IRS W-9 2014 free printable template

Show details

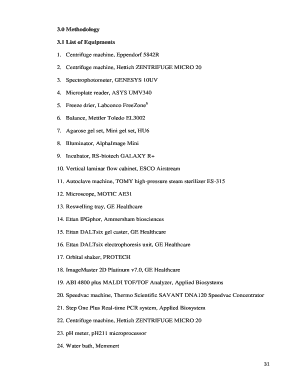

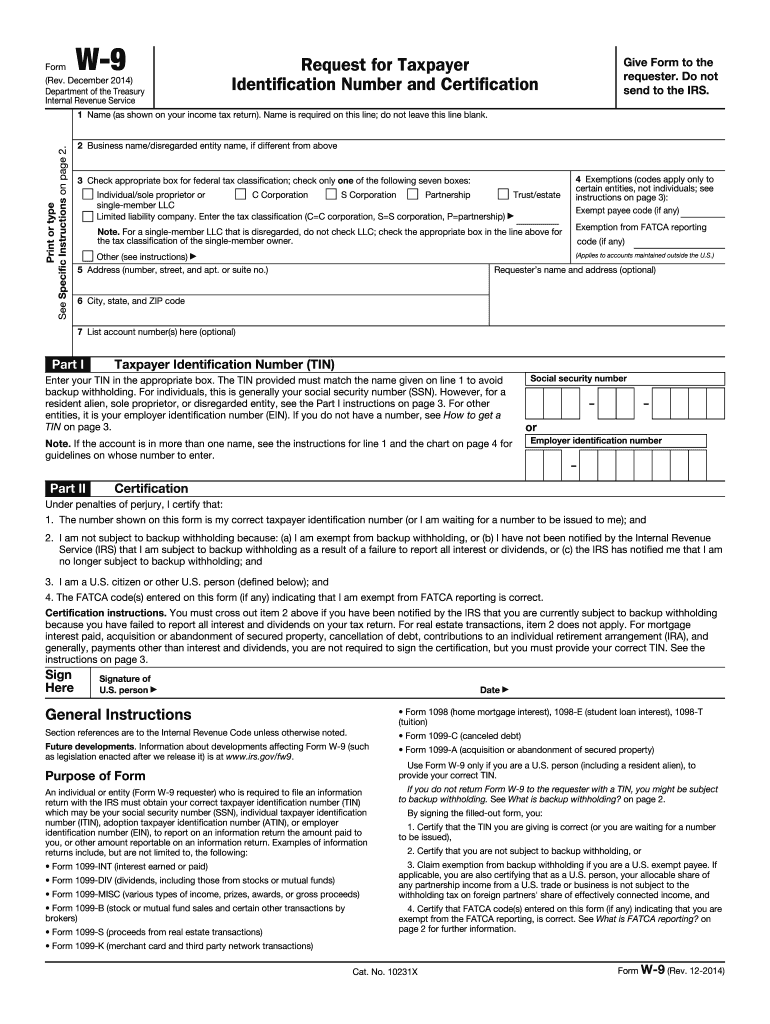

W-9 Form Rev. December 2014 Department of the Treasury Internal Revenue Service Request for Taxpayer Identification Number and Certification Give Form to the requester. See What is FATCA reporting on page 2 for further information. Form 1099-K merchant card and third party network transactions Cat. No. 10231X Form W-9 Rev. 12-2014 Page 2 Note. Do not send to the IRS* Print or type See Specific Instructions on page 2. 1 Name as shown on your income tax return. Name is required on this line do...not leave this line blank. 2 Business name/disregarded entity name if different from above 3 Check appropriate box for federal tax classification check only one of the following seven boxes C Corporation Partnership Trust/estate Individual/sole proprietor or single-member LLC Limited liability company. Enter the tax classification C C corporation S S corporation P partnership Note. For a single-member LLC that is disregarded do not check LLC check the appropriate box in the line above for the...tax classification of the single-member owner. 4 Exemptions codes apply only to certain entities not individuals see instructions on page 3 Exempt payee code if any Exemption from FATCA reporting code if any Applies to accounts maintained outside the U*S* Other see instructions 5 Address number street and apt. or suite no. Requester s name and address optional 6 City state and ZIP code 7 List account number s here optional Part I Taxpayer Identification Number TIN Enter your TIN in the...appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals this is generally your social security number SSN. However for a resident alien sole proprietor or disregarded entity see the Part I instructions on page 3. For other entities it is your employer identification number EIN. If you do not have a number see How to get a TIN on page 3. Note. If the account is in more than one name see the instructions for line 1 and the chart on page 4...for guidelines on whose number to enter. Social security number or Employer identification number Certification Under penalties of perjury I certify that 1. The number shown on this form is my correct taxpayer identification number or I am waiting for a number to be issued to me and 2. I am not subject to backup withholding because a I am exempt from backup withholding or b I have not been notified by the Internal Revenue Service IRS that I am subject to backup withholding as a result of a...failure to report all interest or dividends or c the IRS has notified me that I am no longer subject to backup withholding and 3. I am a U*S* citizen or other U*S* person defined below and 4. The FATCA code s entered on this form if any indicating that I am exempt from FATCA reporting is correct. because you have failed to report all interest and dividends on your tax return* For real estate transactions item 2 does not apply. For mortgage interest paid acquisition or abandonment of secured...property cancellation of debt contributions to an individual retirement arrangement IRA and generally payments other than interest and dividends you are not required to sign the certification but you must provide your correct TIN* See the Sign Here Signature of U*S* person Date General Instructions Form 1098 home mortgage interest 1098-E student loan interest 1098-T tuition Section references are to the Internal Revenue Code unless otherwise noted* Form 1099-C canceled debt Future...developments.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

Instructions and Help about IRS W-9

How to edit IRS W-9

To edit the IRS W-9 form, begin by accessing the form through a reliable platform like pdfFiller. Once opened, you can make necessary changes by typing directly into the designated fields. Ensure that all information is accurate and up-to-date before saving or printing the document. Use pdfFiller's tools to highlight any changes or add notes for clarity.

How to fill out IRS W-9

To fill out the IRS W-9 form, you must provide accurate personal information. Follow these steps:

01

Enter your name as it appears on your tax return.

02

Input your business name if different from your individual name.

03

Provide your address, ensuring it matches IRS records.

04

Indicate your taxpayer identification number (TIN), using your Social Security Number (SSN) or Employer Identification Number (EIN).

Once completed, review the form for accuracy and sign it in the designated area. It's crucial to ensure all fields are filled out correctly to avoid potential penalties.

About IRS W-9 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-9 previous version

What is IRS W-9?

IRS W-9, or the Request for Taxpayer Identification Number and Certification, is a form used by individuals and entities to provide their taxpayer identification information. This form is primarily utilized by businesses that are required to report payments made to independent contractors and freelancers. By completing the W-9, you authorize the requester to use your TIN for reporting purposes.

What is the purpose of this form?

The purpose of the IRS W-9 form is to gather taxpayer identification information from individuals and businesses. Specifically, it serves to ensure that the correct TIN is used for reporting income to the IRS. The information collected is mainly used for tax reporting purposes by those who pay you for services rendered, ensuring proper compliance with U.S. tax laws.

Who needs the form?

The IRS W-9 form is commonly needed by independent contractors, freelancers, and other non-employees who receive payment from a business. This includes but is not limited to consultants, artists, and service providers. Businesses that hire these individuals are required to collect W-9 forms to accurately report income paid on 1099 forms to the IRS.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS W-9 form if you are a corporation or LLC that is tax-exempt under certain provisions of the Internal Revenue Code. Additionally, foreign entities that do not reside in the U.S. typically do not need to fill out this form. If you are unsure about your eligibility for exemption, consult a tax professional.

Components of the form

The IRS W-9 form includes several key components:

01

Full name of the taxpayer.

02

Business name (if applicable).

03

Address including street, city, state, and ZIP code.

04

Taxpayer Identification Number (TIN).

05

Certification signature and date.

Each of these components is crucial for the form's processing, making it essential to provide accurate and complete information.

What are the penalties for not issuing the form?

If a payer does not issue the IRS W-9 form when required, they may face penalties from the IRS, including a potential fine for failure to report payments. Additionally, the recipient may experience increased tax withholding rates imposed by the IRS when they do not provide a valid W-9. These penalties underscore the importance of issuing and collecting W-9 forms in a timely manner.

What information do you need when you file the form?

When filing the IRS W-9 form, you need to provide your legal name, business name (if applicable), address, and taxpayer identification number (TIN). This information is critical for the payer and the IRS to accurately report your earnings. Ensure that all information matches what's on file with the IRS to avoid discrepancies and potential audits.

Is the form accompanied by other forms?

The IRS W-9 form is typically not submitted directly to the IRS. Instead, it is usually provided to the requester (payer) and may be accompanied by other forms, such as a 1099-MISC or 1099-NEC, which report payments made during the tax year. It is important to retain a copy of the W-9 for your records, as it supports the information reported by the payer in their filings.

Where do I send the form?

The IRS W-9 form is not sent to the IRS. Instead, once completed, you should send it directly to the requester who needs the information to comply with tax reporting requirements. Ensure you keep a copy for your records for any future reference or audits.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It's cool doing everything I need done. Only problem is your month-to-month fee for personal is to high .

too new to the site ..to comment just yet ..

See what our users say