Hartford Funds MF-10029 2015 free printable template

Show details

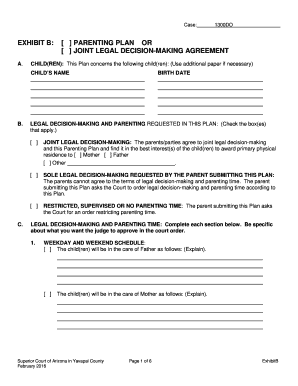

Print Form Reset Form Hartford Funds SIMPLE IRA Investment Transmittal Form This form is designed to make communicating investment needs for each payroll submission easier and to help organize investment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Hartford Funds MF-10029

Edit your Hartford Funds MF-10029 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Hartford Funds MF-10029 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Hartford Funds MF-10029 online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Hartford Funds MF-10029. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Hartford Funds MF-10029 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Hartford Funds MF-10029

How to fill out Hartford Simple IRA:

01

Obtain the necessary documents: Begin by contacting Hartford or your employer to acquire the necessary forms and documents to establish a Simple IRA. These may include an enrollment form, beneficiary designation form, and salary reduction agreement.

02

Complete the enrollment form: Fill out the required information on the enrollment form accurately and legibly. This typically includes personal details such as your name, address, Social Security number, and employment information.

03

Choose your contribution amount: Decide how much you want to contribute to your Simple IRA. Keep in mind that there are annual contribution limits set by the IRS, so ensure you stay within those limits. You may also have the option to select a percentage of your salary to contribute automatically.

04

Designate your beneficiaries: Complete the beneficiary designation form, specifying who will receive the assets in your Simple IRA in the event of your death. Be sure to keep this information up to date as your circumstances change.

05

Establish investment options: Your Simple IRA may offer various investment options, such as mutual funds or stocks. Review the available investments, consider your risk tolerance and financial goals, and select the investment options that align with your preferences.

06

Review and sign the necessary agreements: Read through all the terms and conditions provided in the documents, including the salary reduction agreement, and ensure you understand the agreements. Provide your signature where required to authorize the establishment of your Hartford Simple IRA.

Who needs Hartford Simple IRA:

01

Small business owners: Hartford Simple IRA can be an attractive retirement savings option for small business owners who wish to provide retirement benefits to their employees without the administrative burden associated with other retirement plans.

02

Employees of eligible businesses: If you work for a business that offers a Hartford Simple IRA, you may consider enrolling in this retirement plan to take advantage of the employer contributions and potential tax advantages it offers.

03

Individuals seeking a straightforward retirement savings option: Hartford Simple IRA is designed to be user-friendly and easy to understand. If you prefer a simple and convenient way to save for retirement, regardless of your employment situation, this retirement plan might be suitable for you.

Fill

form

: Try Risk Free

People Also Ask about

What is the catch for SIMPLE IRA?

If permitted by the SIMPLE IRA plan, participants who are age 50 or over at the end of the calendar year can also make catch-up contributions. The catch-up contribution limit for SIMPLE IRA plans is $3,500 in 2023 ($3,000 in 2015 - 2022).

What is the 2 year rule for SIMPLE IRAs?

During the first 2 years of participation in a SIMPLE IRA plan, you may roll over amounts from another SIMPLE retirement account. After 2 years of participation, you also may roll over amounts from a qualified retirement plan or an IRA.

What is the 2 year rule for SIMPLE IRA distribution?

After the 2-year period, you can make tax-free rollovers from SIMPLE IRAs to other types of non-Roth IRAs, or to an employer-sponsored retirement plan. You can also roll over money into a Roth IRA after the 2-year period, but must include any untaxed money rolled over in your income.

What are the 2023 SIMPLE IRA rules?

The amount an employee contributes from their salary to a SIMPLE IRA cannot exceed $15,500 in 2023 ($14,000 in 2022; $13,500 in 2020 and 2021; $13,000 in 2019 and $12,500 in 2015 – 2018).

How long does a SIMPLE IRA have to be established?

You must establish a new SIMPLE IRA plan between January 1 and October 1 of the tax year unless your business is established after October 1. You may not maintain any other retirement plans such as SEP-IRAs, profit-sharing or 401(k) plans. (Unionized employees are an exception to this rule.)

What happens to my SIMPLE IRA if I quit my job?

Plan participants typically can leave money in the plan, take a withdrawal, or roll over their savings. If your money has been in the SIMPLE IRA for two or more years, income taxes may be withheld, and a 10 percent penalty tax may be owed, depending on your age.

What is the 2 year penalty for SIMPLE IRA?

• 25 percent tax The amount of the additional tax you have to pay increases from 10 percent to 25 percent if you make the withdrawal within two years from when you first participated in your employer's SIMPLE IRA plan.

What are the disadvantages of a SIMPLE IRA?

Are There Downsides to SIMPLE IRAs and SEPs? Employee limitations. SIMPLE IRAs can only be implemented at companies with 100 or fewer employees. Total annual contribution limits. Lower contribution limits than a 401(k). Mandatory employer contributions. No loans or Roth contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Hartford Funds MF-10029 to be eSigned by others?

When your Hartford Funds MF-10029 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find Hartford Funds MF-10029?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Hartford Funds MF-10029 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the Hartford Funds MF-10029 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Hartford Funds MF-10029 in minutes.

What is hartford simple ira?

Hartford Simple IRA is a retirement savings plan that allows small businesses to offer a tax-deferred retirement plan for their employees.

Who is required to file hartford simple ira?

Employers who offer Hartford Simple IRA to their employees are required to file the necessary paperwork and contributions.

How to fill out hartford simple ira?

To fill out Hartford Simple IRA, employers need to gather employee information, determine contribution amounts, and submit the necessary forms to the IRS.

What is the purpose of hartford simple ira?

The purpose of Hartford Simple IRA is to provide a retirement savings option for small businesses and their employees that is easy to administer and tax-efficient.

What information must be reported on hartford simple ira?

Employers must report employee contributions, employer matching contributions, and any rollovers or transfers on Hartford Simple IRA forms.

Fill out your Hartford Funds MF-10029 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hartford Funds MF-10029 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.