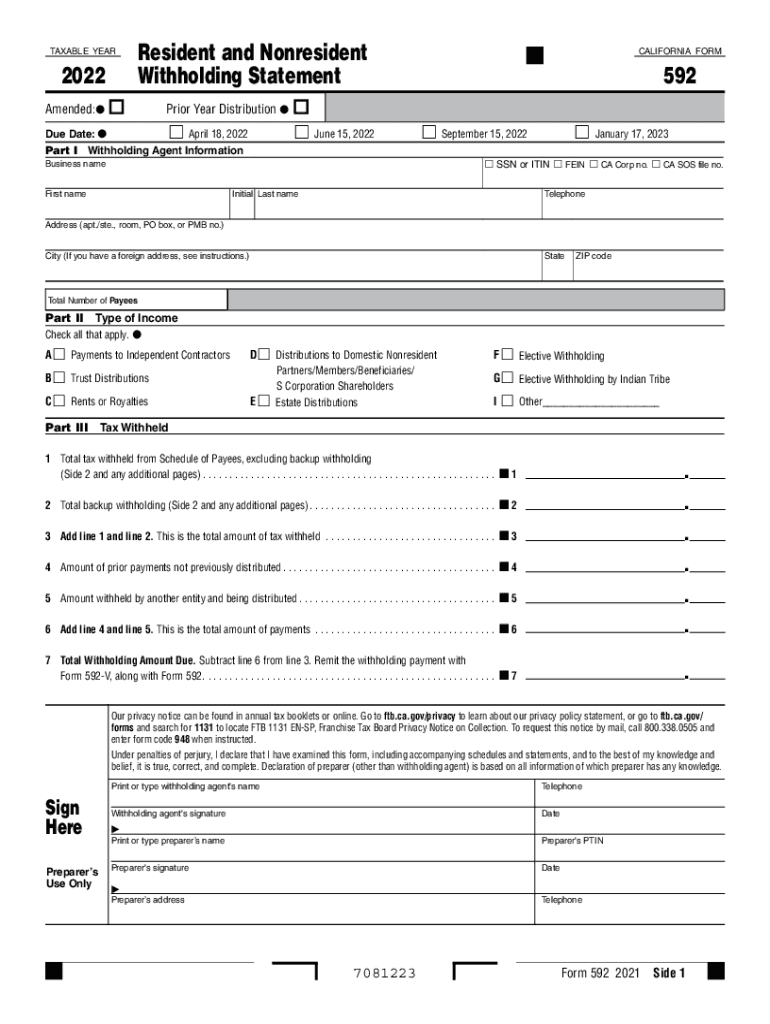

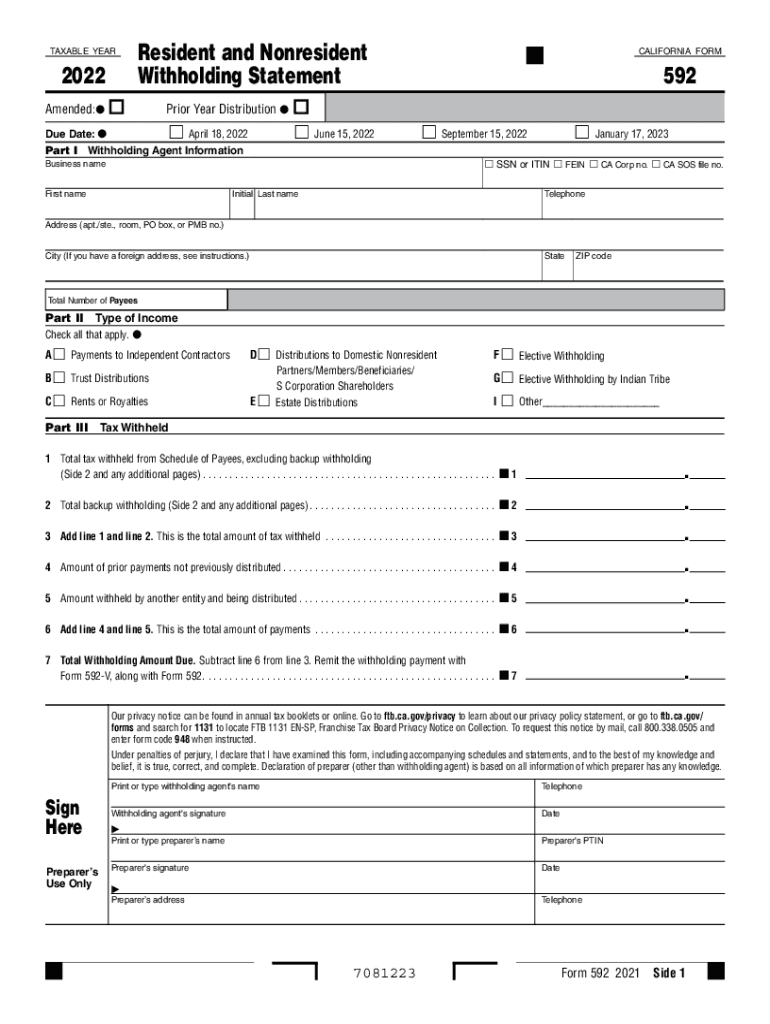

CA FTB 592 2022 free printable template

Get, Create, Make and Sign CA FTB 592

Editing CA FTB 592 online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 592 Form Versions

How to fill out CA FTB 592

How to fill out CA FTB 592

Who needs CA FTB 592?

Instructions and Help about CA FTB 592

Sound effect music Let's talk about withholding Agents It sounds like a pretty fancy title maybe something you have to take a test for get license sign up for classes pretty official sounding right Well the fact is anyone can be a withholding agent Generally speaking if you live in California and you hire someone from out of state for services you're required to WITHHOLD 7 of the payment for taxes to California Let's take a look at an example of a withholding agent Eric Smith owns Giggles a comedy club in Santa Monica He enters into a contract with comedian Roger Dillard from Nevada for 3 performances for 11000 Since Giggles pays a California nonresident for more than 1500 it becomes withholding agent under California withholding law Therefore Giggles is required to withhold7 of the 11000 and pay 770 to the Franchise Tax Board Roger Dillard receives the remaining10230 for his services Basically the responsibility lies on youth person paying for the services to keep track of the taxes owed to California for out of state workers Of course there are some exceptions and details that need to be understood- like the payment must exceed 1500 per calendar year before you're required to withhold the 7 withholding tax And there are ways to qualify for a waiver or reduction of this withholding tax Just head over to our website at ftbcagov But to simplify it a withholding agent ISA California resident or business who hires someone from another state It's your responsibility to keep track of the taxes owed to California For more information or any other tax questions go to ftbcagov

People Also Ask about

Who provides form 593?

Who is subject to California withholding?

Who must file CA Form 592?

Who is the withholding agent on Form 592 PTE?

What are the three types of withholding taxes?

What is California Form 592 for?

Who is exempt from California tax withholding?

Who needs to file 592-B?

What is withholding tax at source requirements?

Who is not subject to California withholding?

Who must file CA 592-PTE?

What is a California withholding agent?

Does form 593 need to be attached to tax return?

What is California Form 592-B?

What is 592 withholding?

How do you know if you are subject to California withholding?

Who is required to withhold tax on the California real estate sale?

What are the three 3 types of tax that are typically withheld from a worker's paycheck?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 592?

Can I edit CA FTB 592 on an iOS device?

How can I fill out CA FTB 592 on an iOS device?

What is CA FTB 592?

Who is required to file CA FTB 592?

How to fill out CA FTB 592?

What is the purpose of CA FTB 592?

What information must be reported on CA FTB 592?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.