Get the free www.hardincountyia.govAgendaCenterViewFileRe: Property Tax Suspension To: Hardin ......

Show details

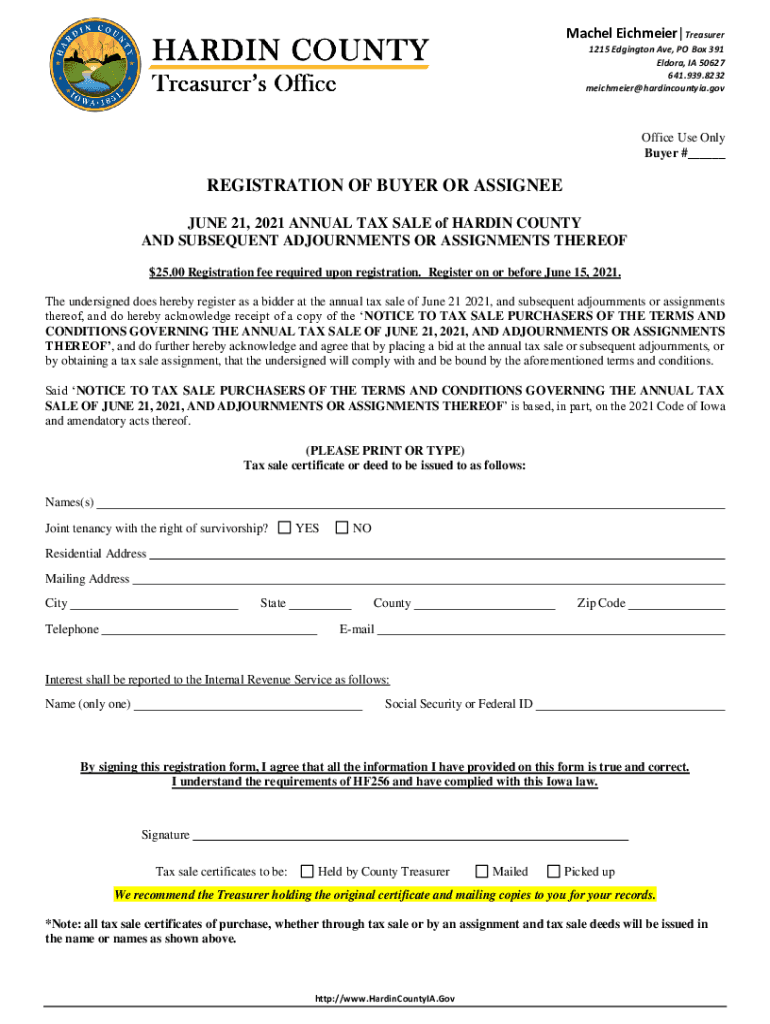

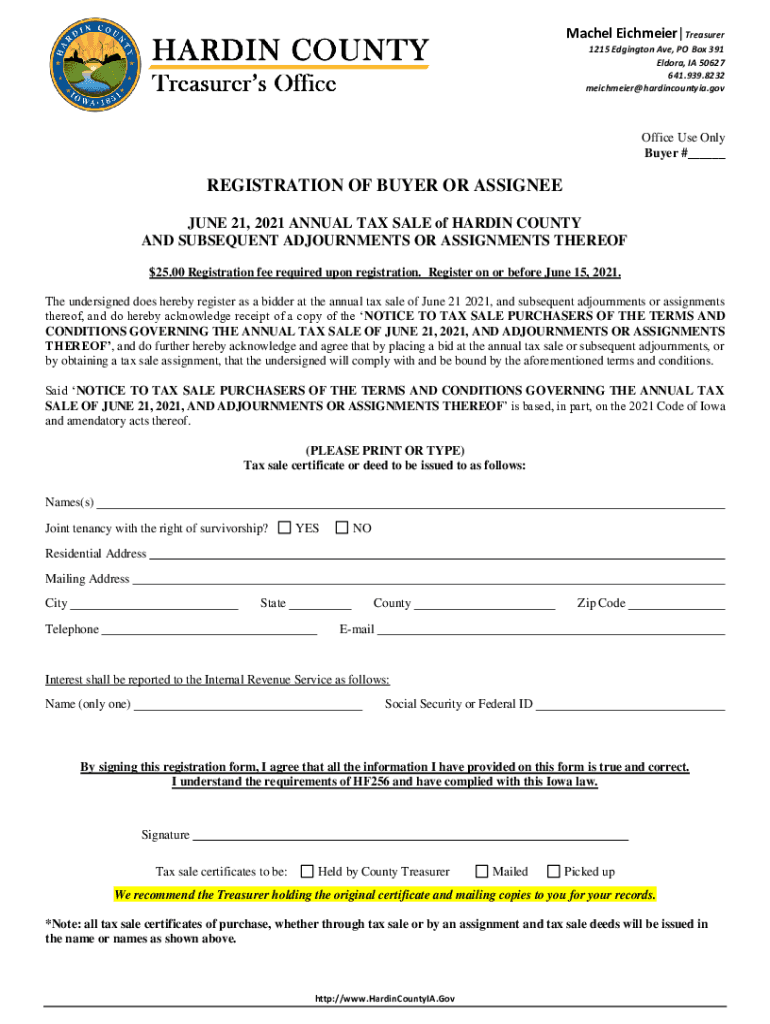

Michel Eichmann×Treasurer 1215 Eddington Ave, PO Box 391 Elnora, IA 50627 641.939.8232 maintain×hardincountyia.office Use Only Buyer #___REGISTRATION OF BUYER OR ASSIGNEE JUNE 21, 2021, ANNUAL TAX

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwhardincountyiagovagendacenterviewfilere property tax suspension

Edit your wwwhardincountyiagovagendacenterviewfilere property tax suspension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwhardincountyiagovagendacenterviewfilere property tax suspension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wwwhardincountyiagovagendacenterviewfilere property tax suspension online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wwwhardincountyiagovagendacenterviewfilere property tax suspension. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwhardincountyiagovagendacenterviewfilere property tax suspension

How to fill out wwwhardincountyiagovagendacenterviewfilere property tax suspension

01

Here is a step-by-step guide on how to fill out the property tax suspension form on www.hardincountyiowa.gov:

02

Visit the official website of Hardin County, Iowa at www.hardincountyiowa.gov.

03

Navigate to the 'Agenda Center' or 'Property Tax' section of the website.

04

Look for the 'File Property Tax Suspension' link or form.

05

Click on the link to access the form.

06

Read the instructions and requirements carefully before filling out the form.

07

Enter your personal information accurately, including your name, address, and contact details.

08

Provide the necessary details about your property, such as the property address and parcel number.

09

If applicable, indicate the reason for requesting a property tax suspension.

10

Double-check all the information you have entered and make sure it is accurate.

11

Once you have completed the form, submit it on the website.

12

Keep a copy of the submitted form for your records.

13

Await confirmation or further instructions from the Hardin County authorities regarding your property tax suspension request.

Who needs wwwhardincountyiagovagendacenterviewfilere property tax suspension?

01

Property owners in Hardin County, Iowa who meet certain criteria may need the property tax suspension offered by www.hardincountyiowa.gov.

02

Some individuals who might need this property tax suspension include:

03

- Senior citizens on fixed incomes who find it challenging to pay their property taxes

04

- Individuals with disabilities or health issues who require financial assistance

05

- Low-income individuals or families who are struggling to make ends meet

06

- Property owners facing unexpected financial hardship due to job loss, medical expenses, or other unforeseen circumstances

07

It is advisable to review the eligibility requirements and guidelines provided on the Hardin County website to determine if one qualifies for the property tax suspension.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my wwwhardincountyiagovagendacenterviewfilere property tax suspension directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your wwwhardincountyiagovagendacenterviewfilere property tax suspension and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit wwwhardincountyiagovagendacenterviewfilere property tax suspension on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing wwwhardincountyiagovagendacenterviewfilere property tax suspension right away.

How do I edit wwwhardincountyiagovagendacenterviewfilere property tax suspension on an Android device?

You can make any changes to PDF files, like wwwhardincountyiagovagendacenterviewfilere property tax suspension, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is wwwhardincountyiagovagendacenterviewfilere property tax suspension?

The property tax suspension is a program that allows qualifying individuals to temporarily suspend the payment of property taxes on their primary residence.

Who is required to file wwwhardincountyiagovagendacenterviewfilere property tax suspension?

Individuals who meet certain age, income, and residency requirements are required to file for the property tax suspension.

How to fill out wwwhardincountyiagovagendacenterviewfilere property tax suspension?

To fill out the property tax suspension, individuals need to provide information about their age, income, residency, and property details as required by the application form.

What is the purpose of wwwhardincountyiagovagendacenterviewfilere property tax suspension?

The purpose of the property tax suspension is to provide financial relief to qualifying individuals by temporarily suspending the payment of property taxes on their primary residence.

What information must be reported on wwwhardincountyiagovagendacenterviewfilere property tax suspension?

Information such as age, income, residency status, and property details must be reported on the property tax suspension application.

Fill out your wwwhardincountyiagovagendacenterviewfilere property tax suspension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwhardincountyiagovagendacenterviewfilere Property Tax Suspension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.