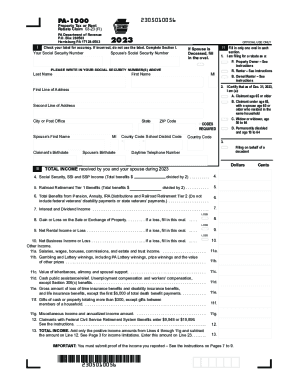

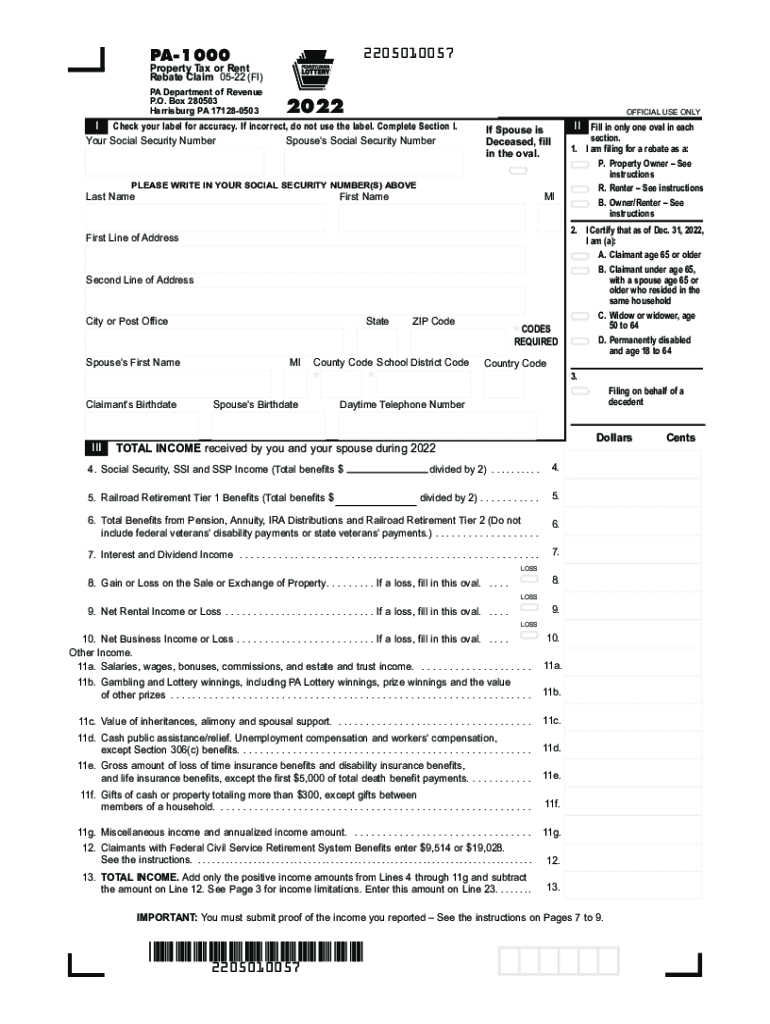

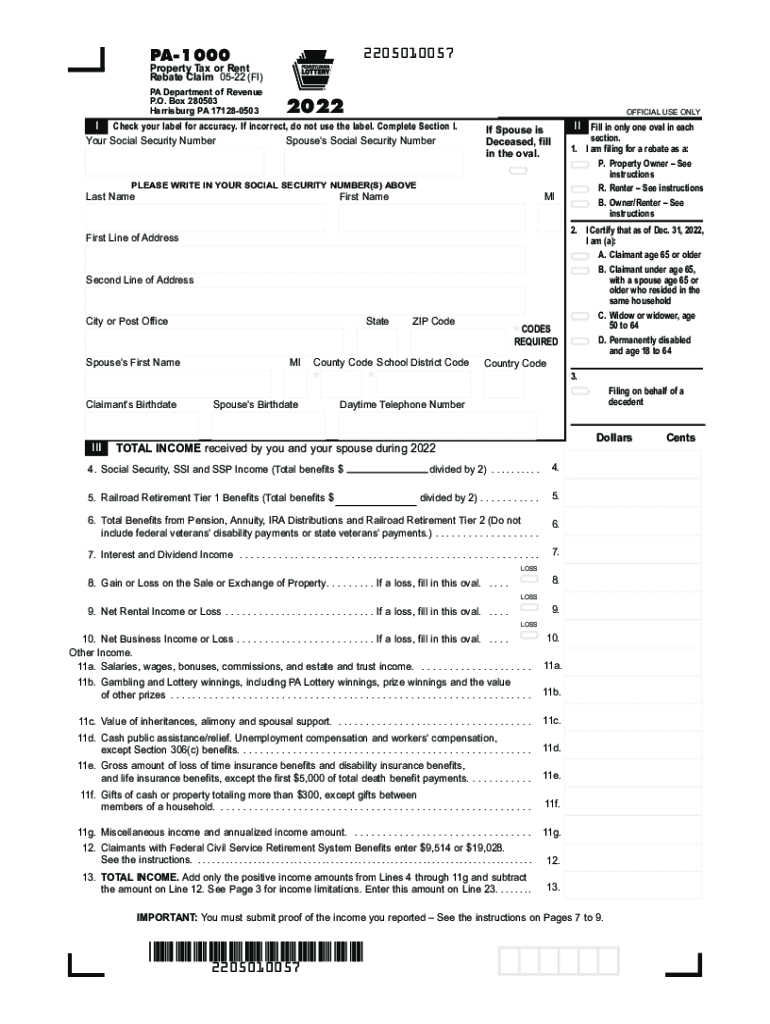

PA PA-1000 Booklet 2022 free printable template

Show details

PENNSYLVANIA property PARENT REBATE PROGRAM 2022PA1000 Booklet 0522HARRISBURG PA 171280503 www.revenue.pa.govAPPLICATION INSIDEIMPORTANT DATES Application deadline: JUNE 30, 2023, Rebates begin: EARLY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA-1000 Booklet

Edit your PA PA-1000 Booklet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-1000 Booklet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA PA-1000 Booklet online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA PA-1000 Booklet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-1000 Booklet Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-1000 Booklet

How to fill out PA PA-1000 Booklet

01

Gather necessary documents: Collect your income documents, identification, and any other required paperwork.

02

Begin filling out the PA PA-1000: Start with your personal information such as name, address, and Social Security number.

03

Report your income: Fill in your sources of income including wages, benefits, and any other earnings.

04

Detail your expenses: Provide information on allowable expenses including housing costs, medical expenses, etc.

05

Complete the certification section: Sign and date the form to certify that the information provided is accurate.

06

Review your application: Check all entries for accuracy and completeness before submission.

07

Submit your PA PA-1000: Mail or submit the application through the designated online platform.

Who needs PA PA-1000 Booklet?

01

Individuals who are applying for assistance programs in Pennsylvania.

02

Residents seeking financial support due to low income or special circumstances.

03

Those who need to report income for eligibility determination.

Fill

form

: Try Risk Free

People Also Ask about

Is Virginia getting a rebate check?

The 2022 Virginia General Assembly passed a law giving taxpayers with a liability a rebate of up to $250 for individual filers and up to $500 for joint filers.

What is a Virginia 760 form?

2022 Virginia Resident Form 760 Individual Income Tax Return.

Where can I get a PA property tax rebate form?

Property Tax/Rent Rebate application assistance is available at no cost from Department of Revenue district offices, local Area Agencies on Aging, senior centers and state legislators' offices.

What do you attach to VA 760?

REQUIRED ATTACHMENTS TO FORM 760 Forms W-2, 1099 & VK-1 showing Virginia withholding. Schedule ADJ. Schedule VAC. Schedule OSC. Schedule CR. Form 760C or Form 760F. Virginia Credit Schedules. Other Virginia Statements or Schedules.

What is Virginia Form 763 2022?

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PA PA-1000 Booklet directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your PA PA-1000 Booklet along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit PA PA-1000 Booklet on an iOS device?

You certainly can. You can quickly edit, distribute, and sign PA PA-1000 Booklet on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete PA PA-1000 Booklet on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your PA PA-1000 Booklet, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is PA PA-1000 Booklet?

The PA PA-1000 Booklet is a tax document used in Pennsylvania for reporting income tax for individuals and businesses. It is specifically designed to help the Department of Revenue collect information necessary for tax assessment.

Who is required to file PA PA-1000 Booklet?

Individuals, businesses, or entities that have earned income or conducted business activities in Pennsylvania are required to file the PA PA-1000 Booklet.

How to fill out PA PA-1000 Booklet?

To fill out the PA PA-1000 Booklet, you need to gather necessary financial documents, complete the required sections with your income details, deductions, and other relevant information, then review the booklet for accuracy before submitting it to the Pennsylvania Department of Revenue.

What is the purpose of PA PA-1000 Booklet?

The purpose of the PA PA-1000 Booklet is to report and document income earned by Pennsylvania residents or businesses, ensuring compliance with state tax laws and facilitating the assessment and collection of income tax.

What information must be reported on PA PA-1000 Booklet?

The PA PA-1000 Booklet requires reporting of personal information, total income, deductions, tax credits, and other pertinent financial data to accurately assess tax liabilities.

Fill out your PA PA-1000 Booklet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-1000 Booklet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.