Get the free What Is Liability Coverage In An Insurance Policy?Allstate

Show details

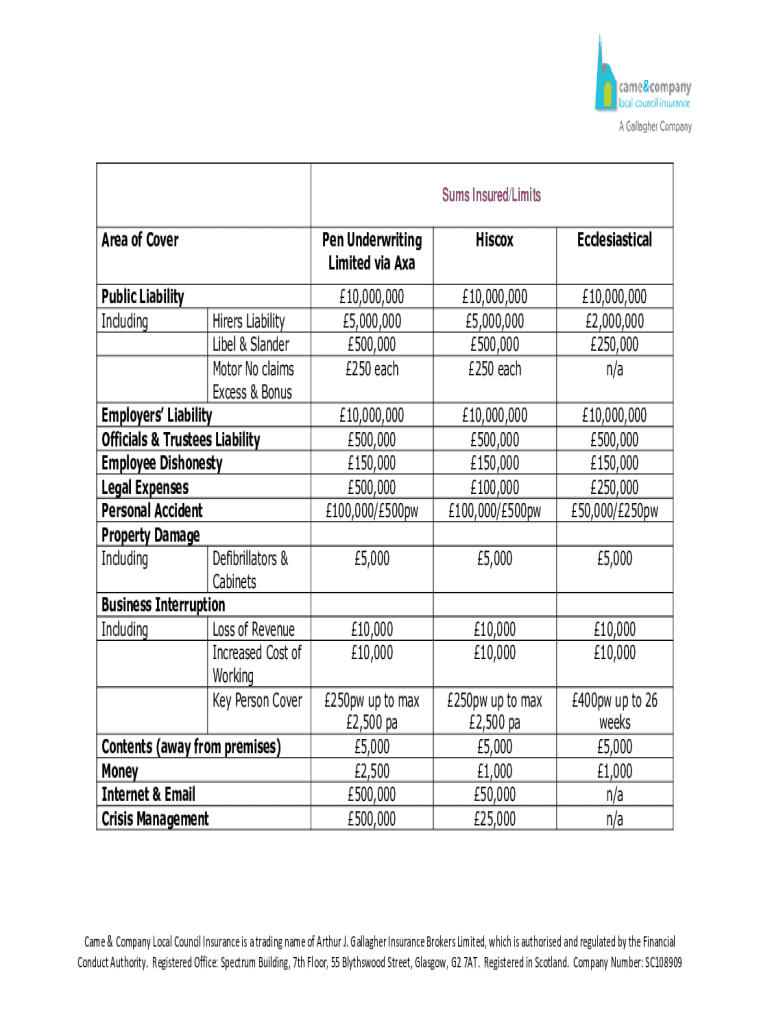

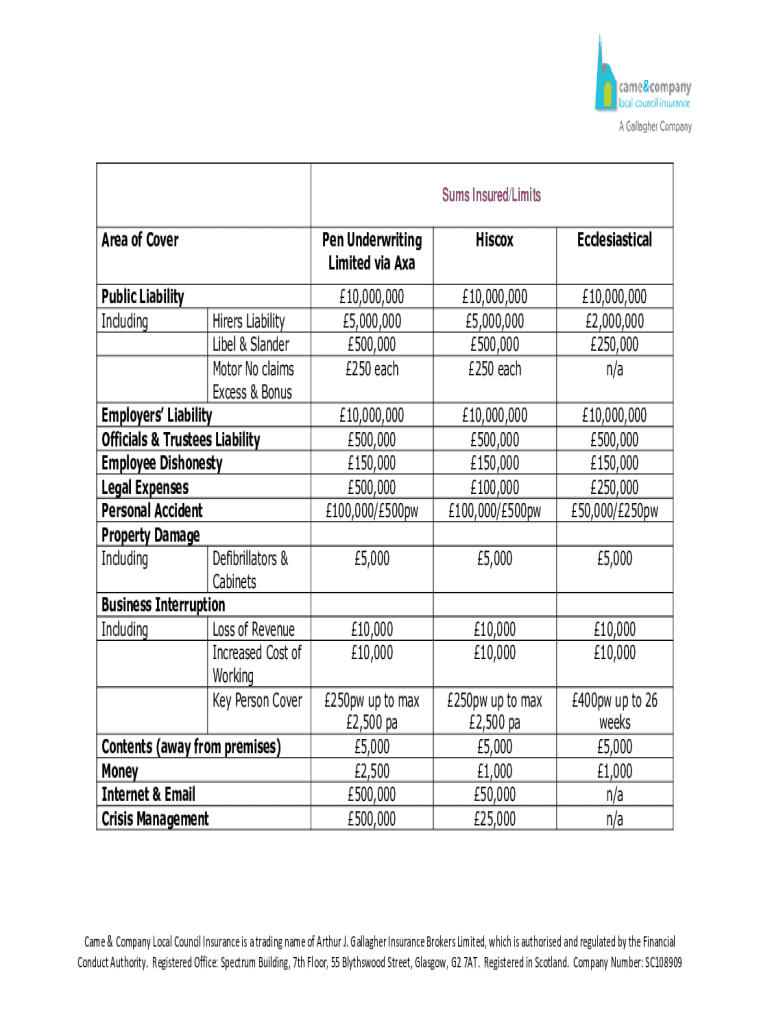

Sums Insured×Limits Area of Cover Public Liability IncludingHirers Liability Libel & Slander Motor No claims Excess & Bonus Employers Liability Officials & Trustees Liability Employee Dishonesty

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is liability coverage

Edit your what is liability coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is liability coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is liability coverage online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit what is liability coverage. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is liability coverage

How to fill out what is liability coverage

01

To fill out liability coverage, follow these steps:

02

Determine the coverage amount: Decide how much liability coverage you need to protect yourself financially in case of an accident.

03

Understand the different types of liability coverage: Liability coverage can include bodily injury liability, property damage liability, and personal injury liability. Familiarize yourself with these terms and the coverage they provide.

04

Decide on the coverage limits: Set the maximum amount your insurance will pay for each liability claim. This could be in the form of split limits (e.g., $100,000 bodily injury per person, $300,000 bodily injury per accident) or a combined single limit (e.g., $300,000 total coverage for bodily injury and property damage).

05

Consider any additional coverage: Depending on your needs, you may also want to add optional coverages such as uninsured/underinsured motorist coverage or medical payments coverage.

06

Compare insurance quotes: Shop around and compare insurance quotes from different providers to get the best coverage at the best price.

07

Fill out the necessary forms: Once you've chosen an insurance provider and policy, you will need to fill out the required forms accurately and provide any requested information.

08

Review and understand the policy terms: Read through your policy carefully to understand the terms, conditions, and exclusions of your liability coverage.

09

Keep your liability coverage up to date: Regularly review your coverage needs and make any necessary adjustments to ensure you are adequately protected.

Who needs what is liability coverage?

01

Liability coverage is typically needed by:

02

- Vehicle owners: If you own a car, motorcycle, or any other type of vehicle, liability coverage is essential to protect yourself from financial liability in case of an accident.

03

- Homeowners: Homeowners may also benefit from liability coverage, as it can protect them if someone gets injured on their property and files a lawsuit.

04

- Business owners: Business owners should have liability coverage to protect their businesses from legal claims related to accidents, injuries, or damages that may occur.

05

- Renters: Even if you don't own a home, liability coverage may be necessary. Renters insurance often includes liability coverage to protect against personal liability claims.

06

- Individuals with assets: If you have assets such as savings, investments, or valuable property, liability coverage can help protect those assets in case of a lawsuit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in what is liability coverage?

With pdfFiller, it's easy to make changes. Open your what is liability coverage in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the what is liability coverage electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your what is liability coverage and you'll be done in minutes.

How do I complete what is liability coverage on an Android device?

Use the pdfFiller Android app to finish your what is liability coverage and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is what is liability coverage?

Liability coverage is a type of insurance that helps cover the costs of damages and injuries that you are legally responsible for.

Who is required to file what is liability coverage?

Individuals and businesses who want to protect themselves from potential financial losses due to damages or injuries caused by their actions.

How to fill out what is liability coverage?

You can fill out liability coverage forms provided by insurance companies or agents by providing accurate information about your assets, risks, and coverage needs.

What is the purpose of what is liability coverage?

The purpose of liability coverage is to protect individuals and businesses from financial losses that may result from being legally liable for damages or injuries.

What information must be reported on what is liability coverage?

Information such as the insured party's name, address, coverage limits, risks, assets, and any previous claims may need to be reported on liability coverage forms.

Fill out your what is liability coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Liability Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.