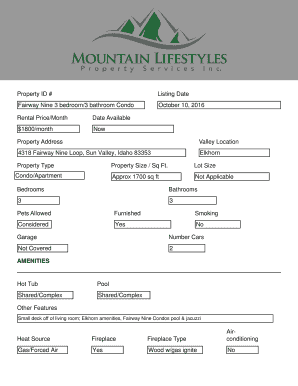

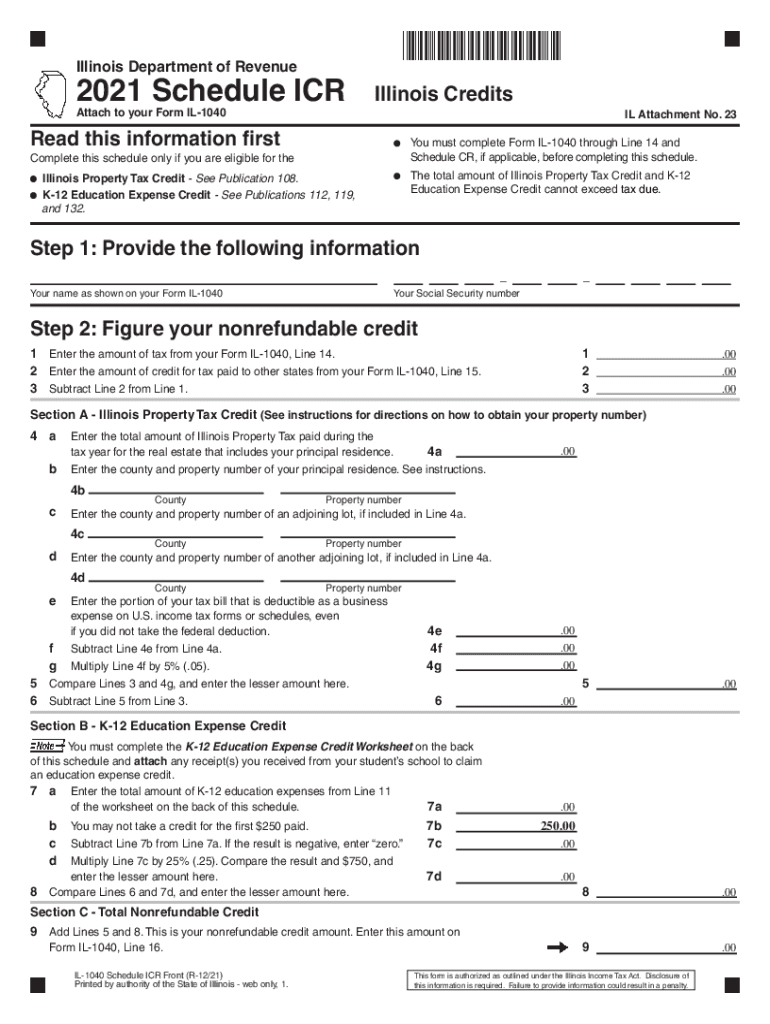

IL IL-1040 Schedule ICR 2021 free printable template

Instructions and Help about IL IL-1040 Schedule ICR

How to edit IL IL-1040 Schedule ICR

How to fill out IL IL-1040 Schedule ICR

About IL IL-1040 Schedule ICR 2021 previous version

What is IL IL-1040 Schedule ICR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IL IL-1040 Schedule ICR

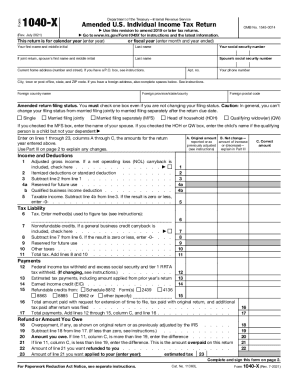

What should I do if I've made a mistake on my illinois filing?

If you've made an error on your illinois submission, you should file an amended return as soon as possible. Ensure to reference the original form and indicate the corrections clearly. It's also advisable to include any additional documentation that supports your amendments.

How can I check the status of my illinois filing?

To verify the status of your illinois form, you can use the state’s online verification portal. You'll need specific details such as your Social Security number and the type of form submitted. This will help you track whether your submission has been processed or if there were any issues.

What should I do if my illinois submission is rejected?

If your illinois filing is rejected, you will typically receive a notice indicating the reason for rejection. Carefully review this feedback and make the necessary corrections. Afterward, you can resubmit the form either electronically or via mail, depending on the initial submission method.

What are the privacy measures surrounding my illinois filing?

Illinois has stringent privacy measures in place to protect your personal data during the filing process. This includes secure data encryption and access limitations to ensure that only authorized personnel can view sensitive information related to your filing.

Can I e-file my illinois form using mobile devices?

Yes, you can e-file your illinois form using mobile devices as long as you have a compatible browser. Ensure that your device meets the technical requirements specified by the illinois Department of Revenue for a smooth filing experience.