PR AS 2781.1 2018-2025 free printable template

Show details

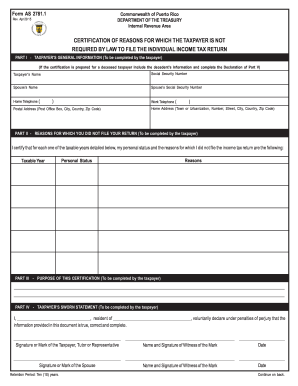

Este documento es utilizado por los contribuyentes para certificar las razones por las cuales no están obligados por ley a presentar la declaración de impuestos sobre la renta individual.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign as 2781 tax form

Edit your pr 2781 taxpayer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2781 taxpayer return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2781 certification form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2781 certification pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR AS 2781.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out puerto rico 2781 form

How to fill out PR AS 2781.1

01

Begin by obtaining the PR AS 2781.1 form from the relevant authority or website.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide any required identification or registration numbers.

05

Complete any sections regarding your qualifications or experience as needed.

06

Review your entries to ensure all information is accurate and complete.

07

Sign and date the form, if required.

08

Submit the completed form as per the instructions, whether online or by mail.

Who needs PR AS 2781.1?

01

Individuals applying for specific certifications or licenses under the PR AS 2781.1 standard.

02

Organizations requiring compliance with specific standards as dictated by PR AS 2781.1.

03

Professionals in fields governed by this standard who need to demonstrate their qualifications.

Fill

as2781 tax form

: Try Risk Free

People Also Ask about as2781 1 form

Where is individual income on joint tax return 1040?

**AGI stands for Adjusted Gross Income. This can be found on Line 11 of the 2021 and 2020 1040 Forms (1040 or 1040-SR).

Which tax form do I use?

Form 1040 is the standard tax return form that most individual taxpayers use every year.

What is Form 2781.1 in Puerto Rico?

Form AS 2781.1 is used in those cases where Form SC 6088 shows that the taxpayer did not file some of the income tax returns corresponding to the last 5 or 10 taxable years, as applicable.

Can I download a 1040 tax form?

You can e-file directly to the IRS and download or print a copy of your tax return.

Can I print a 1040 tax form?

A copy of the tax return can also be printed from within the return. The print location from inside the return is located on the Submission page under the e-File section. After all required information has been entered on the e-file page, select Save.

How do I know which tax form to use?

Key Takeaways. Form 1040 is the standard tax return form that most individual taxpayers use every year. The IRS no longer accepts Forms 1040-EZ or Form 1040-A for tax years 2018 and beyond, which means most taxpayers must use Form 1040 to complete their tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my as2781 taxpayer tax in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your as2781 taxpayer fillable and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send as2781 return printable to be eSigned by others?

Once you are ready to share your as2781 tax fill, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete as2781 tax template on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your as2781 1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is PR AS 2781.1?

PR AS 2781.1 is a regulatory form used for reporting specific financial and operational information by certain entities as part of compliance with industry standards.

Who is required to file PR AS 2781.1?

Entities that meet certain criteria, typically related to their size, type of operations, or industry standards, are required to file PR AS 2781.1.

How to fill out PR AS 2781.1?

To fill out PR AS 2781.1, entities must provide accurate financial data, operational metrics, and other required information in the designated sections of the form as per the guidelines provided.

What is the purpose of PR AS 2781.1?

The purpose of PR AS 2781.1 is to ensure transparency, accountability, and regulatory compliance by collecting standardized data from relevant entities.

What information must be reported on PR AS 2781.1?

The information reported on PR AS 2781.1 typically includes financial statements, operational performance indicators, compliance data, and other relevant metrics.

Fill out your 2781 tax return 2018-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2781 Certification is not the form you're looking for?Search for another form here.

Keywords relevant to 2781 certification tax

Related to 2781 taxpayer individual

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.