MI DoT MI-1041 2021 free printable template

Show details

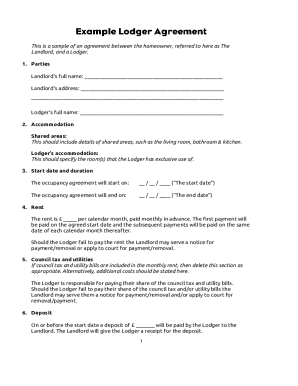

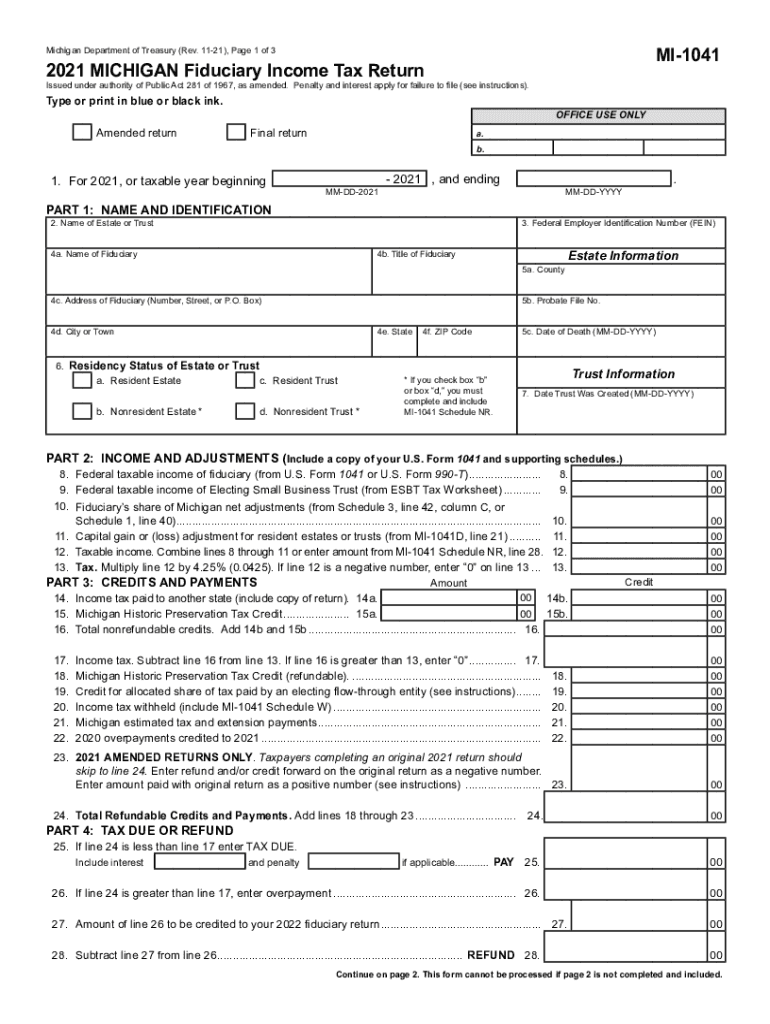

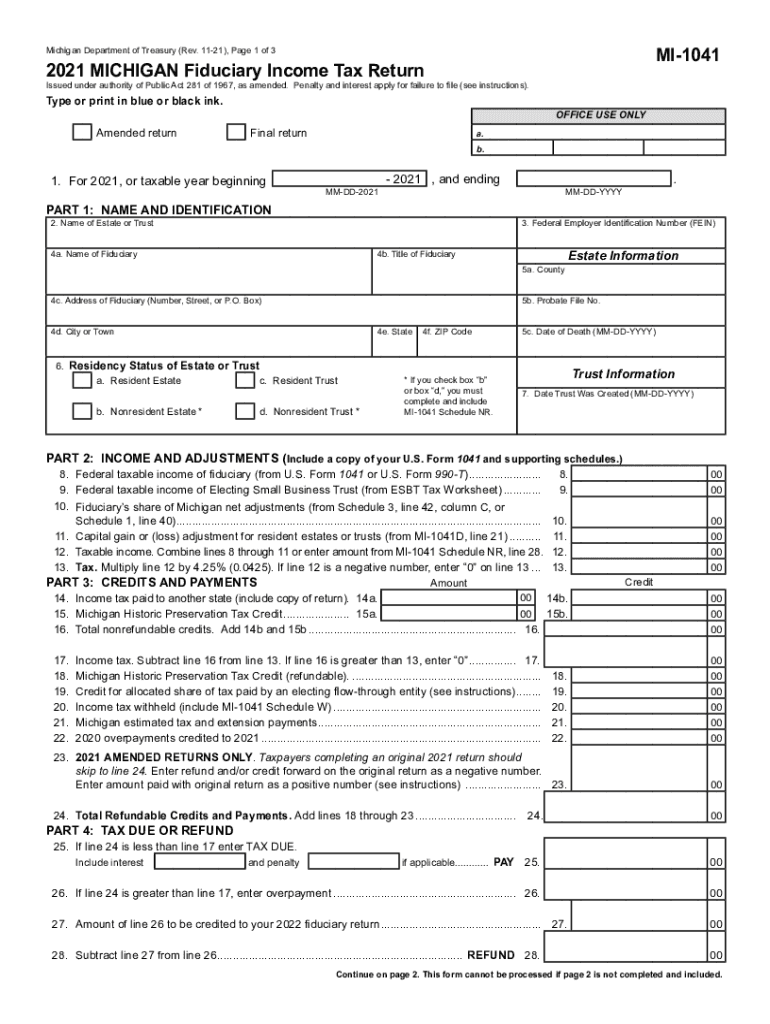

Instructions Complete Schedules 2 3 and 4 as applicable. If additional space is needed complete the Michigan Fiduciary Income Tax Information Continuation Schedule Form 5680. Reset Form MI-1041 Michigan Department of Treasury Rev. 11-21 Page 1 of 3 2021 MICHIGAN Fiduciary Income Tax Return Issued under authority of Public Act 281 of 1967 as amended. Penalty and interest apply for failure to file see instructions. Type or print in blue or black ink. Amended return OFFICE USE ONLY Final return...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT MI-1041

Edit your MI DoT MI-1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT MI-1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT MI-1041 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI DoT MI-1041. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT MI-1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT MI-1041

How to fill out MI DoT MI-1041

01

Obtain the MI DoT MI-1041 form from the Michigan Department of Transportation website or designated office.

02

Read the instructions provided on the form carefully to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact information.

04

Provide detailed information about the type of request or application you are submitting in the relevant sections.

05

Review any additional documentation requirements specified on the form and gather necessary papers.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the application where required.

08

Submit the completed MI DoT MI-1041 form through the recommended submission method, whether by mail or online.

Who needs MI DoT MI-1041?

01

Individuals or businesses seeking permits, licenses, or approvals related to transportation or roadway projects in Michigan.

02

Contractors applying for state-funded transportation projects.

03

Anyone needing to report or request action regarding state-maintained roadways.

Fill

form

: Try Risk Free

People Also Ask about

What is considered income in a trust account?

Trust accounting income(also called fiduciary accounting income or FAI) refers to income available for payment only to trust income beneficiaries. It includes dividends, interest, and ordinary income. Principal and capital gains are generally reserved for distribution to the remainder beneficiaries.

What is considered income for Form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Who is exempt from Michigan state tax?

The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. An additional $400 exemption is available for each disabled veteran in the household.

Can you deduct charitable contributions on a 1041?

If a trust claims a charitable deduction, it must file Form 1041-A, U.S. Information Return: Trust Accumulation of Charitable Amounts, for the relevant tax year unless it meets one of the exceptions noted in the instructions to the form.

Do I have to file a Mi tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

Do you have to file a Form 1041 if there is no income?

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

Do I have to file taxes if I made less than $5 000?

Do You Have to File Taxes If You Made Less than $5,000? Typically, if a filer files less than $5,000 per year, they don't need to do any filing for the IRS. Your employment status can also be used to determine if you're making less than $5,000.

What is 1041 form for?

Schedule D (Form 1041), Capital Gains and Losses Use Schedule D (Form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust.

What deductions can I claim on a 1041?

On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. After the section on deductions is complete you'll get to the kicker – taxes and payments.

Which is considered non taxable income?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Do I need to file a Michigan income tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

What income goes on Form 1041?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is the minimum income to avoid filing taxes?

Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

How much money do you have to make in Michigan to file taxes?

You must file a Michigan Individual Income Tax Return if your Michigan income exceeds your prorated exemption allowance. Note: For the 2021 tax year, each Michigan personal and dependent exemption allowance is $4,900 plus $2,800 for each eligible special exemption.

How much do you have to make to file taxes in Michigan 2022?

If you can be claimed as a dependent on your parents tax return, and your AGI amount is $1,500 or less and your filing status is Single or Married Filing Separately, or $3,000 or less and your filing status is Married Filing Jointly, you will not be required to file a Michigan state return unless you are claiming a

What is deductible on a 1041 for an estate?

You can deduct the expenses incurred by an estate for its administration either as an expense against the estate tax or against the annual income tax of the estate. You may deduct the expense from the estate's gross income in figuring the estate's income tax on Form 1041, U.S. Income Tax Return for Estates and Trusts.

Is the sale of a house considered income on Form 1041?

Any net gain resulting from the sale of the home would be considered a capital gain (or perhaps a loss depending on the above considerations) that can be reported on Form 1041 for estates and trusts for the year of sale. There may be other income of the deceased to consider for this tax form.

What expenses are deductible on estate tax return?

Cost of storing or maintaining property. Brokerage fees for selling property of the estate. Auctioneers' fees for selling property of the estate. Interest on federal and state income, gift, and estate tax deficiencies that accrues after death.

Who is required to file a MI tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax.

What deductions are allowed on Form 1041?

Just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions.

Do I have to file a city tax return in Michigan?

You will need to file if you lived in the city during any part of the tax year and had taxable income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI DoT MI-1041 for eSignature?

Once your MI DoT MI-1041 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in MI DoT MI-1041?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your MI DoT MI-1041 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in MI DoT MI-1041 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MI DoT MI-1041 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is MI DoT MI-1041?

MI DoT MI-1041 is a tax form used by businesses in the state of Michigan to report and remit the state income tax withheld from employees' wages.

Who is required to file MI DoT MI-1041?

Employers in Michigan who withhold income tax from their employees' wages are required to file MI DoT MI-1041.

How to fill out MI DoT MI-1041?

To fill out MI DoT MI-1041, employers must provide their business information, report total wages paid, the amount of income tax withheld, and any other required information as specified in the form's instructions.

What is the purpose of MI DoT MI-1041?

The purpose of MI DoT MI-1041 is to ensure that employers report and remit the correct amount of state income tax withheld from employee wages to the Michigan Department of Treasury.

What information must be reported on MI DoT MI-1041?

The information that must be reported on MI DoT MI-1041 includes the employer's name, address, total wages paid, total tax withheld, and any additional details as outlined in the form.

Fill out your MI DoT MI-1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT MI-1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.