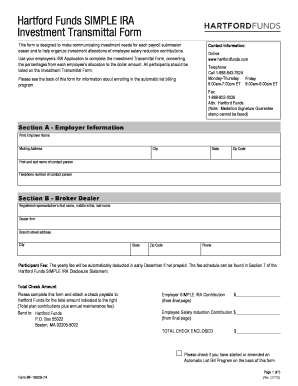

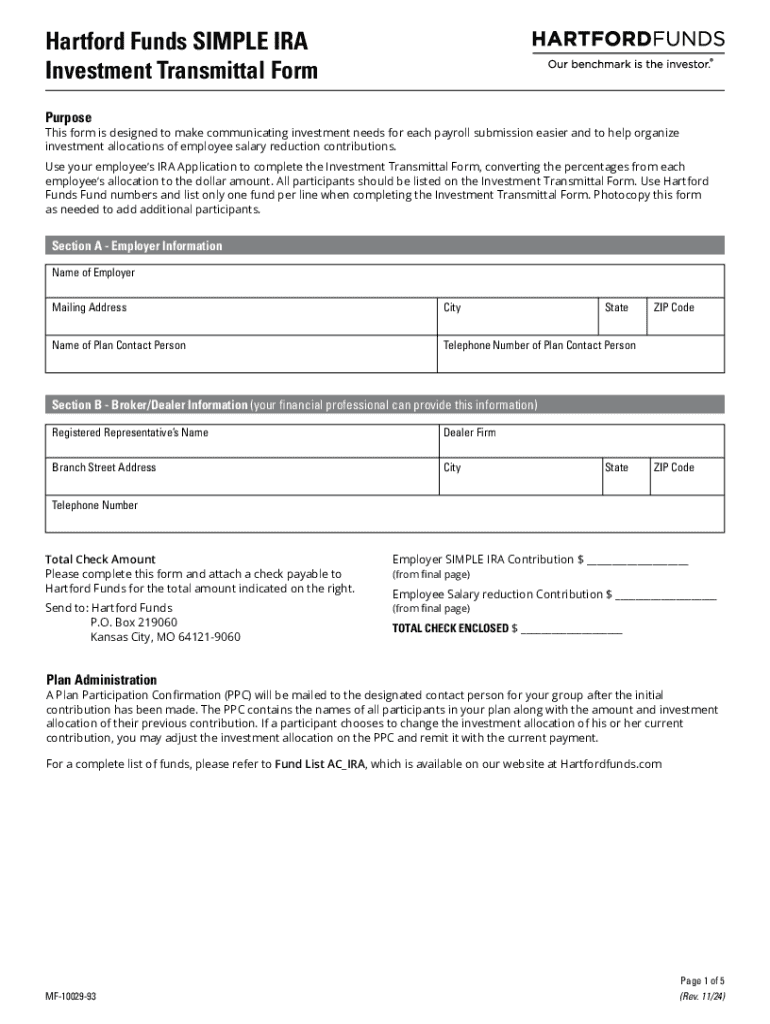

Hartford Funds MF-10029 2024-2025 free printable template

Show details

Este formulario está diseñado para facilitar la comunicación de las necesidades de inversión para cada presentación de nómina y ayudar a organizar las asignaciones de inversión de las contribuciones

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hartford funds simple ira

Edit your hartford funds simple ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hartford funds simple ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hartford funds simple ira online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit hartford funds simple ira. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Hartford Funds MF-10029 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

What is the catch for SIMPLE IRA?

If permitted by the SIMPLE IRA plan, participants who are age 50 or over at the end of the calendar year can also make catch-up contributions. The catch-up contribution limit for SIMPLE IRA plans is $3,500 in 2023 ($3,000 in 2015 - 2022).

What is the 2 year rule for SIMPLE IRAs?

During the first 2 years of participation in a SIMPLE IRA plan, you may roll over amounts from another SIMPLE retirement account. After 2 years of participation, you also may roll over amounts from a qualified retirement plan or an IRA.

What is the 2 year rule for SIMPLE IRA distribution?

After the 2-year period, you can make tax-free rollovers from SIMPLE IRAs to other types of non-Roth IRAs, or to an employer-sponsored retirement plan. You can also roll over money into a Roth IRA after the 2-year period, but must include any untaxed money rolled over in your income.

What are the 2023 SIMPLE IRA rules?

The amount an employee contributes from their salary to a SIMPLE IRA cannot exceed $15,500 in 2023 ($14,000 in 2022; $13,500 in 2020 and 2021; $13,000 in 2019 and $12,500 in 2015 – 2018).

How long does a SIMPLE IRA have to be established?

You must establish a new SIMPLE IRA plan between January 1 and October 1 of the tax year unless your business is established after October 1. You may not maintain any other retirement plans such as SEP-IRAs, profit-sharing or 401(k) plans. (Unionized employees are an exception to this rule.)

What happens to my SIMPLE IRA if I quit my job?

Plan participants typically can leave money in the plan, take a withdrawal, or roll over their savings. If your money has been in the SIMPLE IRA for two or more years, income taxes may be withheld, and a 10 percent penalty tax may be owed, depending on your age.

What is the 2 year penalty for SIMPLE IRA?

• 25 percent tax The amount of the additional tax you have to pay increases from 10 percent to 25 percent if you make the withdrawal within two years from when you first participated in your employer's SIMPLE IRA plan.

What are the disadvantages of a SIMPLE IRA?

Are There Downsides to SIMPLE IRAs and SEPs? Employee limitations. SIMPLE IRAs can only be implemented at companies with 100 or fewer employees. Total annual contribution limits. Lower contribution limits than a 401(k). Mandatory employer contributions. No loans or Roth contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hartford funds simple ira for eSignature?

Once your hartford funds simple ira is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find hartford funds simple ira?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the hartford funds simple ira in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for the hartford funds simple ira in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your hartford funds simple ira and you'll be done in minutes.

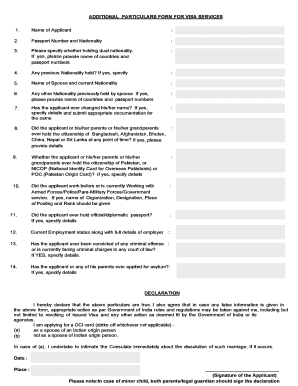

What is hartford funds simple ira?

Hartford Funds Simple IRA is a retirement savings plan designed for small businesses and self-employed individuals, allowing them to contribute towards their retirement with tax advantages.

Who is required to file hartford funds simple ira?

Employers with a Simple IRA plan must file certain IRS forms, and employees who contribute are also required to report their contributions on their tax returns.

How to fill out hartford funds simple ira?

To fill out a Hartford Funds Simple IRA, individuals must complete the enrollment form provided by the custodian or plan sponsor, include personal and employment information, and choose contribution amounts.

What is the purpose of hartford funds simple ira?

The purpose of Hartford Funds Simple IRA is to provide a simplified retirement savings option for small business owners and their employees, making it easier to save for retirement.

What information must be reported on hartford funds simple ira?

Information that must be reported includes employee contributions, employer matches, and any withdrawals or distributions from the account.

Fill out your hartford funds simple ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hartford Funds Simple Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.