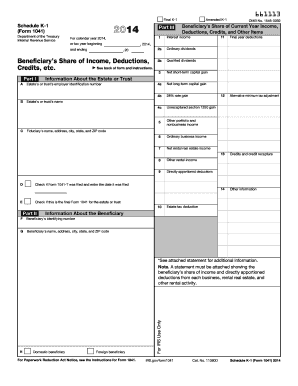

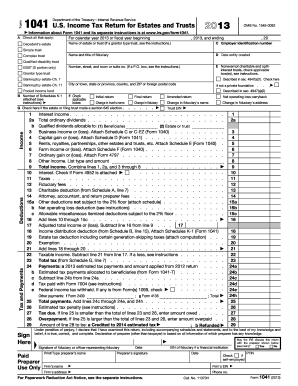

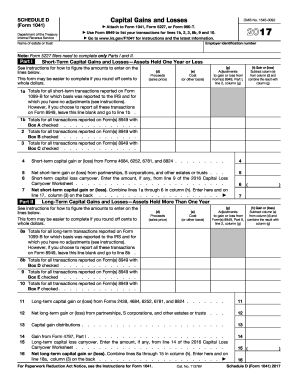

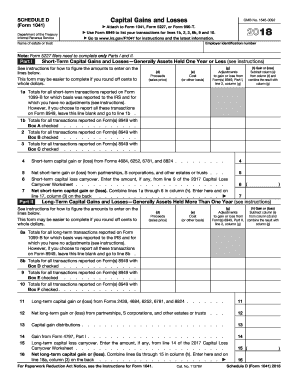

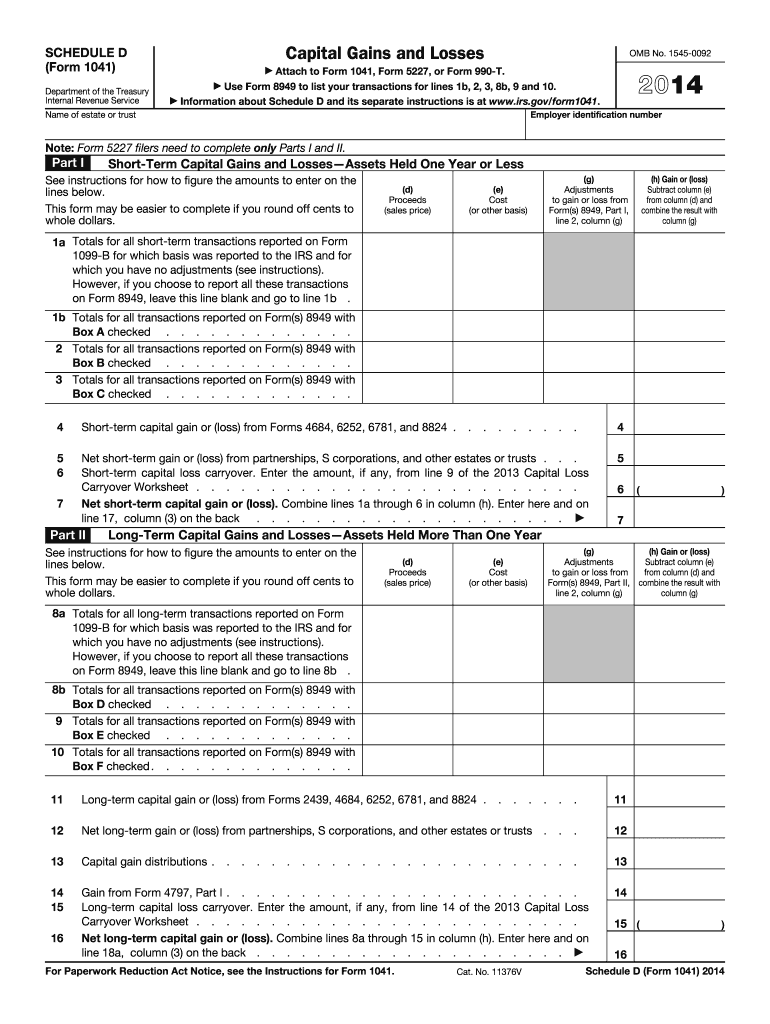

IRS 1041 - Schedule D 2014 free printable template

Instructions and Help about IRS 1041 - Schedule D

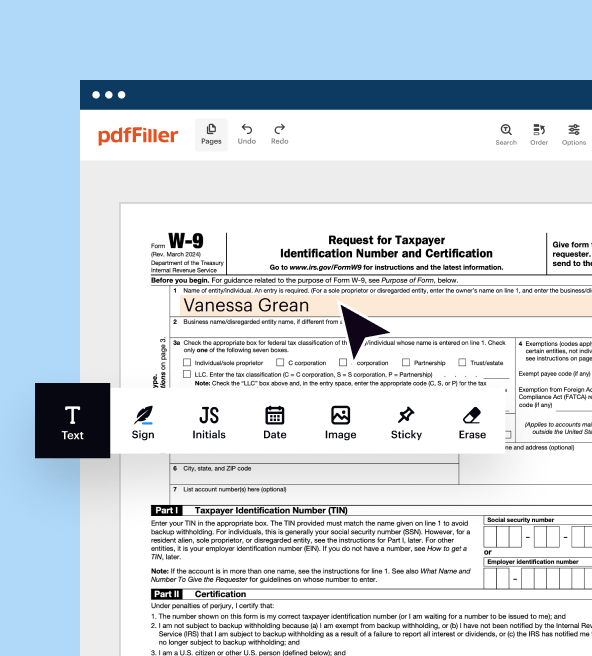

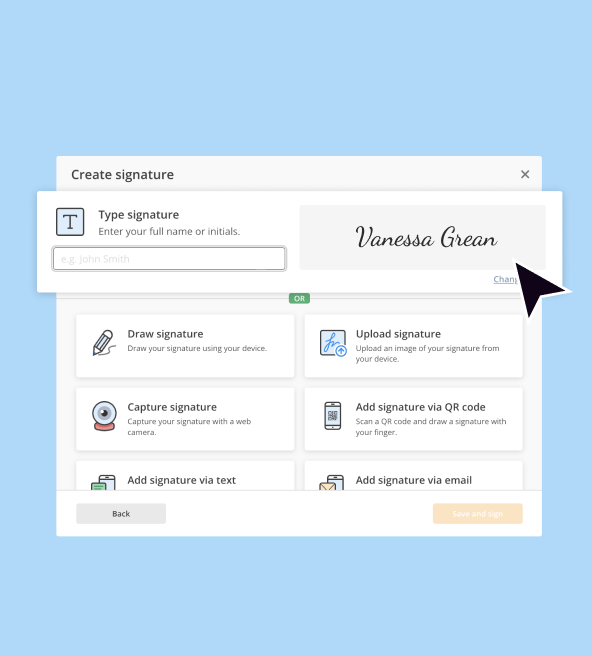

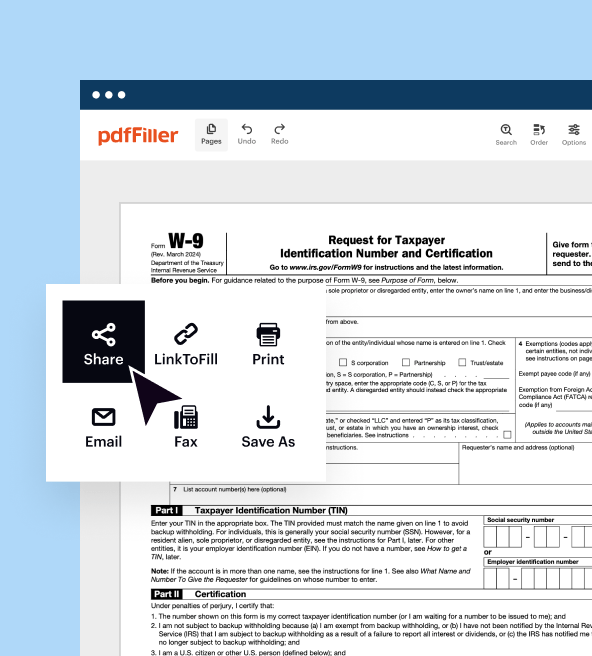

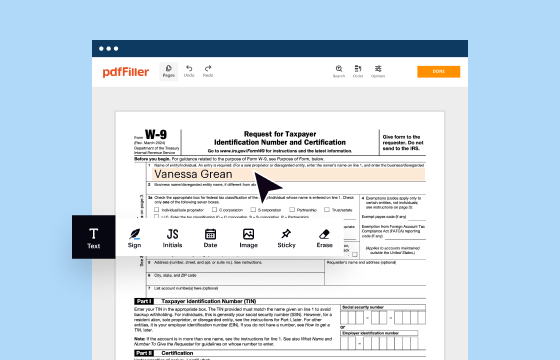

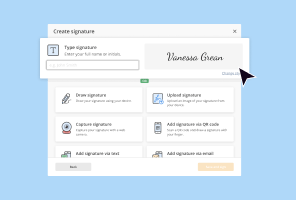

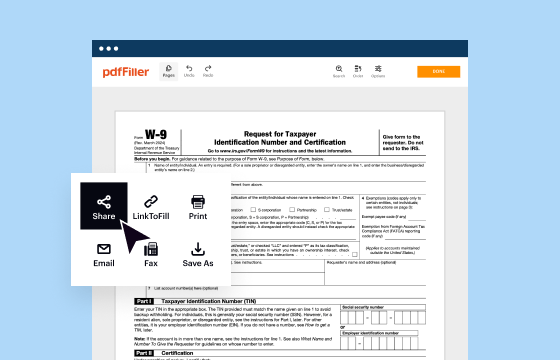

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2014 previous version

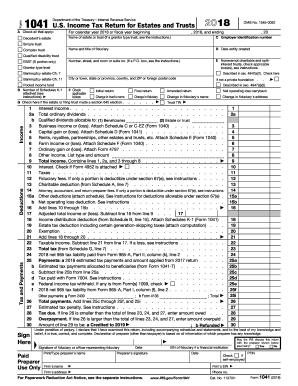

What is IRS 1041 - Schedule D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1041 - Schedule D

What should I do if I realize I made a mistake on my instructions for schedule d after submitting?

If you discover an error on your instructions for schedule d after submission, you can file an amended return. This process involves completing the correct version of the form, indicating it is an amendment, and submitting it as soon as possible to avoid potential penalties.

How can I verify if my e-filed instructions for schedule d have been received?

To check the status of your e-filed instructions for schedule d, visit the IRS website or use their filing status tool. This allows you to confirm receipt and processing successfully, ensuring that your submission is on track.

Are there specific legal considerations for filing instructions for schedule d for foreign payees?

When filing instructions for schedule d for foreign payees, ensure compliance with IRS regulations regarding nonresidents. Nonresidents must provide a valid taxpayer identification number and may require additional forms to verify withholding and reporting obligations.

What common errors should I avoid when preparing my instructions for schedule d?

To minimize errors in your instructions for schedule d, always double-check your calculations and ensure that all required information is accurately reported. Missing or incorrect data can lead to rejection or delays in processing your form.

What should I do if I receive an audit notice after submitting my instructions for schedule d?

If you receive an audit notice regarding your instructions for schedule d, respond promptly by gathering all relevant documentation. It's essential to review any discrepancies noted in the audit and prepare a detailed response, possibly accompanied by supporting evidence to clarify your submission.

See what our users say