MS Form 71-661 2023 free printable template

Show details

Reset Form

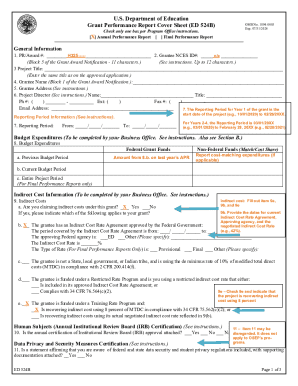

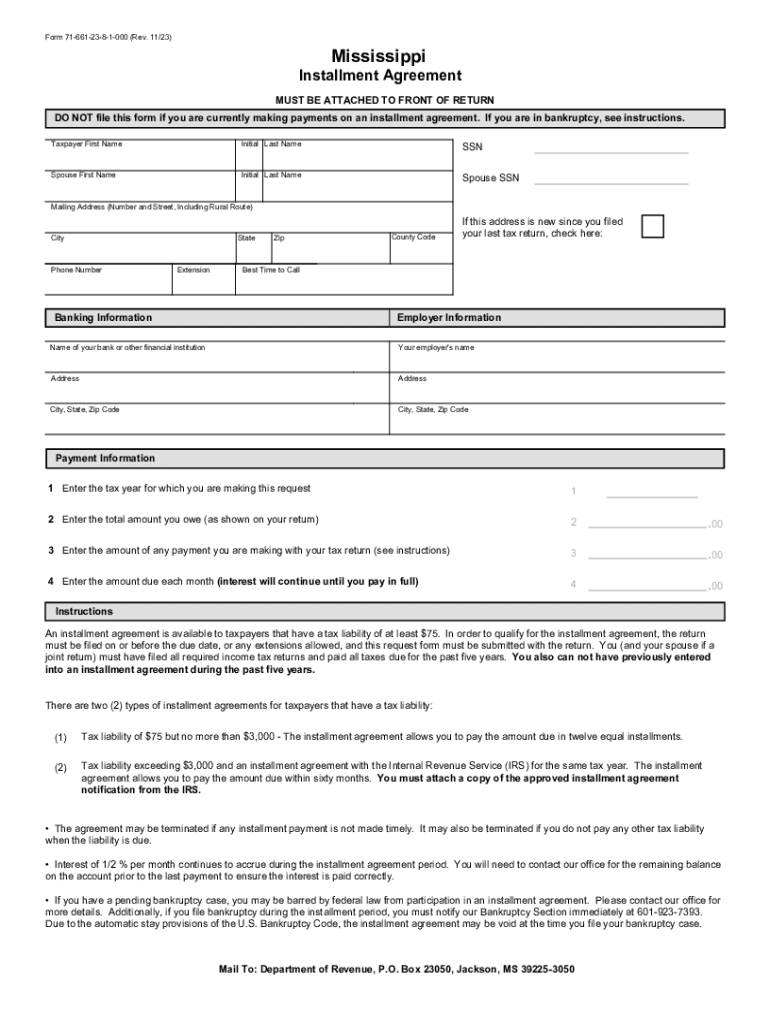

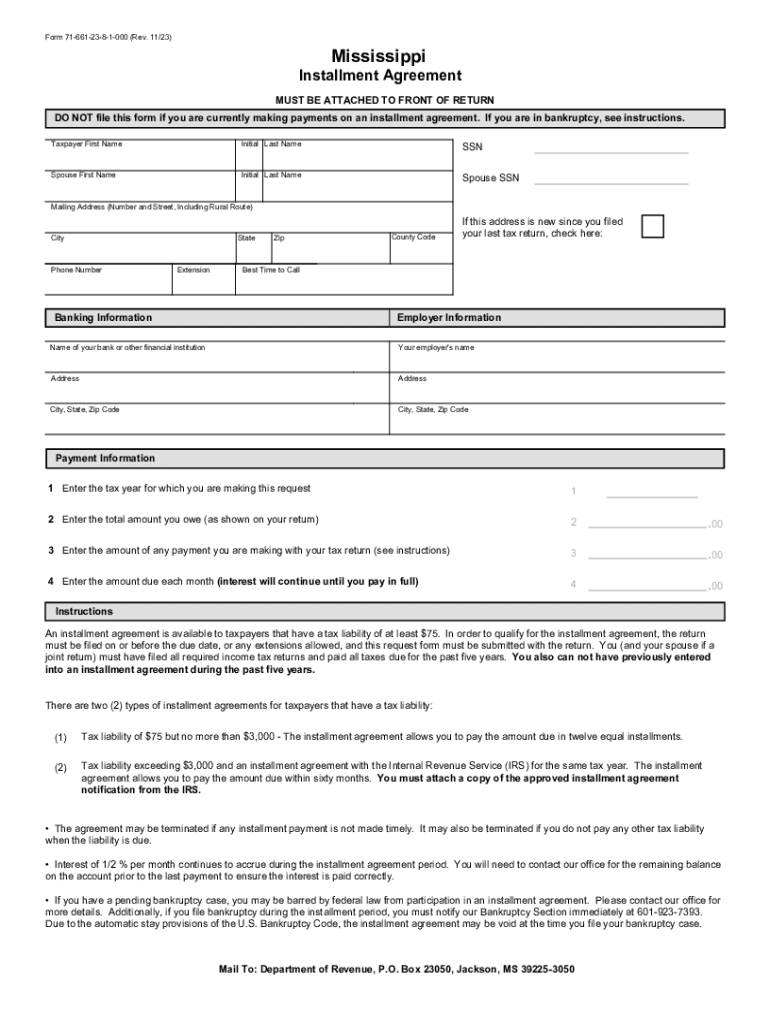

Form 716612381000 (Rev. 11/23)MississippiPrint FormInstallment Agreement

MUST BE ATTACHED TO FRONT OF RETURN

DO NOT file this form if you are currently making payments on an installment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mississippi 71 661 form

Edit your mississippi installment agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ms revenue 71661 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing installment agreement revenue online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ms installment agreement form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS Form 71-661 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 71 661 form

How to fill out MS Form 71-661

01

Obtain a copy of MS Form 71-661 from the official website or your organization.

02

Read the instructions provided with the form carefully.

03

Fill in your personal information such as name, address, and contact details in the designated sections.

04

Provide any required identification details as specified in the form.

05

Complete the relevant sections based on the purpose of the form; ensure all required fields are filled.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the end.

08

Submit the form according to the instructions (online, via mail, or in person).

Who needs MS Form 71-661?

01

Military personnel requiring administrative processing.

02

Active duty members of the armed forces.

03

Veterans seeking benefits or evaluations.

04

Government employees involved with military operations.

Fill

ms 71 661

: Try Risk Free

People Also Ask about installment agreement 71661

How do I set up a payment plan with MS state taxes?

You must include a copy of your approved installment agreement with the IRS. Again, interest will continue to accrue. To apply for an installment agreement, you will need to do the following: Complete Form 71-661, Mississippi Installment Agreement and attach it to the front of your tax return.

Do I have to file a Mississippi state tax return non-resident?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

What is MS income tax schedule?

There is no tax schedule for Mississippi income taxes. The graduated income tax rate is: 0% on the first $5,000 of taxable income.

What happens if you don't file nonresident tax return?

If you don't file and owe taxes, you will pay penalties. If you owe taxes and don't file a USA tax return, the IRS will find you. Moreover, if you are considered a resident alien for tax purposes, you might face the same penalties as the U.S. citizen.

Who must file a Mississippi state tax return?

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You are a Non-Resident or Part-Year Resident with income taxed by Mississippi.

Do I need to file tax return on a state I don't live in?

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your “resident” state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

What is the return filing requirement for non resident?

An NRI, like any other individual taxpayer, must file his return of income in India if his gross total income received in India exceeds Rs 2.5 lakh for any given financial year.

What is MS personal income tax?

0% on the first $2,000 of taxable income. 3% on the next $3,000 of taxable income. 4% on the next $5,000 of taxable income. 5% on all taxable income over $10,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mississippi revenue 71661 2023 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing mississippi revenue 71661 2023 right away.

How can I fill out mississippi revenue 71661 2023 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your mississippi revenue 71661 2023 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit mississippi revenue 71661 2023 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share mississippi revenue 71661 2023 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MS Form 71-661?

MS Form 71-661 is a form used by certain organizations to report specific information related to military service and funding allocations.

Who is required to file MS Form 71-661?

Organizations receiving military funding or support are typically required to file MS Form 71-661.

How to fill out MS Form 71-661?

To fill out MS Form 71-661, individuals must provide accurate information regarding the organization’s military-related activities, funding received, and expenditures in the specified sections of the form.

What is the purpose of MS Form 71-661?

The purpose of MS Form 71-661 is to ensure proper accountability and transparency in the use of military funds and to track the effectiveness of military services provided.

What information must be reported on MS Form 71-661?

The form requires reporting details such as the organization's name, funding sources, amounts received, and specific expenditures related to military support.

Fill out your mississippi revenue 71661 2023 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mississippi Revenue 71661 2023 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.