Get the free comptroller.texas.govforms50-144Business Personal Property Rendition of Taxable Prop...

Show details

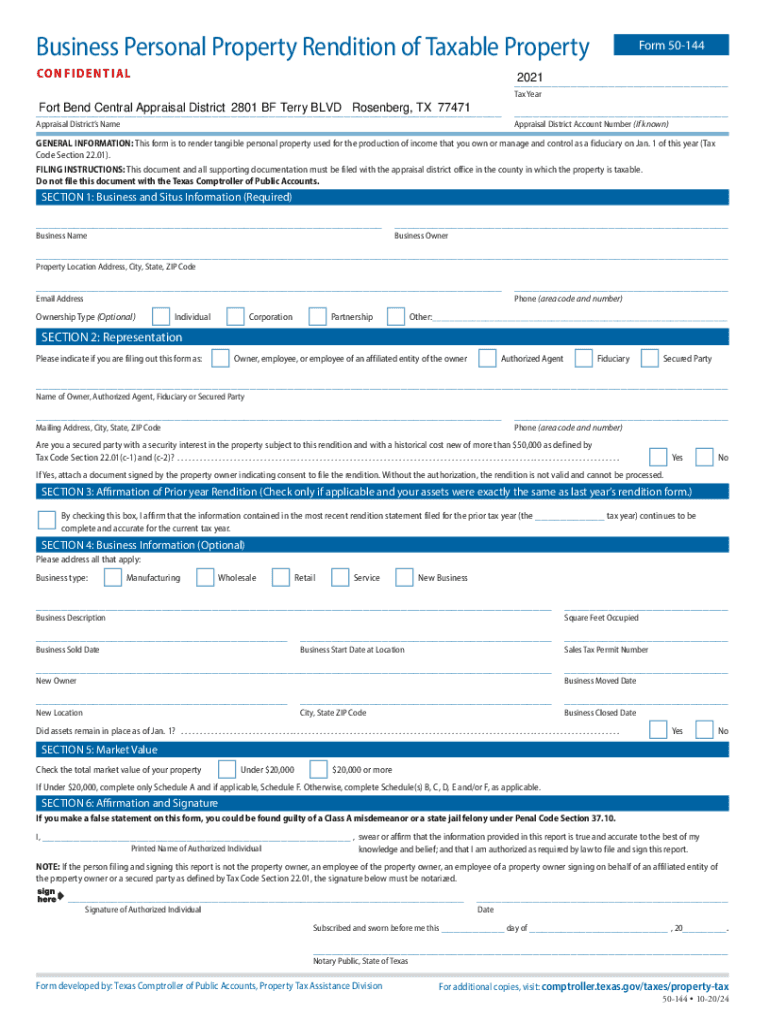

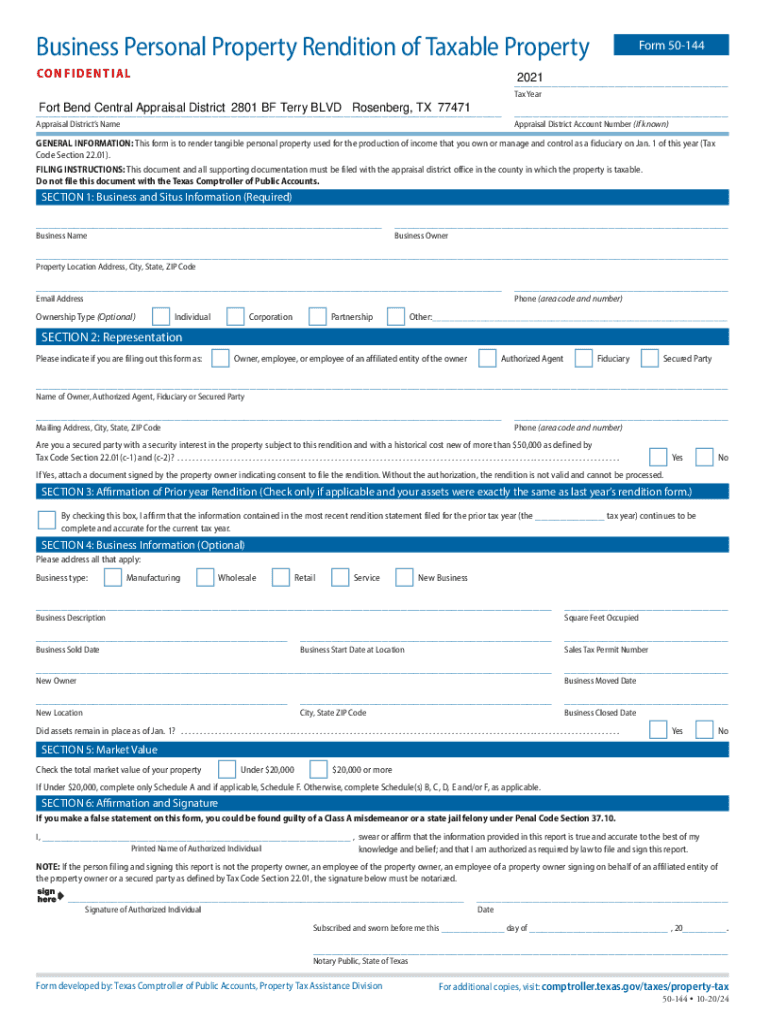

Business Personal Property Rendition of Taxable Property CONFIDENTIALForm 501442021___ Tax Airport Bend Central Appraisal District 2801 BF Terry BLVD Rosenberg, TX 77471 ___ Appraisal Districts Name___

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comptrollertexasgovforms50-144business personal property rendition

Edit your comptrollertexasgovforms50-144business personal property rendition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comptrollertexasgovforms50-144business personal property rendition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing comptrollertexasgovforms50-144business personal property rendition online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit comptrollertexasgovforms50-144business personal property rendition. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comptrollertexasgovforms50-144business personal property rendition

How to fill out comptrollertexasgovforms50-144business personal property rendition

01

Start by downloading the comptrollertexasgovforms50-144business personal property rendition form from the official website of the Texas Comptroller of Public Accounts.

02

Carefully read through the instructions provided with the form to understand the requirements and guidelines for filling it out.

03

Gather all necessary information and documentation related to your business's personal property, such as equipment, furniture, fixtures, etc.

04

Fill out the form accurately and completely, providing all the requested information including your business's name, address, contact information, property descriptions, and values.

05

Double-check all the information entered to ensure its accuracy and make any necessary corrections.

06

Sign and date the form once you have reviewed it and are satisfied with the information provided.

07

Submit the completed form to the Texas Comptroller of Public Accounts by the specified deadline, either by mail or through their online portal.

08

Keep copies of the filled-out form and any supporting documentation for your records.

09

It is advisable to consult with a tax professional or the Comptroller's office directly if you have any questions or need further assistance in filling out the form.

Who needs comptrollertexasgovforms50-144business personal property rendition?

01

Any business operating in Texas that owns taxable personal property is required to fill out and submit the comptrollertexasgovforms50-144business personal property rendition form. This includes businesses of all sizes and types, such as corporations, partnerships, sole proprietorships, and limited liability companies.

02

Additionally, individuals or entities that lease personal property to others or have control or possession of personal property belonging to others may also be required to file this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify comptrollertexasgovforms50-144business personal property rendition without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including comptrollertexasgovforms50-144business personal property rendition, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit comptrollertexasgovforms50-144business personal property rendition in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing comptrollertexasgovforms50-144business personal property rendition and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit comptrollertexasgovforms50-144business personal property rendition on an iOS device?

You certainly can. You can quickly edit, distribute, and sign comptrollertexasgovforms50-144business personal property rendition on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is comptrollertexasgovforms50-144business personal property rendition?

The comptrollertexasgovforms50-144business personal property rendition is a form used to report business personal property to the Texas Comptroller's office.

Who is required to file comptrollertexasgovforms50-144business personal property rendition?

All businesses in Texas that own tangible personal property used for production or in the course of business are required to file the comptrollertexasgovforms50-144business personal property rendition.

How to fill out comptrollertexasgovforms50-144business personal property rendition?

The form can be filled out online on the Texas Comptroller's website or submitted via mail. It requires detailed information about the business personal property owned.

What is the purpose of comptrollertexasgovforms50-144business personal property rendition?

The purpose of the form is to assess and tax business personal property owned by businesses in Texas.

What information must be reported on comptrollertexasgovforms50-144business personal property rendition?

The form requires information about the description, location, and value of each item of business personal property owned.

Fill out your comptrollertexasgovforms50-144business personal property rendition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

comptrollertexasgovforms50-144business Personal Property Rendition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.