MI MI-1040ES 2025-2026 free printable template

Show details

Reset FormMichigan Department of Treasury (Rev. 0724) Issued under authority of Public Act 281 of 1967, as amended.2025 MI1040ES, Michigan Estimated Income Tax for Individuals Important Information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mi 1040es form

Edit your 771574043 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2025 mi 1040es form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI MI-1040ES online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI MI-1040ES. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI MI-1040ES Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI MI-1040ES

How to fill out MI MI-1040ES

01

Obtain the MI MI-1040ES form from the Michigan Department of Treasury website.

02

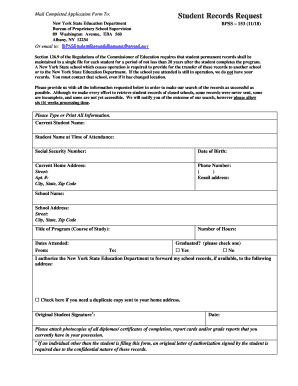

Fill in your name, address, and Social Security number in the designated fields.

03

Calculate your estimated tax for the year based on your expected income and deductions.

04

Divide your estimated tax by four to determine your quarterly payment amount.

05

Enter the payment amounts for each quarter in the respective boxes provided on the form.

06

Sign and date the form at the bottom.

07

Mail the completed MI MI-1040ES form along with your payment to the appropriate address listed on the form.

Who needs MI MI-1040ES?

01

Individuals who expect to owe Michigan income tax of $500 or more in the current tax year.

02

Self-employed individuals who are required to pay estimated taxes.

03

Taxpayers with income not subject to withholding, such as rental income or interest income.

Fill

form

: Try Risk Free

People Also Ask about

What is a MI 5338 form?

Michigan Department of Treasury - City Tax Administration. 5338 (Rev. 10-21), Page 1 of 2. 2021 CITY Underpayment of Estimated Income Tax. Issued under authority of Public Act 284 of 1964, as amended.

What form do I use for estimated tax payments in Michigan 2022?

Form MI-1041ES must be completed with the name and FEIN of the FTE who will claim the estimated payments on the composite return. Estimated payments should only be remitted for participants of a composite return. Fiduciaries and composite filers may pay in full with the first voucher, due April 18, 2022.

What is a Michigan 1040-ES?

Important Information.

What is Michigan form 5674?

11. Form 5674 is used to compute the current year Michigan net operating loss (NOL) deduction from available Group 1 and/or Group 2 NOLs. Form 5674 is required when claiming an NOL deduction on the Michigan Schedule 1. Both the Schedule 1 and Form 5674 must be included with the MI-1040 when claiming an NOL deduction.

What is the limitation on NOL in Michigan?

Group 2 CARES NOLs are those created in 2018, 2019 and 2020. The carryforward of these NOL deductions are limited to 80 percent of Michigan taxable income before exemptions and previously claimed NOL deductions beginning in tax year 2021. Group 2 TCJA NOLs are those created in 2021 and future tax years.

What is Michigan excess business loss?

A Michigan NOL occurs when business losses exceed income in a particular tax year. An individual, a trust, or an estate can sustain an NOL in one tax year and use that loss to offset income in other tax years. The resulting offset to income in those other tax years is referred to as an NOL deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MI MI-1040ES from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including MI MI-1040ES, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute MI MI-1040ES online?

Easy online MI MI-1040ES completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit MI MI-1040ES on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI MI-1040ES on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MI MI-1040ES?

MI MI-1040ES is a form used in Michigan for estimated income tax payments for individuals.

Who is required to file MI MI-1040ES?

Individuals who expect to owe tax of $100 or more when they file their annual tax return are required to file MI MI-1040ES.

How to fill out MI MI-1040ES?

To fill out MI MI-1040ES, you need to provide your name, address, Social Security number, estimated income, deductions, and the total amount of estimated tax you expect to pay.

What is the purpose of MI MI-1040ES?

The purpose of MI MI-1040ES is to facilitate individuals in making estimated tax payments to avoid penalties at the time of filing their income tax returns.

What information must be reported on MI MI-1040ES?

The information that must be reported on MI MI-1040ES includes your personal details, estimated income, estimated tax due for the year, payment amount, and payment schedule.

Fill out your MI MI-1040ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MI-1040es is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.