Get the free www.sat.gob.mxtramites24016Solicita tu devolucin - Portal de trmites y servicios - SAT

Show details

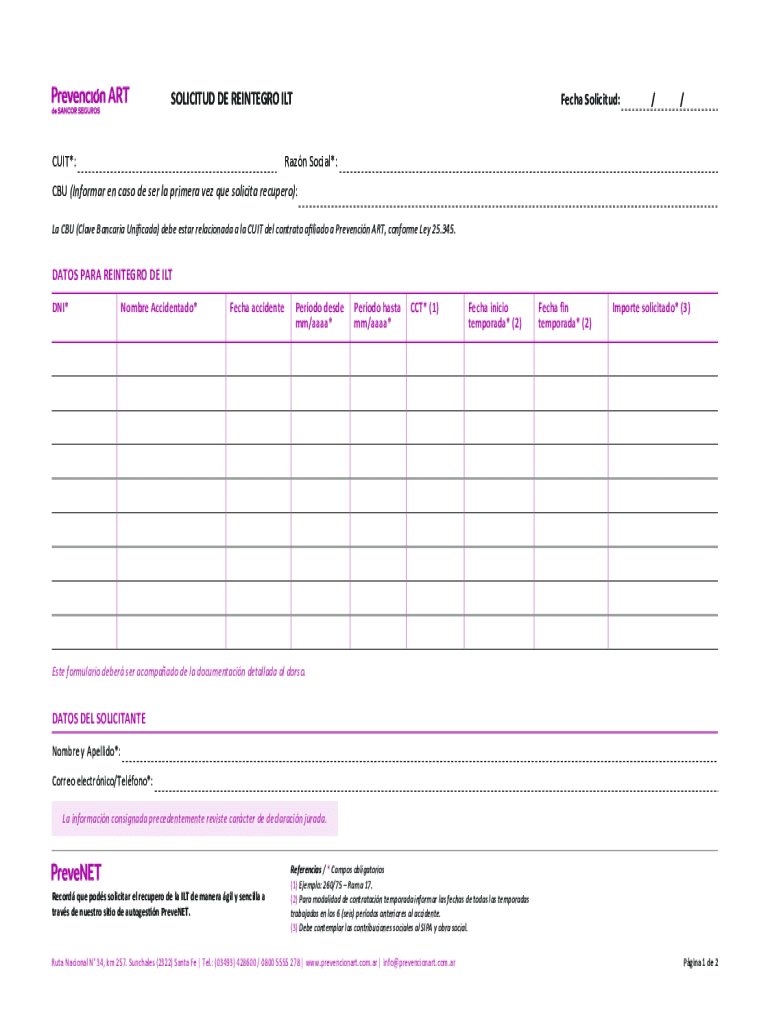

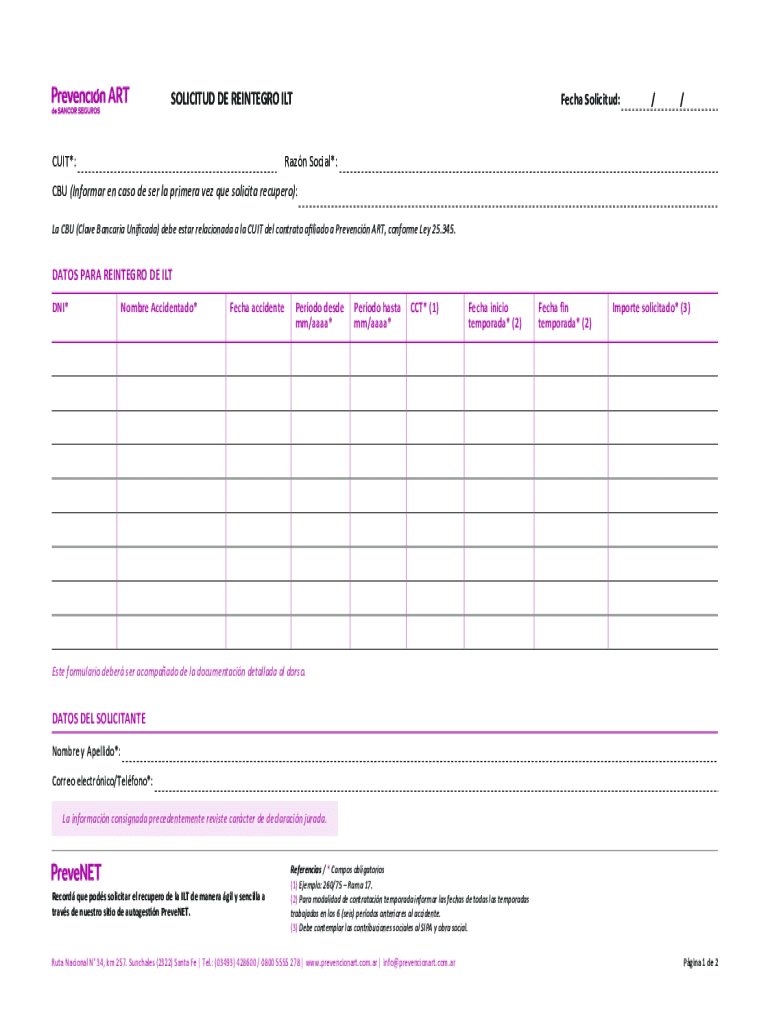

SOLICITED DE REINTER IT CUT*:Tech Solicited://Ran Social*:CBU (Informal en case DE SER la primer viz Que solicit recover): La CBU (Clave Bavaria Unicode) debt star relational à la CUT Del contralto

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwsatgobmxtramites24016solicita tu devolucin

Edit your wwwsatgobmxtramites24016solicita tu devolucin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwsatgobmxtramites24016solicita tu devolucin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wwwsatgobmxtramites24016solicita tu devolucin online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wwwsatgobmxtramites24016solicita tu devolucin. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwsatgobmxtramites24016solicita tu devolucin

How to fill out wwwsatgobmxtramites24016solicita tu devolucin

01

Visit the website www.sat.gob.mx/tramites24016solicita-tu-devolucion.

02

Click on the button 'Solicita tu devolución' to start the process.

03

Enter your tax identification number (RFC) and password to log in.

04

If you don't have an account, click on the option 'Crear cuenta' to register.

05

Once logged in, select the type of refund you want to request (e.g. ISR, IVA).

06

Fill out the required information, such as personal details, bank account information, and tax documents.

07

Double-check the information you entered for accuracy.

08

Submit your request by clicking on the 'Enviar solicitud' button.

09

After submitting, you will receive a confirmation message with a reference number for your request.

10

Wait for the tax authority to review and process your request.

11

You can check the status of your refund request on the same website anytime.

12

Once approved, the refund will be deposited into the bank account provided.

13

If there are any issues or further instructions from the tax authority, they will communicate with you through the website or contact information provided.

14

Make sure to keep a record of the reference number and any communication regarding your refund request for future reference.

Who needs wwwsatgobmxtramites24016solicita tu devolucin?

01

Anyone who has paid taxes in Mexico and is eligible for a refund can use www.sat.gob.mx/tramites24016solicita-tu-devolucion. This includes individuals, businesses, and other legal entities who have overpaid their taxes or are eligible for a tax credit. It is important to consult the specific eligibility criteria and requirements stated on the website before starting the refund process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wwwsatgobmxtramites24016solicita tu devolucin on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing wwwsatgobmxtramites24016solicita tu devolucin.

How can I fill out wwwsatgobmxtramites24016solicita tu devolucin on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your wwwsatgobmxtramites24016solicita tu devolucin. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit wwwsatgobmxtramites24016solicita tu devolucin on an Android device?

You can make any changes to PDF files, like wwwsatgobmxtramites24016solicita tu devolucin, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is wwwsatgobmxtramites24016solicita tu devolucin?

wwwsatgobmxtramites24016solicita tu devolucin is a form used to request a refund.

Who is required to file wwwsatgobmxtramites24016solicita tu devolucin?

Individuals or businesses who are eligible for a refund from the government.

How to fill out wwwsatgobmxtramites24016solicita tu devolucin?

You can fill out wwwsatgobmxtramites24016solicita tu devolucin online or in person following the instructions provided on the form.

What is the purpose of wwwsatgobmxtramites24016solicita tu devolucin?

The purpose of wwwsatgobmxtramites24016solicita tu devolucin is to request a refund for overpaid taxes or fees.

What information must be reported on wwwsatgobmxtramites24016solicita tu devolucin?

You must report your personal information, details of the overpayment, and any supporting documents.

Fill out your wwwsatgobmxtramites24016solicita tu devolucin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

wwwsatgobmxtramites24016solicita Tu Devolucin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.