MS Form 71-661 2021 free printable template

Show details

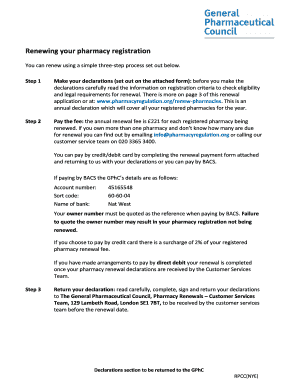

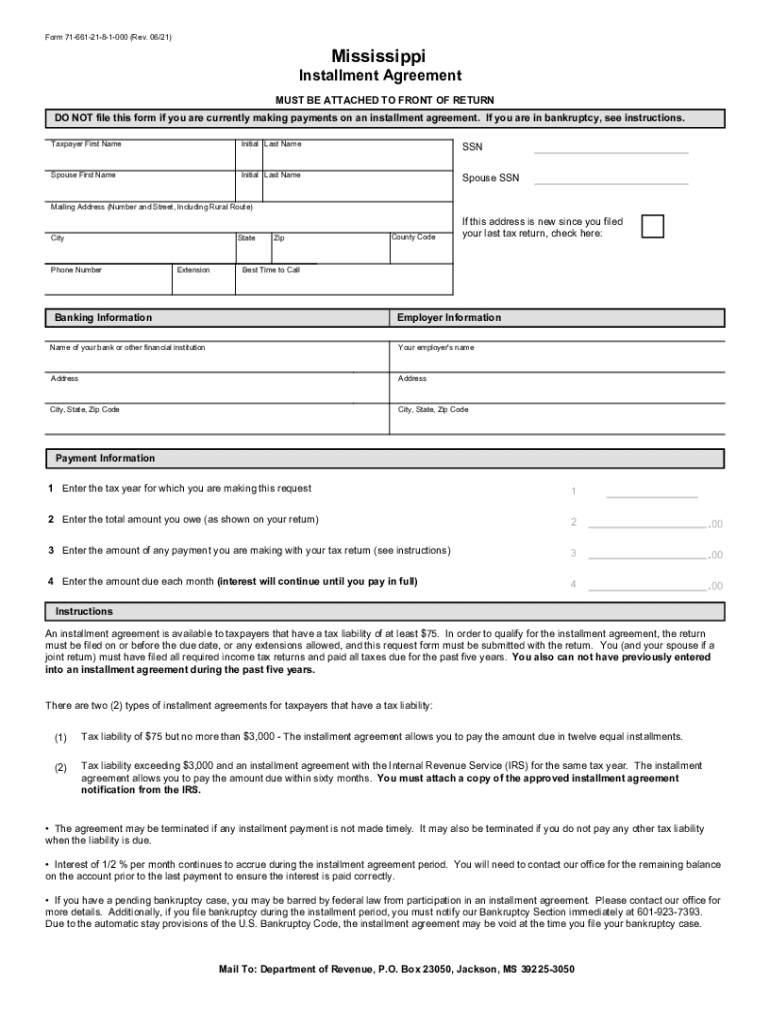

Reset Form Form 716612181000 (Rev. 06/21)MississippiPrint FormInstallment Agreement MUST BE ATTACHED TO FRONT OF RETURN DO NOT file this form if you are currently making payments on an installment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS Form 71-661

Edit your MS Form 71-661 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS Form 71-661 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MS Form 71-661 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MS Form 71-661. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS Form 71-661 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS Form 71-661

How to fill out MS Form 71-661

01

Open MS Form 71-661 on your computer.

02

Read the instructions carefully at the top of the form.

03

Fill in your personal information in the designated fields, including name, address, and contact information.

04

Provide any relevant identification numbers as required by the form.

05

Complete the sections pertaining to your specific case, following any guidelines provided.

06

Review your entries for accuracy.

07

Sign and date the form at the designated space.

08

Submit the form according to the instructions, whether online or by mail.

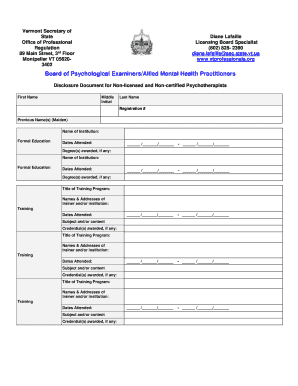

Who needs MS Form 71-661?

01

Individuals who are applying for benefits, grants, or services that require MS Form 71-661.

02

Caseworkers or agency employees assisting clients with applications.

03

Anyone involved in processes that require submission of this specific form for formal documentation.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up a payment plan with MS state taxes?

You must include a copy of your approved installment agreement with the IRS. Again, interest will continue to accrue. To apply for an installment agreement, you will need to do the following: Complete Form 71-661, Mississippi Installment Agreement and attach it to the front of your tax return.

Do I have to file a Mississippi state tax return non-resident?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

What is MS income tax schedule?

There is no tax schedule for Mississippi income taxes. The graduated income tax rate is: 0% on the first $5,000 of taxable income.

What happens if you don't file nonresident tax return?

If you don't file and owe taxes, you will pay penalties. If you owe taxes and don't file a USA tax return, the IRS will find you. Moreover, if you are considered a resident alien for tax purposes, you might face the same penalties as the U.S. citizen.

Who must file a Mississippi state tax return?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You are a Non-Resident or Part-Year Resident with income taxed by Mississippi.

Do I need to file tax return on a state I don't live in?

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your “resident” state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

What is the return filing requirement for non resident?

An NRI, like any other individual taxpayer, must file his return of income in India if his gross total income received in India exceeds Rs 2.5 lakh for any given financial year.

What is MS personal income tax?

0% on the first $2,000 of taxable income. 3% on the next $3,000 of taxable income. 4% on the next $5,000 of taxable income. 5% on all taxable income over $10,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MS Form 71-661 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share MS Form 71-661 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete MS Form 71-661 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MS Form 71-661. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit MS Form 71-661 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as MS Form 71-661. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is MS Form 71-661?

MS Form 71-661 is a specific form used for reporting and documenting certain information related to military service members' actions or circumstances.

Who is required to file MS Form 71-661?

Military service members or personnel who meet specific criteria set forth by the military regulations are required to file MS Form 71-661.

How to fill out MS Form 71-661?

To fill out MS Form 71-661, individuals need to accurately complete all sections of the form based on the required information, ensuring clarity and correctness before submission.

What is the purpose of MS Form 71-661?

The purpose of MS Form 71-661 is to facilitate the collection of key data regarding military personnel, ensuring effective record-keeping and management within the military framework.

What information must be reported on MS Form 71-661?

MS Form 71-661 requires reporting of personal identification information, service details, specific actions or events that prompted the filing of the form, and any other pertinent data as outlined in the instructions.

Fill out your MS Form 71-661 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS Form 71-661 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.