MI MI-1040ES 2022 free printable template

Show details

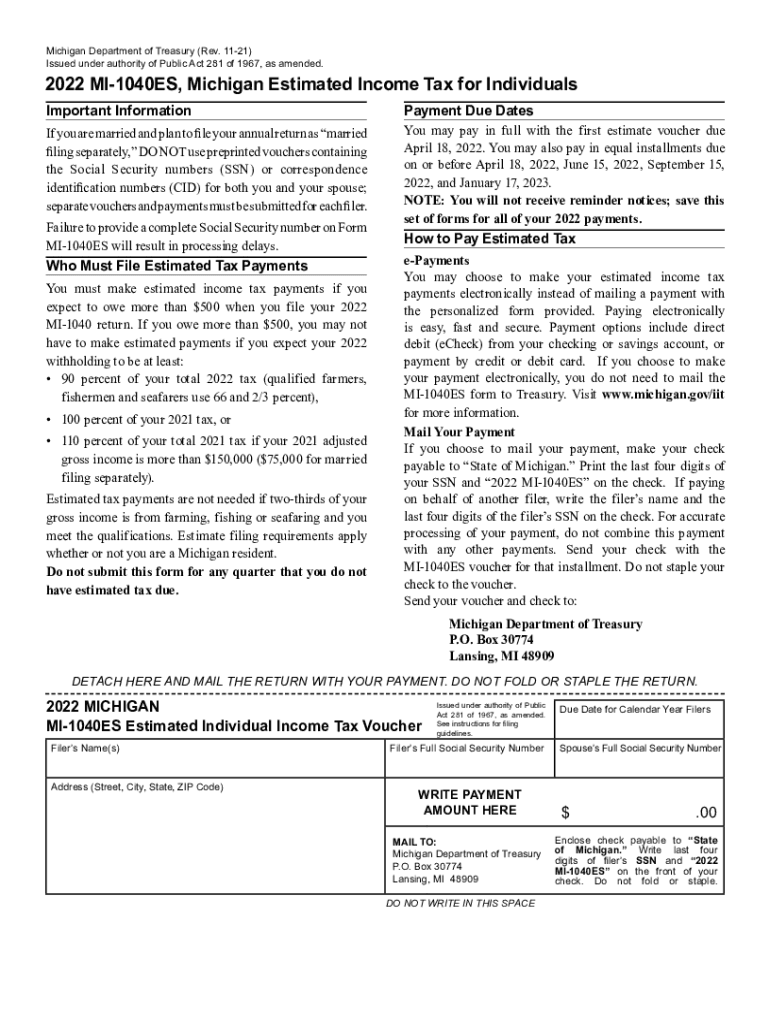

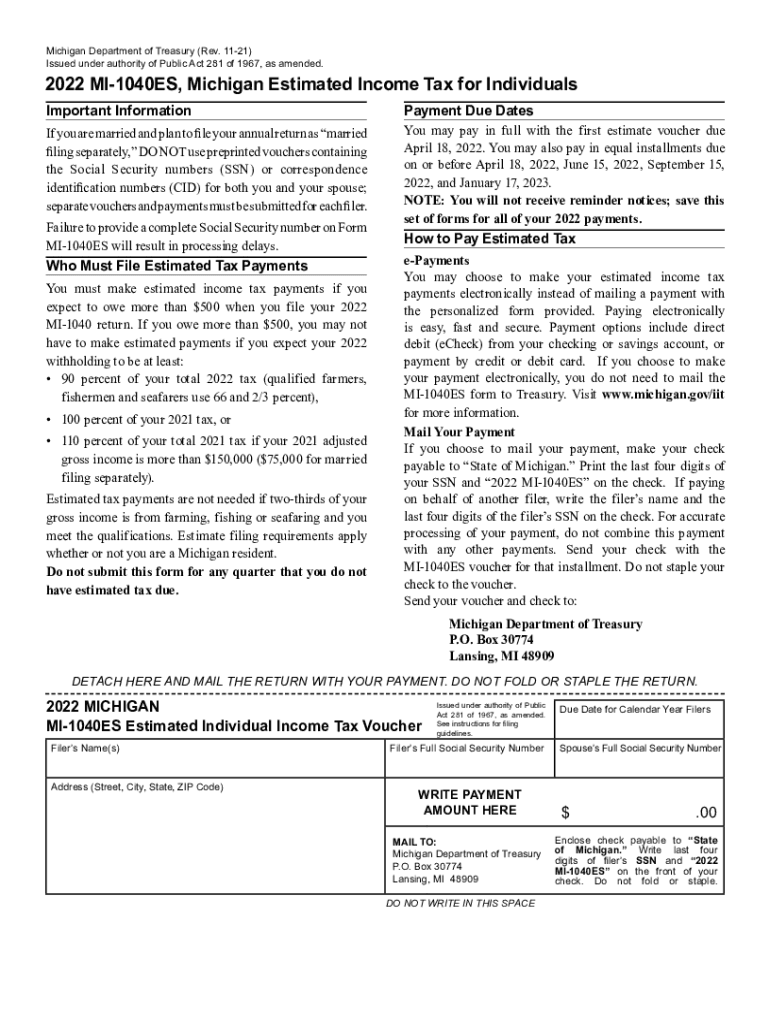

2013 MI-1040ES Michigan Estimated Income Tax for Individuals NOTE If you are married and plan to file your annual return as married filing separately DO NOT use preprinted vouchers containing the Social Security Numbers SSN or correspondence identification numbers for both you and your spouse separate vouchers and payments must be submitted for each filer. Who Must File Estimated Tax Payments You must make estimated income tax payments if you expect to owe more than 500 when you file your...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI MI-1040ES

Edit your MI MI-1040ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI MI-1040ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI MI-1040ES online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI MI-1040ES. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI MI-1040ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI MI-1040ES

How to fill out MI MI-1040ES

01

Obtain a copy of the MI MI-1040ES form from the Michigan Department of Treasury website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Estimate your total income for the year to calculate your expected tax liability.

04

Determine your withholding and credits, if any, that you expect to receive.

05

Subtract your estimated credits from your estimated tax liability to find your payment due.

06

Divide your estimated payment by the number of quarterly payments you plan to make (usually four).

07

Complete the payment calculation section on the form.

08

Sign and date the form before submitting it.

Who needs MI MI-1040ES?

01

Individuals who expect to owe Michigan state income tax at the end of the year.

02

Self-employed individuals who need to report and pay estimated taxes.

03

Taxpayers who have income that is not subject to withholding, such as rental income or investment income.

04

Anyone required to pay estimated taxes based on prior year tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What is a MI 5338 form?

Michigan Department of Treasury - City Tax Administration. 5338 (Rev. 10-21), Page 1 of 2. 2021 CITY Underpayment of Estimated Income Tax. Issued under authority of Public Act 284 of 1964, as amended.

What form do I use for estimated tax payments in Michigan 2022?

Form MI-1041ES must be completed with the name and FEIN of the FTE who will claim the estimated payments on the composite return. Estimated payments should only be remitted for participants of a composite return. Fiduciaries and composite filers may pay in full with the first voucher, due April 18, 2022.

What is a Michigan 1040-ES?

Important Information.

What is Michigan form 5674?

11. Form 5674 is used to compute the current year Michigan net operating loss (NOL) deduction from available Group 1 and/or Group 2 NOLs. Form 5674 is required when claiming an NOL deduction on the Michigan Schedule 1. Both the Schedule 1 and Form 5674 must be included with the MI-1040 when claiming an NOL deduction.

What is the limitation on NOL in Michigan?

Group 2 CARES NOLs are those created in 2018, 2019 and 2020. The carryforward of these NOL deductions are limited to 80 percent of Michigan taxable income before exemptions and previously claimed NOL deductions beginning in tax year 2021. Group 2 TCJA NOLs are those created in 2021 and future tax years.

What is Michigan excess business loss?

A Michigan NOL occurs when business losses exceed income in a particular tax year. An individual, a trust, or an estate can sustain an NOL in one tax year and use that loss to offset income in other tax years. The resulting offset to income in those other tax years is referred to as an NOL deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MI MI-1040ES?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MI MI-1040ES in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit MI MI-1040ES straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing MI MI-1040ES.

How do I fill out the MI MI-1040ES form on my smartphone?

Use the pdfFiller mobile app to fill out and sign MI MI-1040ES on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is MI MI-1040ES?

MI MI-1040ES is the Michigan Estimated Income Tax form used by individuals to calculate and pay estimated taxes on income that is not subject to withholding.

Who is required to file MI MI-1040ES?

Individuals who expect to owe at least $500 in Michigan income tax for the current tax year and do not have enough tax withheld from their wages or other income are required to file MI MI-1040ES.

How to fill out MI MI-1040ES?

To fill out MI MI-1040ES, taxpayers must provide their name, address, Social Security number, and estimated adjusted gross income. They will also calculate the total estimated tax for the year and divide that amount into four quarterly payments.

What is the purpose of MI MI-1040ES?

The purpose of MI MI-1040ES is to allow taxpayers to prepay their estimated income taxes for the year, helping to avoid a large tax bill at the end of the year and potential penalties for underpayment.

What information must be reported on MI MI-1040ES?

The information that must be reported on MI MI-1040ES includes the taxpayer's name, address, Social Security number, estimated income, tax credits, and the calculated estimated tax liability.

Fill out your MI MI-1040ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MI-1040es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.