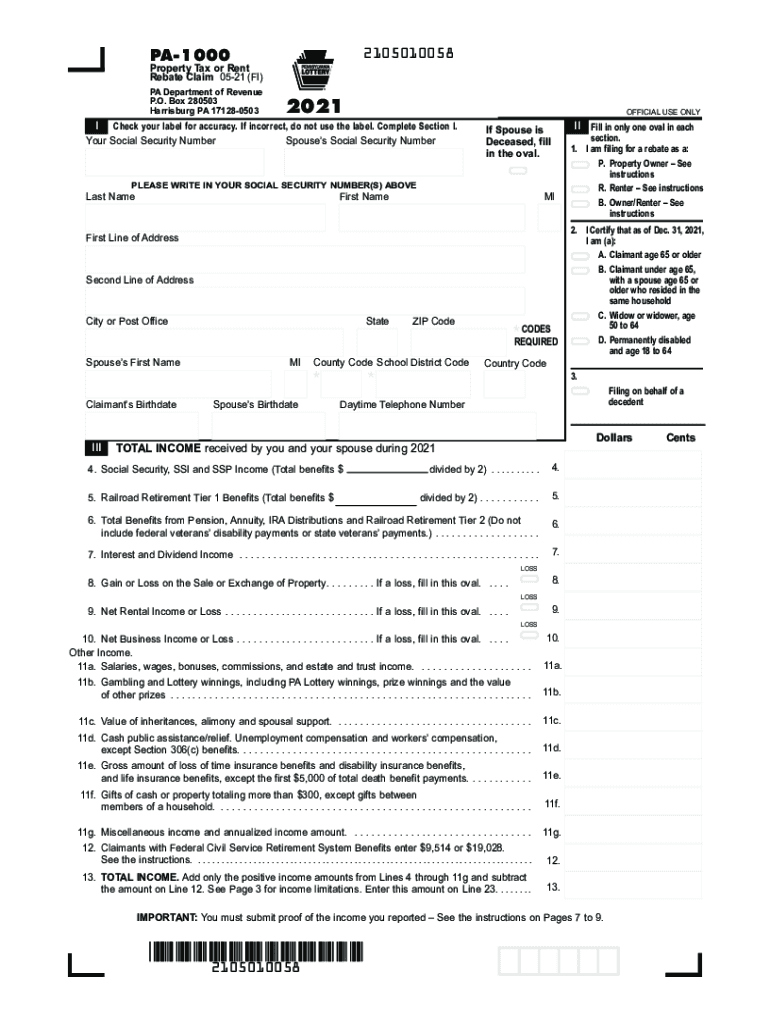

PA PA-1000 Booklet 2021 free printable template

Show details

PENNSYLVANIA

property PARENT REBATE PROGRAM

2021PA1000 Booklet 0621HARRISBURG PA 171280503

www.revenue.pa.govAPPLICATION INSIDEIMPORTANT DATES

Application deadline: JUNE 30, 2022,

Rebates begin: EARLY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA-1000 Booklet

Edit your PA PA-1000 Booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-1000 Booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA PA-1000 Booklet online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA PA-1000 Booklet. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-1000 Booklet Form Versions

Version

Form Popularity

Fillable & printabley

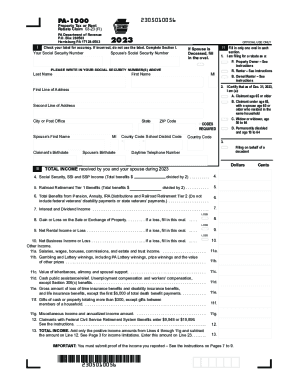

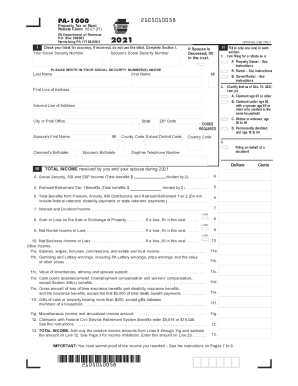

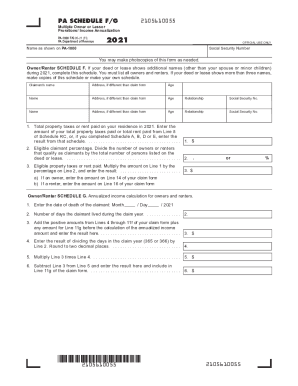

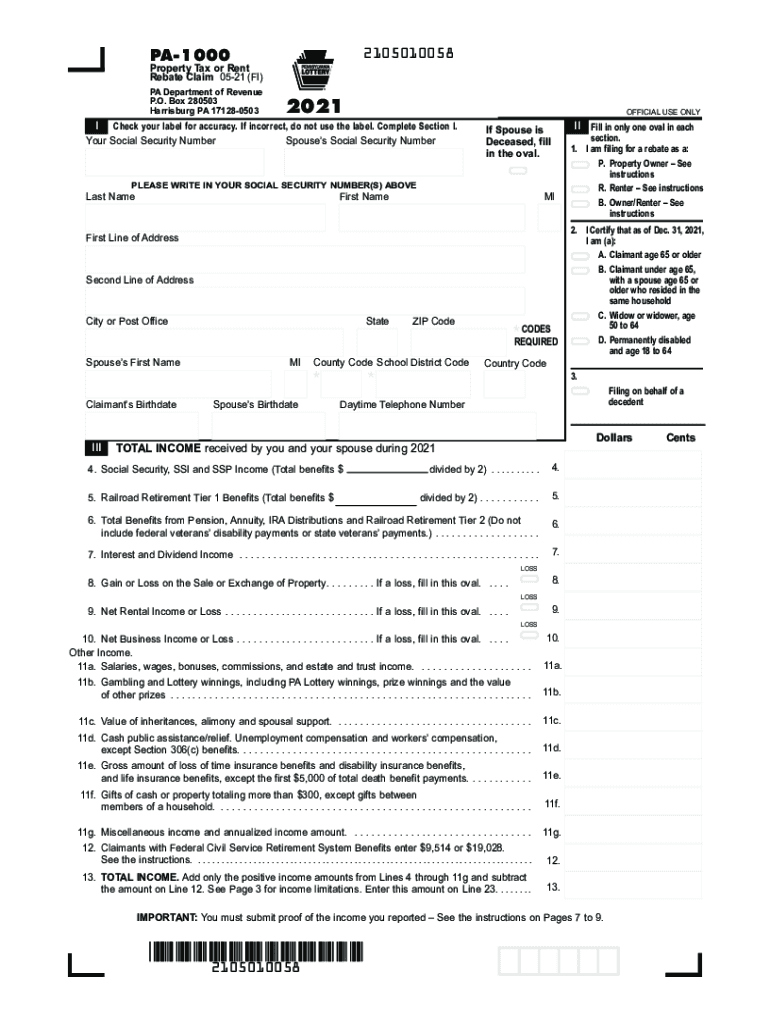

How to fill out PA PA-1000 Booklet

How to fill out PA PA-1000 Booklet

01

Gather necessary documents, including proof of income, residency, and identification.

02

Obtain the PA PA-1000 booklet from the appropriate state website or office.

03

Read the instructions carefully before starting to fill out the form.

04

Fill in your personal information such as name, address, and social security number.

05

Report all sources of income, including wages, pensions, and any other financial supports.

06

Detail your household composition, including family members and their relationships to you.

07

Indicate your assets, including bank accounts, property, and other valuables.

08

Review your answers for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the completed booklet to the designated office as instructed.

Who needs PA PA-1000 Booklet?

01

Individuals or households applying for certain state benefits or assistance in Pennsylvania.

02

Residents who need to report income and eligibility for programs like medical assistance or food assistance.

03

Anyone undergoing financial assessments for state-supported services.

Fill

form

: Try Risk Free

People Also Ask about

How much do you get back for a rent rebate in PA?

The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975. The Property Tax/Rent Rebate Program is one of five programs supported by the Pennsylvania Lottery.Property Tax/Rent Rebate Program. IncomeMaximum Rebate$15,001 to $18,000$300$18,001 to $35,000$2502 more rows

Are PA rent rebates late this year?

The deadline to apply for rebates on rent and property taxes paid in 2021 was extended to Dec. 31, 2022.

How do I claim my renters rebate in MN?

Request your RPA by: Phone: 651-296-3781 or 1-800-652-9094. Email: individual.incometax@state.mn.us. If you request an RPA by email, only include the last four digits of any Social Security Numbers.

Has pa rent rebate been extended?

This year, Pennsylvania has extended the filing deadline for the Property Tax or Rent Rebate Claim to December 31, 2022. Typically the deadline is June 30th. Here's what you need to know about taking advantage of this extension.

Is Pennsylvania getting a second rent rebate check?

Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will receive an additional one-time bonus rebate later this year. The one-time bonus rebate will be equal to 70% of your original rebate amount.Property Tax/Rent Rebate Program. IncomeMaximum Rebate$15,001 to $18,000$300$18,001 to $35,000$2502 more rows

How much do you get back for a rent rebate in pa?

Normally, the maximum rebate you can receive is $650, although homeowners in Philadelphia, Pittsburgh, and Scranton can get additional rebates because of the way those cities structure their local taxes. Some older homeowners can also receive extra if they pay a lot of their income in property taxes.

Where can I get a pa rent rebate form?

Property Tax/Rent Rebate application forms and assistance are available at no cost from the Department of Revenue district offices, legislators' offices, and GECAC Area Agency on Aging. Contact this helpline for more information.

How do I get a rent rebate in pa?

Who qualifies for the Property Tax/Rent Rebate and bonus rebate? Eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 a year for renters. Half of Social Security income is excluded.

When can I file my 2021 rent rebate in pa?

Yes, there is time to file an application through the remainder of the year. The deadline to apply for rebates on rent and property taxes paid in 2021 was extended to Dec. 31, 2022. The department strongly encourages eligible claimants to use myPATH to file their applications online.

How do I claim my renters credit on my taxes?

How do I apply for the €500 tax credit? Tenants must apply with Revenue to avail of the €500 tax benefit. When the tax credit is applied it will reduce the amount of tax you pay. The tenant's landlord must be registered with the Rental Tenancy Board for it to be claimed.

Can I still apply for rent rebate in pa?

Under Pennsylvania law, the annual deadline for the Property Tax/Rent Rebate Program is set as June 30.

Is it too late to file renters rebate MN?

You can file up to 1 year late. To claim your 2021 refund, you have until August 15, 2023 to file.

Has Pa rent rebate been extended?

This year, Pennsylvania has extended the filing deadline for the Property Tax or Rent Rebate Claim to December 31, 2022. Typically the deadline is June 30th. Here's what you need to know about taking advantage of this extension.

Can I file my renters rebate online MN?

e-File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile Express! Most calculations are automatically performed for you. Eliminate errors before submitting your return. Receive confirmation that your return was accepted.

What is the income limit for rent rebate in Pennsylvania?

The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded. Spouses, personal representatives or estates may also file rebate claims on behalf of claimants who lived at least one day in 2021 and meet all other eligibility criteria.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PA PA-1000 Booklet online?

With pdfFiller, you may easily complete and sign PA PA-1000 Booklet online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit PA PA-1000 Booklet online?

The editing procedure is simple with pdfFiller. Open your PA PA-1000 Booklet in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit PA PA-1000 Booklet straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing PA PA-1000 Booklet right away.

What is PA PA-1000 Booklet?

The PA PA-1000 Booklet is a tax document used by individuals and entities in Pennsylvania to report income, deductions, and credits for state tax purposes.

Who is required to file PA PA-1000 Booklet?

Individuals, businesses, and organizations that generate taxable income within the state of Pennsylvania are required to file the PA PA-1000 Booklet.

How to fill out PA PA-1000 Booklet?

To fill out the PA PA-1000 Booklet, you must provide personal and financial information, including income sources, deductions, and credits. Detailed instructions are included within the booklet itself to guide the completion.

What is the purpose of PA PA-1000 Booklet?

The purpose of the PA PA-1000 Booklet is to facilitate the reporting of state income tax, ensuring that individuals and entities comply with Pennsylvania tax laws.

What information must be reported on PA PA-1000 Booklet?

The PA PA-1000 Booklet requires reporting of personal information, income earned, deductions claimed, tax credits, and any other relevant financial details pertinent to state taxation.

Fill out your PA PA-1000 Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-1000 Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.