Get the free rut 25 lse - tax illinois

Show details

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of Revenue RUT-25-LSE-X Amended Use Tax Return Rev 01 Form 964 Station

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rut 25 lse

Edit your rut 25 lse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rut 25 lse form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rut 25 lse online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rut 25 lse. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rut 25 lse

How to fill out rut 25 lse:

01

Gather the necessary information: Before filling out the rut 25 lse form, make sure you have all the required information at hand. This may include personal details, such as name, address, and contact information.

02

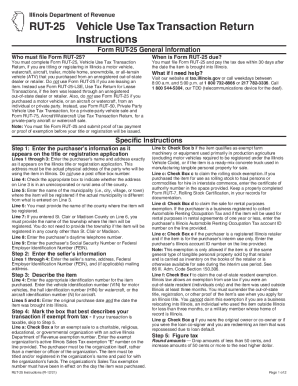

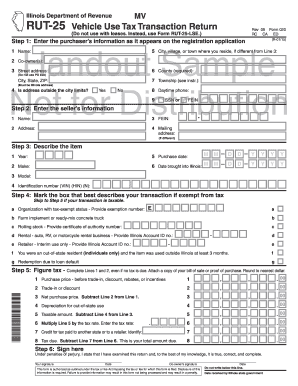

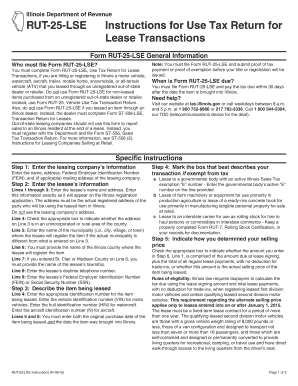

Understand the purpose of the form: The rut 25 lse form is typically used for reporting the sale or transfer of a motor vehicle in certain states. Familiarize yourself with the specific purpose of the form in your jurisdiction to ensure accurate completion.

03

Provide vehicle details: In the rut 25 lse form, you will need to provide specific details about the motor vehicle being sold or transferred. This may include information such as the make, model, year, and Vehicle Identification Number (VIN).

04

Include buyer and seller information: Both the buyer and seller of the motor vehicle will need to provide their respective information in the form. This may include their names, addresses, driver's license numbers, and signatures.

05

Attach supporting documents: Depending on the requirements of your jurisdiction, you may need to include additional documents along with the rut 25 lse form. Examples can include bill of sale, odometer disclosure, or title transfer documents. Make sure to review your local regulations to determine which documents are needed.

Who needs rut 25 lse:

01

Individuals selling a motor vehicle: If you are selling a motor vehicle, you may need to fill out the rut 25 lse form. This form helps ensure a proper record of the sale or transfer and may be required by your local department of motor vehicles or similar authority.

02

Individuals buying a motor vehicle: In some cases, buyers may also be required to complete the rut 25 lse form as part of the purchasing process. This helps establish proof of ownership and allows for proper registration and titling of the vehicle.

03

Authorities and regulatory bodies: The rut 25 lse form may also be used by authorities and regulatory bodies to track and monitor motor vehicle sales and transfers. This helps ensure compliance with local laws and regulations regarding vehicle ownership and taxation.

Remember, it is important to consult the specific guidelines and requirements of your jurisdiction when filling out the rut 25 lse form to ensure accuracy and compliance.

Fill

form

: Try Risk Free

People Also Ask about

What is Rut-50 tax Illinois?

You must file Form RUT-50, Private Party Vehicle Use Tax. Transaction, if you purchased or acquired by gift or transfer a motor. vehicle from a private party. If you purchased a vehicle from an unregistered out-of-state dealer, lending institution, leasing company, or retailer; or if you purchased.

What does use tax liability mean?

The use tax is a form of sales tax that you must pay for goods and services you intend to use in a state where you'd normally pay sales tax and purchase anywhere else where they aren't required to collect sales tax. The government does this to ensure that local sellers aren't at a disadvantage.

What is a rut-25-LSE form?

Forms RUT-25, RUT-25-LSE, and RUT-50 are generally obtained when you license and title your vehicle at the applicable state facility or at a currency exchange. Do not make copies of the forms prior to completing. These forms have unique transaction numbers that should not be duplicated. Doing so could delay processing.

What does use tax mean in Illinois?

Use Tax is a sales tax that you, as the purchaser, owe on items that you buy for use in Illinois. If the seller does not collect at least 6.25 percent sales tax, you must pay the difference to the Illinois Department of Revenue.

What is the use tax to be added to your Illinois tax liability?

What are the Illinois Use Tax rates? Illinois Use Tax rates are 6.25 percent of the purchase price of general merchandise and 1.00 percent of the purchase price of qualifying food, drugs, and medical appliances.

What is the use tax on a car in Illinois?

The rate is 6.25% of the purchase price or fair market value, whichever is greater.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rut 25 lse in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign rut 25 lse and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send rut 25 lse to be eSigned by others?

Once you are ready to share your rut 25 lse, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit rut 25 lse on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign rut 25 lse right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is rut 25 lse?

Rut 25 LSE is a specific tax return form used in certain jurisdictions to report income and taxes owed for LLCs and partnerships, especially in relation to business sales.

Who is required to file rut 25 lse?

Entities such as limited liability companies (LLCs), partnerships, and certain corporations that conduct business in the applicable jurisdiction are required to file rut 25 lse.

How to fill out rut 25 lse?

To fill out rut 25 lse, you will need to gather relevant financial information, complete the form with accurate business details, income figures, and taxpayer identification, and then submit it to the appropriate tax authority.

What is the purpose of rut 25 lse?

The purpose of rut 25 lse is to report business income and calculate the taxes owed by entities operating in the jurisdiction, ensuring compliance with local tax laws.

What information must be reported on rut 25 lse?

The information that must be reported on rut 25 lse includes the entity's name, address, tax identification number, gross income, deductions, and the calculated tax amount due.

Fill out your rut 25 lse online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rut 25 Lse is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.