CO DR 0104CR 2021 free printable template

Show details

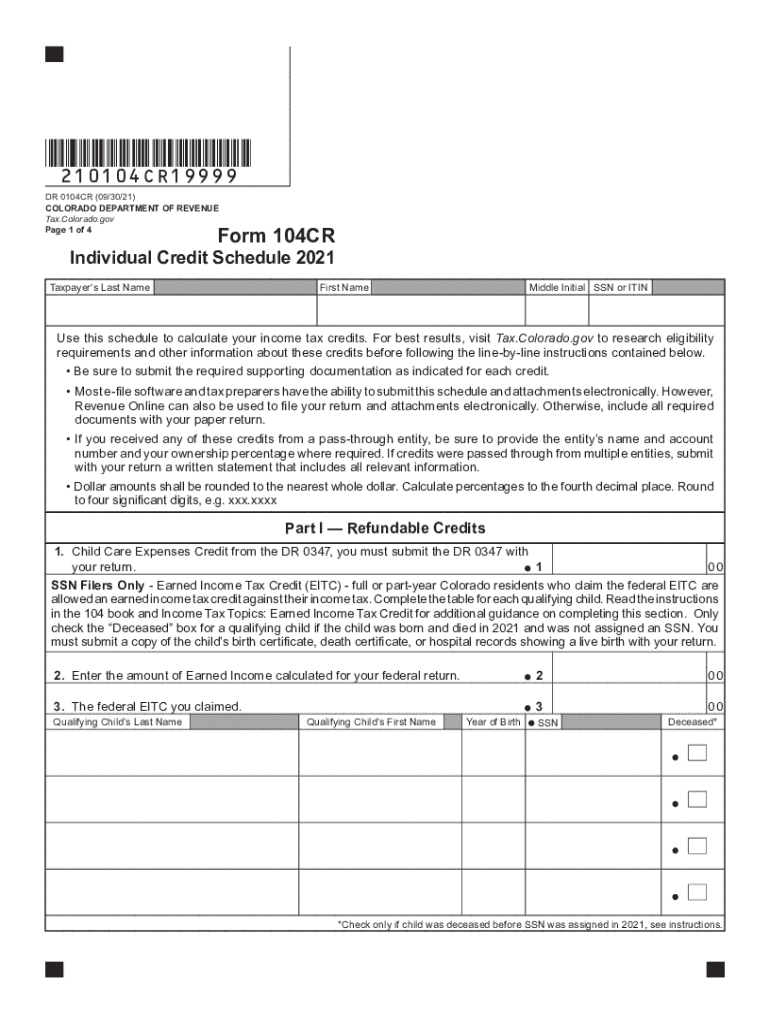

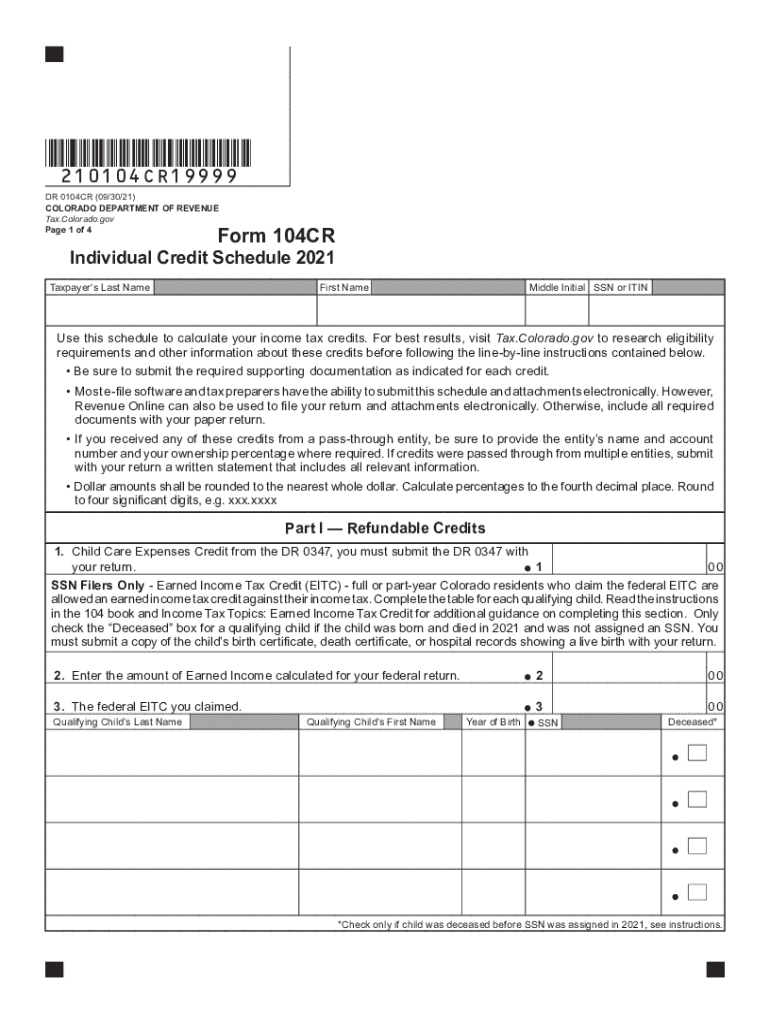

*210104CR19999*

DR 0104CR (09×30/21×COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 4Form 104CRIndividual Credit Schedule 2021

Taxpayers Last NameFirst NameMiddle Initial SSN or Chinese

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 0104CR

Edit your CO DR 0104CR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 0104CR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR 0104CR online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DR 0104CR. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0104CR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 0104CR

How to fill out CO DR 0104CR

01

Obtain the CO DR 0104CR form from the Colorado Department of Revenue website or your local tax office.

02

Enter your name and Social Security number at the top of the form.

03

Fill out the section indicating your filing status (single, married, etc.).

04

Provide information regarding your income for the year, including wages, interest, and any other sources.

05

Itemize any deductions you are claiming according to the specific guidelines provided with the form.

06

Calculate your taxable income by subtracting deductions from your total income.

07

Determine the amount of tax owed based on the provided tax tables.

08

Complete the payment information section if you owe taxes, or fill out the refund section if applicable.

09

Double-check all entries for accuracy.

10

Sign and date the form before submitting it to the Colorado Department of Revenue.

Who needs CO DR 0104CR?

01

The CO DR 0104CR form is needed by individual taxpayers who are residents of Colorado and are required to file a state income tax return.

02

It is also used by those who owe tax or are seeking a refund for overpaid taxes.

Fill

form

: Try Risk Free

People Also Ask about

Does Colorado have their own W 4 form?

Does Colorado have a W-4 form? Yes. Starting in 2022, an employee may complete a Colorado Employee Withholding Certificate (form DR 0004), but it is not required. If an employee completes form DR 0004, the employer must calculate Colorado withholding based on the amounts the employee entered.

How do I calculate credit for taxes paid to another state?

The amount that you receive as a credit should be based on the amount of tax that you actually pay to that other state. Example: If you had $1,000 withheld during the year, but then file the other state return and receive a $250 refund, the amount of tax you actually paid to the other state technically was only $750.

What is the Colorado tax credit?

About Colorado Cash Back On May 23, 2022, Gov. Jared Polis signed a new law (Senate Bill 22-233) to give Coloradans a tax rebate of $750 for individual filers and $1,500 for joint filers this summer.

Do I need to file a Colorado state tax return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Does Colorado require a state tax form?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

What is the Colorado state tax form?

This filing guide will assist you with completing your Colorado Income Tax Return.

What is Colorado individual income tax?

The new Colorado income tax rate is 4.40%, beginning in the 2022 tax year. In 2020, proposition 116 reduced the income tax rate to 4.55%. In 2019, the Colorado income tax rate was temporarily reduced to 4.50%, because a TABOR refund mechanism was triggered. From 2000 to 2018, the Colorado income tax rate was 4.63%.

What is the Colorado state tax form called?

Colorado Form 104 – Personal Income Tax Return for Residents.

Is there a w4 form Colorado?

The Colorado Filing Status (Married, Single, Head of Household, Exempt) must align with the filing status on their federal W-4. A new IRS Form W-4 must be entered in the employee portal if you wish to change your tax filing status or claim exemption from taxes.

Does Colorado have a credit for taxes paid to other states?

The credit for taxes paid to another state is automatically calculated in your account when you add a Nonresident return to your already created resident Colorado return if you pay taxes to both Colorado and another state. Colorado may request a copy of the other state's tax return before processing the return.

Is there a state tax form for Colorado?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

Does Colorado allow a credit for taxes paid to another state?

As a full-year Colorado resident the taxpayer must pay Colorado tax on all of the taxable income. The credit for taxes paid to another state prevents double taxation of income by two states and will not apply in this situation since the other state is not taxing the income.

How to file Colorado state tax form?

File Individual Income Tax Online Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You may opt to e-file through a paid tax professional or purchase tax software to complete and file returns.

Is there a state tax form for Colorado?

An overview of Colorado Form DR 0004: This form does not replace the IRS Form W-4. If an employee does not submit a Colorado Form DR 0004, then CU must calculate their Colorado state withholding tax based on their federal W-4.

What is the 2022 Colorado employee withholding certificate?

Beginning in 2022, form DR 0004 is available for employees to adjust their Colorado withholding. If an employee gives you a completed DR 0004, it will determine two of the amounts you enter into the DR 1098 calculation.

What is the Colorado Individual Income Tax Form?

This filing guide will assist you with completing your Colorado Income Tax Return.

How do I file an individual tax return in Colorado?

File Individual Income Tax Online Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You may opt to e-file through a paid tax professional or purchase tax software to complete and file returns.

What is a tax credit from another state?

Federal/State Law Existing California law allows a tax credit for net income taxes paid to a state other than California. The credit is based on net income taxes paid to the other state on income that has a source in the other state, and is also taxable under California law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CO DR 0104CR?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the CO DR 0104CR in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit CO DR 0104CR on an Android device?

You can make any changes to PDF files, like CO DR 0104CR, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out CO DR 0104CR on an Android device?

Complete your CO DR 0104CR and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CO DR 0104CR?

CO DR 0104CR is a sales tax return form used in Colorado for reporting sales tax collected by retailers.

Who is required to file CO DR 0104CR?

Any business or individual that collects sales tax from customers in Colorado is required to file CO DR 0104CR.

How to fill out CO DR 0104CR?

To fill out CO DR 0104CR, businesses must provide information such as total sales, the amount of sales tax collected, and any deductions or exemptions.

What is the purpose of CO DR 0104CR?

The purpose of CO DR 0104CR is to report and remit the sales tax collected by businesses to the Colorado Department of Revenue.

What information must be reported on CO DR 0104CR?

The form requires reporting total sales, sales tax collected, any adjustments, and the amount due or refund requested.

Fill out your CO DR 0104CR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 0104cr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.