MI DoT MI-1041 2015 free printable template

Show details

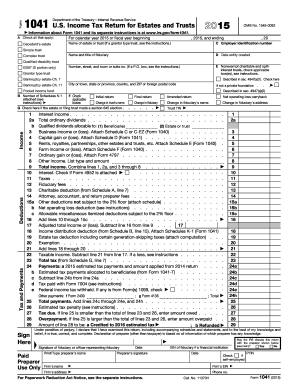

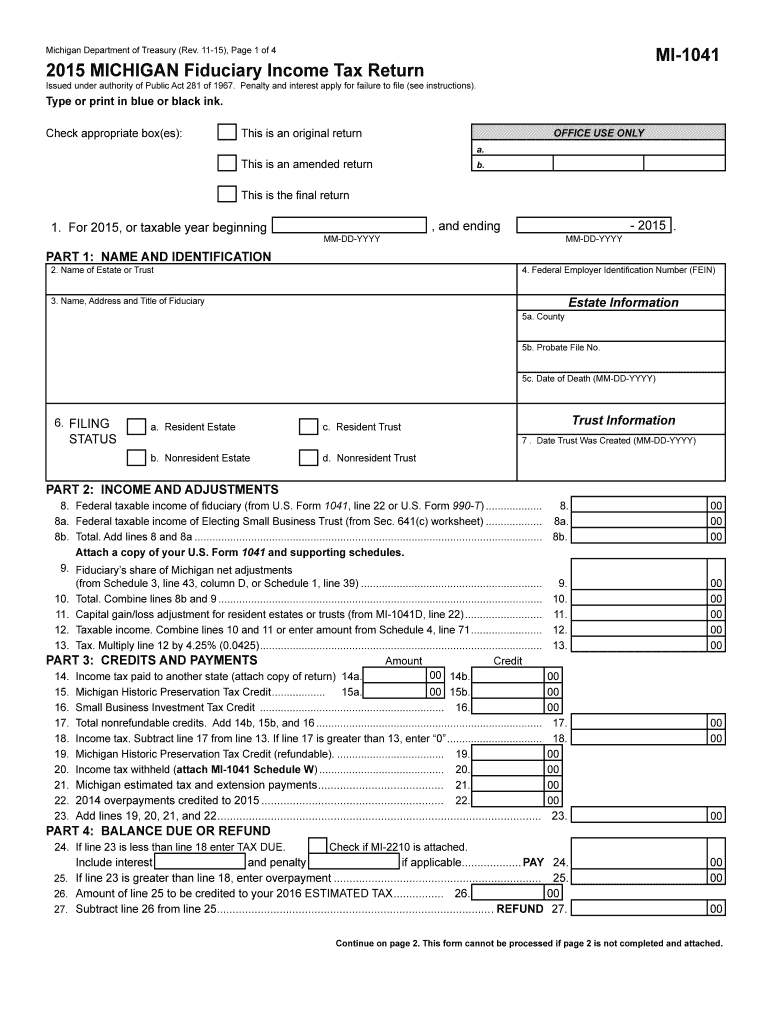

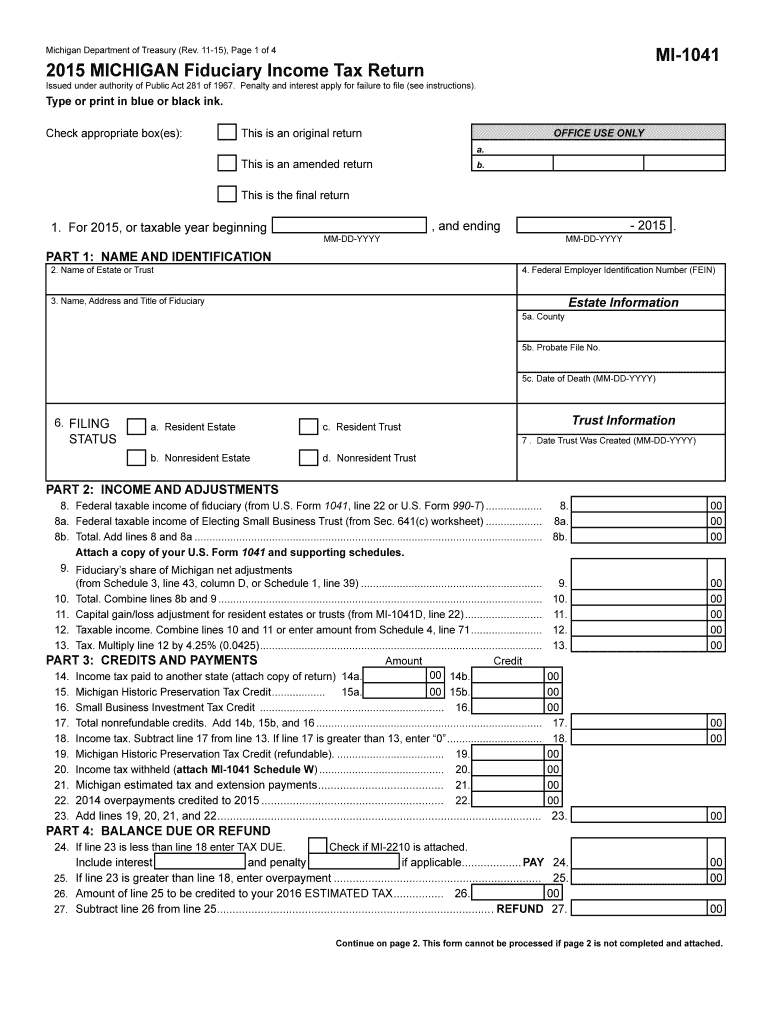

This form cannot be processed if page 2 is not completed and attached. 2015 MI-1041 Page 2 of 4 SCHEDULE 1 NET MICHIGAN ADJUSTMENT FOR RESIDENT ESTATES OR TRUSTS Additions 28. Reset Form MI-1041 Michigan Department of Treasury Rev* 11-15 Page 1 of 4 2015 MICHIGAN Fiduciary Income Tax Return Issued under authority of Public Act 281 of 1967. Penalty and interest apply for failure to file see instructions. Type or print in blue or black ink. Check appropriate box es This is an original return...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2015 michigan schedule 1

Edit your 2015 michigan schedule 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2015 michigan schedule 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2015 michigan schedule 1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2015 michigan schedule 1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT MI-1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2015 michigan schedule 1

How to fill out MI DoT MI-1041

01

Gather your information: Collect relevant details such as your business name, address, and federal employer identification number (FEIN).

02

Obtain the MI DoT MI-1041 form: You can find the form on the Michigan Department of Transportation website or through their offices.

03

Fill in your business information: Enter your business name, address, and FEIN in the appropriate sections of the form.

04

Provide operation details: Indicate the type of operations you perform and any relevant vehicle information if applicable.

05

Complete additional sections: Fill out any extra areas required for your specific situation, such as certification and signatures.

06

Review the form: Make sure all information is accurate and complete before submitting.

07

Submit the form: Mail the completed MI-1041 to the address specified on the form or submit it electronically if available.

Who needs MI DoT MI-1041?

01

Businesses operating commercial vehicles in Michigan that are subject to the International Registration Plan (IRP) and need to report their fleet and registration information.

Fill

form

: Try Risk Free

People Also Ask about

What is considered income in a trust account?

Trust accounting income(also called fiduciary accounting income or FAI) refers to income available for payment only to trust income beneficiaries. It includes dividends, interest, and ordinary income. Principal and capital gains are generally reserved for distribution to the remainder beneficiaries.

What is considered income for Form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Who is exempt from Michigan state tax?

The state also provides a $2,800 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. An additional $400 exemption is available for each disabled veteran in the household.

Can you deduct charitable contributions on a 1041?

If a trust claims a charitable deduction, it must file Form 1041-A, U.S. Information Return: Trust Accumulation of Charitable Amounts, for the relevant tax year unless it meets one of the exceptions noted in the instructions to the form.

Do I have to file a Mi tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

Do you have to file a Form 1041 if there is no income?

Form 1041 is not needed if there is less than $600 of gross income, there is no taxable income and there aren't any nonresident alien beneficiaries.

Do I have to file taxes if I made less than $5 000?

Do You Have to File Taxes If You Made Less than $5,000? Typically, if a filer files less than $5,000 per year, they don't need to do any filing for the IRS. Your employment status can also be used to determine if you're making less than $5,000.

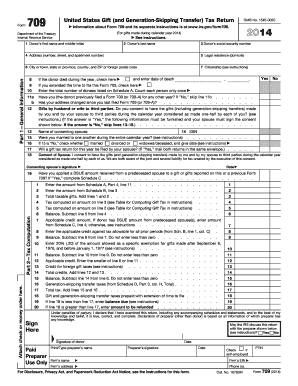

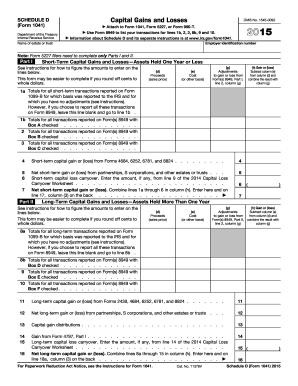

What is 1041 form for?

Schedule D (Form 1041), Capital Gains and Losses Use Schedule D (Form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust.

What deductions can I claim on a 1041?

On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. After the section on deductions is complete you'll get to the kicker – taxes and payments.

Which is considered non taxable income?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Do I need to file a Michigan income tax return?

Yes. You must file a Michigan Individual Income Tax Return MI-1040 and pay tax on income you earned, received, or accrued while living in Michigan. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR and Schedule W.

What income goes on Form 1041?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is the minimum income to avoid filing taxes?

Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

How much money do you have to make in Michigan to file taxes?

You must file a Michigan Individual Income Tax Return if your Michigan income exceeds your prorated exemption allowance. Note: For the 2021 tax year, each Michigan personal and dependent exemption allowance is $4,900 plus $2,800 for each eligible special exemption.

How much do you have to make to file taxes in Michigan 2022?

If you can be claimed as a dependent on your parents tax return, and your AGI amount is $1,500 or less and your filing status is Single or Married Filing Separately, or $3,000 or less and your filing status is Married Filing Jointly, you will not be required to file a Michigan state return unless you are claiming a

What is deductible on a 1041 for an estate?

You can deduct the expenses incurred by an estate for its administration either as an expense against the estate tax or against the annual income tax of the estate. You may deduct the expense from the estate's gross income in figuring the estate's income tax on Form 1041, U.S. Income Tax Return for Estates and Trusts.

Is the sale of a house considered income on Form 1041?

Any net gain resulting from the sale of the home would be considered a capital gain (or perhaps a loss depending on the above considerations) that can be reported on Form 1041 for estates and trusts for the year of sale. There may be other income of the deceased to consider for this tax form.

What expenses are deductible on estate tax return?

Cost of storing or maintaining property. Brokerage fees for selling property of the estate. Auctioneers' fees for selling property of the estate. Interest on federal and state income, gift, and estate tax deficiencies that accrues after death.

Who is required to file a MI tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax.

What deductions are allowed on Form 1041?

Just like with personal income taxes, deductions reduce the taxable income of the estate or trust, indirectly reducing the tax bill. On Form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions.

Do I have to file a city tax return in Michigan?

You will need to file if you lived in the city during any part of the tax year and had taxable income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2015 michigan schedule 1?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 2015 michigan schedule 1. Open it immediately and start altering it with sophisticated capabilities.

How do I edit 2015 michigan schedule 1 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2015 michigan schedule 1 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete 2015 michigan schedule 1 on an Android device?

Use the pdfFiller mobile app and complete your 2015 michigan schedule 1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MI DoT MI-1041?

MI DoT MI-1041 is a tax form used for reporting certain tax information to the Michigan Department of Treasury.

Who is required to file MI DoT MI-1041?

Businesses and individuals who engage in specific taxable activities, as defined by Michigan tax laws, are required to file MI DoT MI-1041.

How to fill out MI DoT MI-1041?

To fill out MI DoT MI-1041, gather the necessary financial documents, enter your business information, report your income and expenses accurately, and submit the form to the Michigan Department of Treasury.

What is the purpose of MI DoT MI-1041?

The purpose of MI DoT MI-1041 is to ensure compliance with Michigan tax laws by providing a standard method for reporting taxable income and related information.

What information must be reported on MI DoT MI-1041?

MI DoT MI-1041 requires reporting details such as business identification, types of income earned, deductions claimed, and any taxes withheld or paid.

Fill out your 2015 michigan schedule 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2015 Michigan Schedule 1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.