IL RUT-25 Instructions 2021 free printable template

Show details

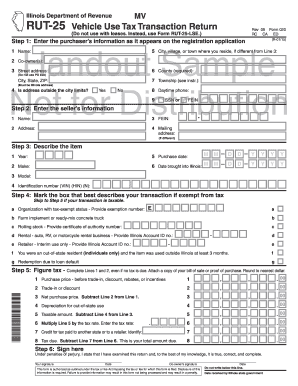

Illinois Department of RevenueRUT25Vehicle Use Tax Transaction Return

Instructions must file Form RUT25? Form RUT25 General Information must complete Form RUT25, Vehicle Use Tax Transaction

Return,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL RUT-25 Instructions

Edit your IL RUT-25 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL RUT-25 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL RUT-25 Instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL RUT-25 Instructions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL RUT-25 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL RUT-25 Instructions

How to fill out IL RUT-25 Instructions

01

Obtain the IL RUT-25 form from the Illinois Department of Revenue website or a local office.

02

Fill in your name and address in the required fields.

03

Indicate your Social Security number or federal employer identification number.

04

Provide details of any tax-exempt organization status if applicable.

05

List the purchases being claimed for exemption, including descriptions and dates.

06

Calculate the total amount of exempt purchases and enter it in the designated box.

07

Sign and date the form, certifying the accuracy of the information provided.

08

Submit the completed form to the appropriate office as indicated in the instructions.

Who needs IL RUT-25 Instructions?

01

Individuals or businesses making tax-exempt purchases in Illinois.

02

Organizations that qualify for sales tax exemptions under Illinois law.

03

Tax professionals assisting clients with tax-exempt transactions in Illinois.

Fill

form

: Try Risk Free

People Also Ask about

What is a rut-25 LSE form?

Forms RUT-25, RUT-25-LSE, and RUT-50 are generally obtained when you license and title your vehicle at the applicable state facility or at a currency exchange. Do not make copies of the forms prior to completing. These forms have unique transaction numbers that should not be duplicated. Doing so could delay processing.

What is a rut 25 LSE?

You must complete Form RUT-25-LSE, Use Tax Return for Lease Transactions, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you leased through an unregistered out-of-state dealer or retailer.

What is Rut 25 tax Illinois?

Who must file Form RUT-25? You must complete Form RUT-25, Vehicle Use Tax Transaction Return, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you purchased from an unregistered out-of-state dealer or retailer.

How do I know if I owe Illinois use tax?

For example, if you purchase an item in a state with an 8.00% sales tax and the tax is collected by the seller, you do not owe any Illinois use tax. On the other hand, if you purchase an item in a state with a 5.00% sales tax, you owe the State of Illinois 1.25%.

What is the tax rate for Rut-25 in Illinois?

Use 6.25 percent (. 0625) unless otherwise instructed.

What is the vehicle Use Tax transaction return form rut-25?

Who must file Form RUT-25? You must complete Form RUT-25, Vehicle Use Tax Transaction Return, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you purchased from an unregistered out-of-state dealer or retailer.

How do I report Use Tax in Illinois?

You can file Form ST-1, Sales and Use Tax and E911 Surcharge electronically using MyTax Illinois to report your sales and use tax liability. If you are reporting sales for more than one location or from a changing location, you must also submit Form ST-2, Multiple Site Form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IL RUT-25 Instructions online?

pdfFiller has made it easy to fill out and sign IL RUT-25 Instructions. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out IL RUT-25 Instructions using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IL RUT-25 Instructions and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete IL RUT-25 Instructions on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IL RUT-25 Instructions. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL RUT-25 Instructions?

IL RUT-25 Instructions are guidelines provided by the Illinois Department of Revenue for filing the RUT-25 form, which is used to report the use tax for purchases made by Illinois residents.

Who is required to file IL RUT-25 Instructions?

Any individual or business that has purchased tangible personal property from out-of-state sellers without paying Illinois sales tax must file IL RUT-25 Instructions.

How to fill out IL RUT-25 Instructions?

To fill out IL RUT-25 Instructions, you need to provide your identification information, detail the items purchased, indicate the purchase date, and calculate the total use tax owed.

What is the purpose of IL RUT-25 Instructions?

The purpose of IL RUT-25 Instructions is to guide taxpayers on how to correctly report and remit use tax due on out-of-state purchases, ensuring compliance with Illinois tax laws.

What information must be reported on IL RUT-25 Instructions?

The information that must be reported includes your name and address, item descriptions, purchase amounts, purchase dates, and the calculated use tax amount owed.

Fill out your IL RUT-25 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL RUT-25 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.