Get the free French probate : An inheritance settlementNotaries of France

Show details

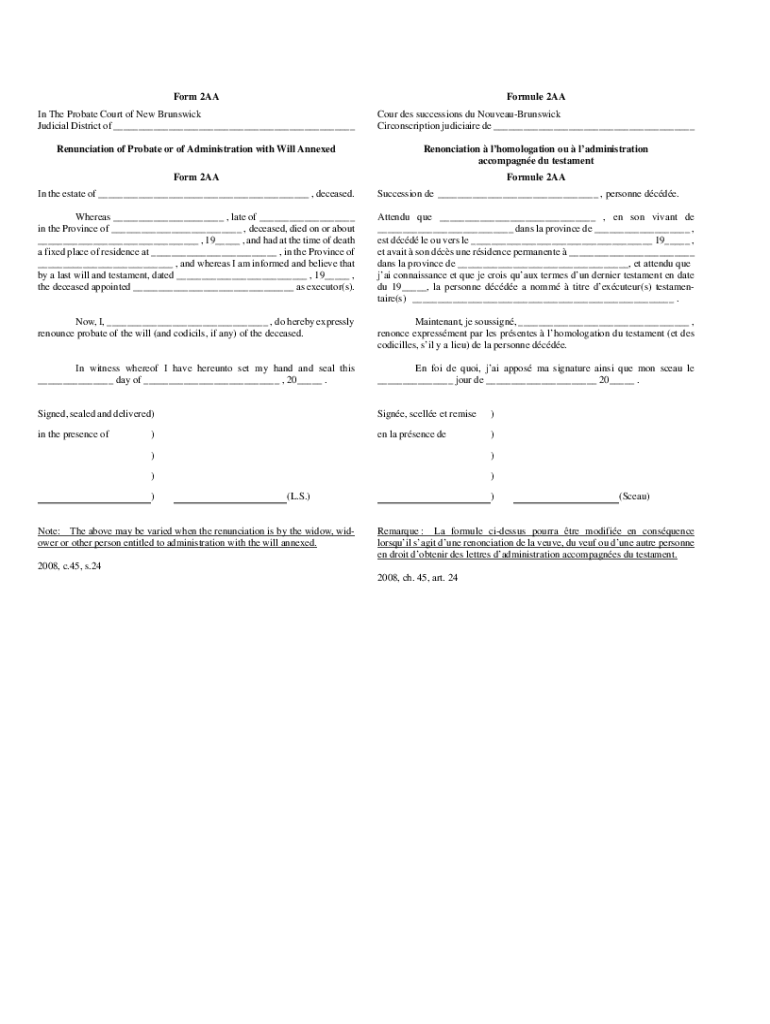

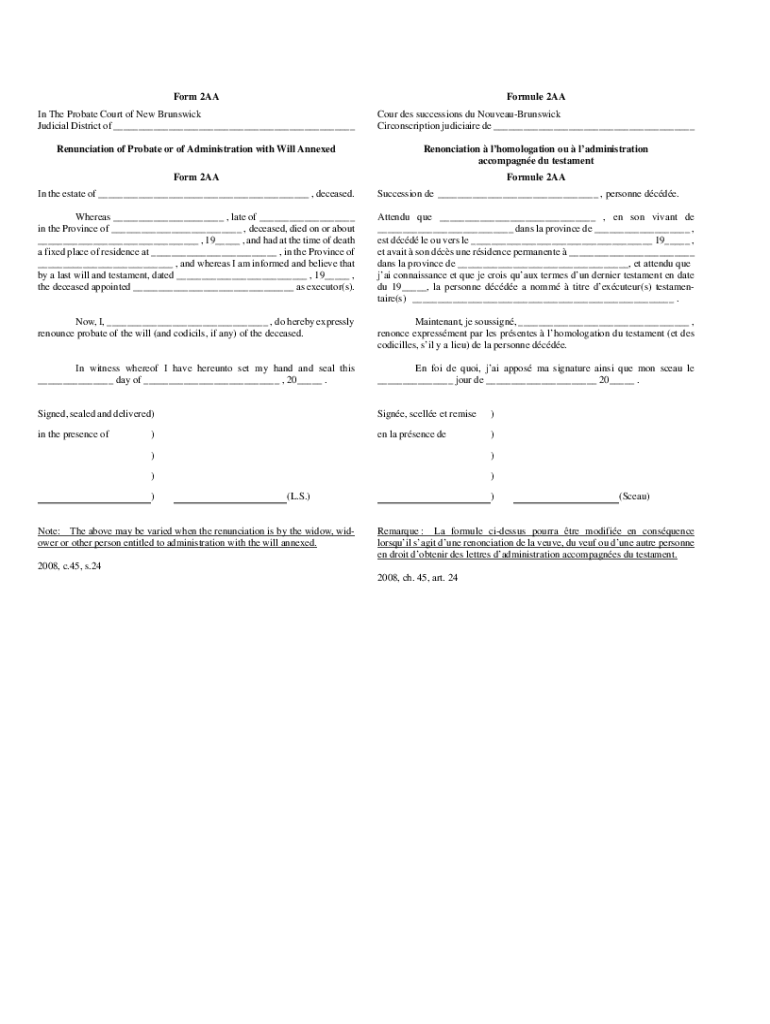

849Loi SUR la Four DES successionsP17.1Form 2AAFormule 2AAIn The Probate Court of New Brunswick Judicial District of ___Four DES successions Du NouveauBrunswick Cir conscription judiciary DE ___Renunciation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign french probate an inheritance

Edit your french probate an inheritance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your french probate an inheritance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing french probate an inheritance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit french probate an inheritance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out french probate an inheritance

How to fill out french probate an inheritance

01

Obtain the death certificate of the deceased from the relevant authority.

02

Determine whether the deceased left a will. If yes, locate the original will document.

03

Contact a notary public or a lawyer specializing in probate law in France.

04

Provide the notary or lawyer with all necessary documents, including but not limited to the death certificate, will (if applicable), proof of relationship to the deceased, and any other relevant documents.

05

The notary or lawyer will guide you through the process of filing the inheritance tax declaration and other required paperwork.

06

Attend any necessary appointments or meetings with the notary or lawyer to provide additional information or clarifications.

07

Once all paperwork has been completed and submitted, wait for the probate process to be finalized.

08

After probate is granted, the notary or lawyer will assist in transferring the assets to the beneficiaries according to the terms of the will or the French inheritance law.

09

It is advisable to seek professional legal advice and guidance throughout the entire process to ensure compliance with French probate laws.

Who needs french probate an inheritance?

01

Anyone who inherits assets located in France may need to go through the French probate process to legally transfer and claim those assets.

02

This includes beneficiaries named in a will, as well as legal heirs who are entitled to a share of the deceased person's estate under French inheritance laws.

03

It is important to note that the specific requirements for French probate may vary depending on the nature and value of the assets, the presence of a will, and the relationship between the deceased and the beneficiary or legal heir.

04

Therefore, it is recommended to consult a notary public or a lawyer specializing in probate law in France to determine if French probate is necessary in your particular case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify french probate an inheritance without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your french probate an inheritance into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute french probate an inheritance online?

Completing and signing french probate an inheritance online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit french probate an inheritance on an Android device?

With the pdfFiller Android app, you can edit, sign, and share french probate an inheritance on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is french probate an inheritance?

French probate is the legal process of distributing a deceased person's assets according to their will or French inheritance laws.

Who is required to file french probate an inheritance?

The legal heirs or beneficiaries of the deceased person's estate are required to file French probate.

How to fill out french probate an inheritance?

To fill out French probate, you will need to gather all relevant documents such as the deceased person's will, death certificate, and information about their assets and debts. It is recommended to seek the assistance of a notary or legal expert.

What is the purpose of french probate an inheritance?

The purpose of French probate is to ensure that the deceased person's assets are distributed correctly and in accordance with the law.

What information must be reported on french probate an inheritance?

Information such as the deceased person's assets, debts, will, and details of beneficiaries must be reported on French probate.

Fill out your french probate an inheritance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

French Probate An Inheritance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.