CO DR 0104CR 2023 free printable template

Show details

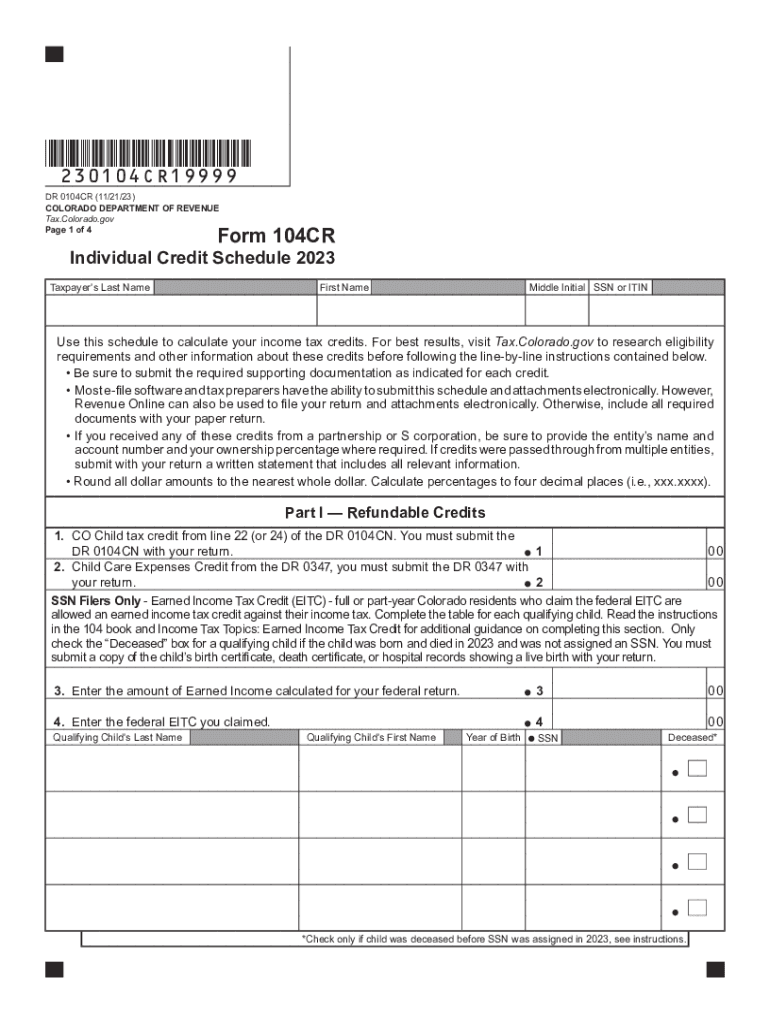

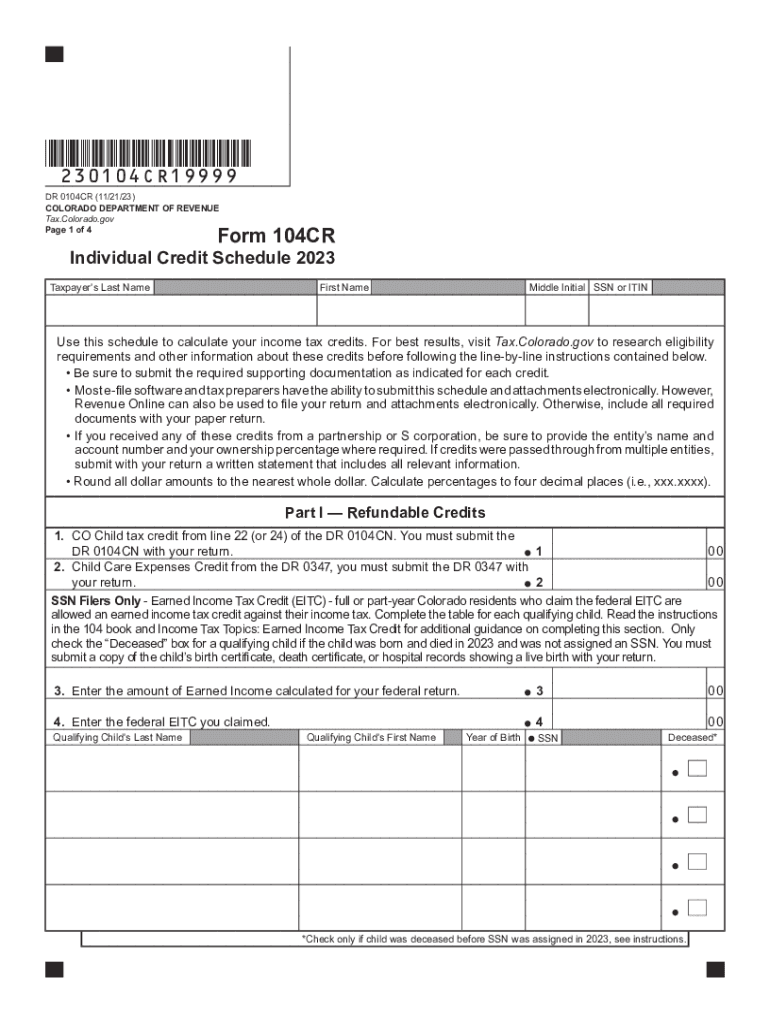

*230104CR19999*

DR 0104CR (11/21/23)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 4Form 104CRIndividual Credit Schedule 2023

Taxpayers Last NameFirst NameMiddle Initial SSN or ITINUse

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign colorado dr 0104cr form

Edit your dr 0104cr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado 0104cr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado dr0104cr online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form dr 0104cr. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0104CR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dr 0104cr form

How to fill out CO DR 0104CR

01

Begin by downloading the CO DR 0104CR form from the Colorado Department of Revenue website.

02

Fill out your personal information in the designated fields, including your name, address, and Social Security number.

03

Indicate your filing status by choosing the appropriate box (single, married, etc.).

04

Enter your income details, including wages, interest, and any other sources of income.

05

Complete the deductions section, ensuring you include any applicable credits or expenses.

06

Review the instructions for any specific calculations that may apply to your situation.

07

Sign and date the form before submission.

Who needs CO DR 0104CR?

01

All Colorado residents who are required to file their income tax returns and claim certain credits.

02

Individuals who are seeking to report their income and calculate their tax liability accurately.

Fill

co 104cr form

: Try Risk Free

People Also Ask about co 104cr

Does Colorado have their own W 4 form?

Does Colorado have a W-4 form? Yes. Starting in 2022, an employee may complete a Colorado Employee Withholding Certificate (form DR 0004), but it is not required. If an employee completes form DR 0004, the employer must calculate Colorado withholding based on the amounts the employee entered.

How do I calculate credit for taxes paid to another state?

The amount that you receive as a credit should be based on the amount of tax that you actually pay to that other state. Example: If you had $1,000 withheld during the year, but then file the other state return and receive a $250 refund, the amount of tax you actually paid to the other state technically was only $750.

What is the Colorado tax credit?

About Colorado Cash Back On May 23, 2022, Gov. Jared Polis signed a new law (Senate Bill 22-233) to give Coloradans a tax rebate of $750 for individual filers and $1,500 for joint filers this summer.

Do I need to file a Colorado state tax return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

Does Colorado require a state tax form?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

What is the Colorado state tax form?

This filing guide will assist you with completing your Colorado Income Tax Return.

What is Colorado individual income tax?

The new Colorado income tax rate is 4.40%, beginning in the 2022 tax year. In 2020, proposition 116 reduced the income tax rate to 4.55%. In 2019, the Colorado income tax rate was temporarily reduced to 4.50%, because a TABOR refund mechanism was triggered. From 2000 to 2018, the Colorado income tax rate was 4.63%.

What is the Colorado state tax form called?

Colorado Form 104 – Personal Income Tax Return for Residents.

Is there a w4 form Colorado?

The Colorado Filing Status (Married, Single, Head of Household, Exempt) must align with the filing status on their federal W-4. A new IRS Form W-4 must be entered in the employee portal if you wish to change your tax filing status or claim exemption from taxes.

Does Colorado have a credit for taxes paid to other states?

The credit for taxes paid to another state is automatically calculated in your account when you add a Nonresident return to your already created resident Colorado return if you pay taxes to both Colorado and another state. Colorado may request a copy of the other state's tax return before processing the return.

Is there a state tax form for Colorado?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

Does Colorado allow a credit for taxes paid to another state?

As a full-year Colorado resident the taxpayer must pay Colorado tax on all of the taxable income. The credit for taxes paid to another state prevents double taxation of income by two states and will not apply in this situation since the other state is not taxing the income.

How to file Colorado state tax form?

File Individual Income Tax Online Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You may opt to e-file through a paid tax professional or purchase tax software to complete and file returns.

Is there a state tax form for Colorado?

An overview of Colorado Form DR 0004: This form does not replace the IRS Form W-4. If an employee does not submit a Colorado Form DR 0004, then CU must calculate their Colorado state withholding tax based on their federal W-4.

What is the 2022 Colorado employee withholding certificate?

Beginning in 2022, form DR 0004 is available for employees to adjust their Colorado withholding. If an employee gives you a completed DR 0004, it will determine two of the amounts you enter into the DR 1098 calculation.

What is the Colorado Individual Income Tax Form?

This filing guide will assist you with completing your Colorado Income Tax Return.

How do I file an individual tax return in Colorado?

File Individual Income Tax Online Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You may opt to e-file through a paid tax professional or purchase tax software to complete and file returns.

What is a tax credit from another state?

Federal/State Law Existing California law allows a tax credit for net income taxes paid to a state other than California. The credit is based on net income taxes paid to the other state on income that has a source in the other state, and is also taxable under California law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr0104cr 2023 form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign dr0104cr 2023 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete dr0104cr 2023 form online?

pdfFiller has made it simple to fill out and eSign dr0104cr 2023 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my dr0104cr 2023 form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your dr0104cr 2023 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is CO DR 0104CR?

CO DR 0104CR is a tax form used in Colorado to report income and calculate the amount of state income tax owed.

Who is required to file CO DR 0104CR?

Individuals, businesses, and organizations that earn income in Colorado are required to file CO DR 0104CR to report their taxable income and determine their state tax liability.

How to fill out CO DR 0104CR?

To fill out CO DR 0104CR, taxpayers need to enter their personal information, report their total income, deductions, and any tax credits. Detailed instructions are provided on the form itself.

What is the purpose of CO DR 0104CR?

The purpose of CO DR 0104CR is to enable the Colorado Department of Revenue to calculate the state income tax owed by individuals and entities based on their reported income.

What information must be reported on CO DR 0104CR?

Information that must be reported on CO DR 0104CR includes the taxpayer's identifying details, total income, any deductions claimed, tax credits, and the final calculation to determine tax owed or refund due.

Fill out your dr0104cr 2023 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

dr0104cr 2023 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.