Get the free Fuel Tax Statistical Report - Wisconsin Department of Revenue

Show details

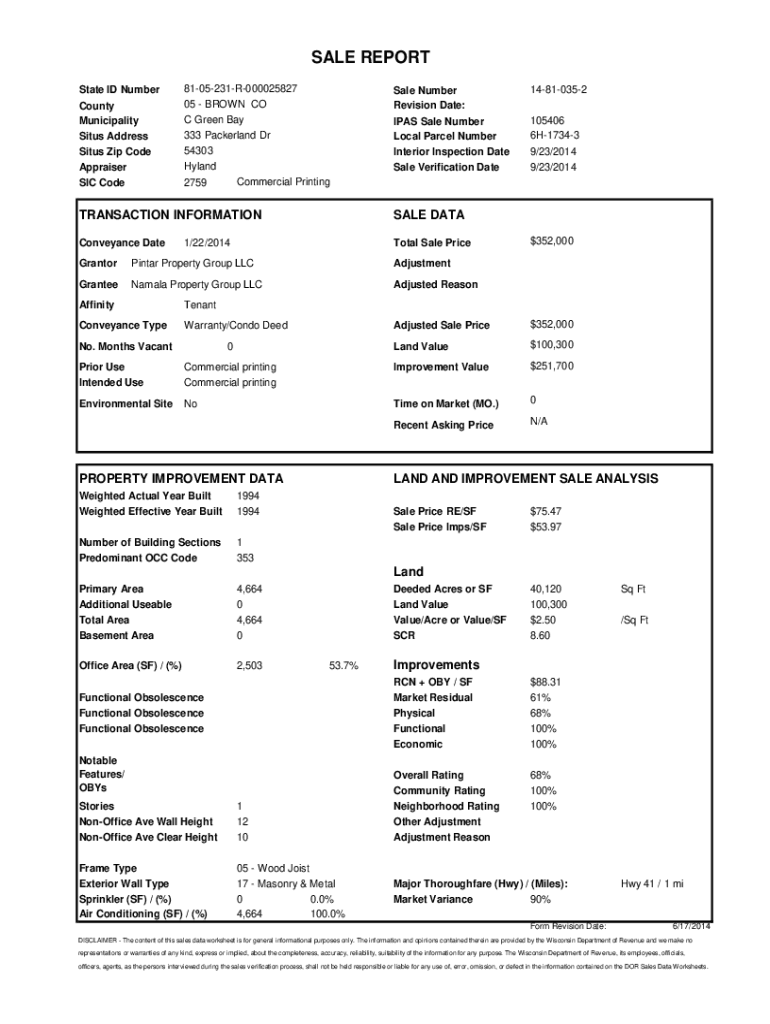

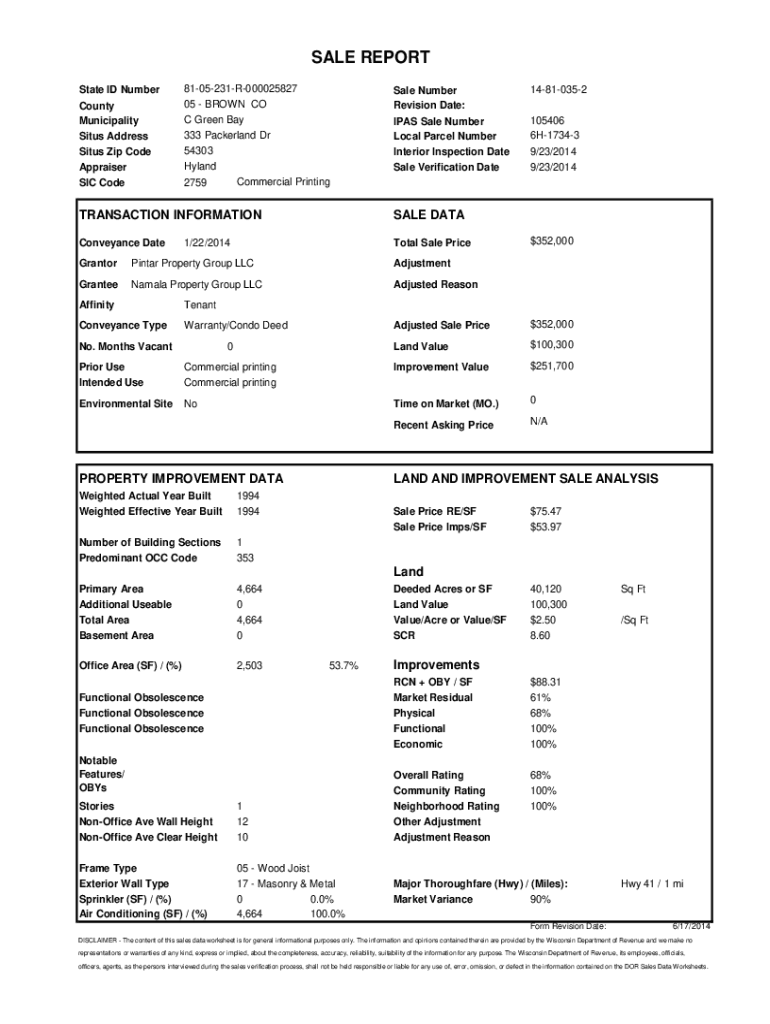

SALE REPORT State ID Number County Municipality Sites Address Sites Zip Code Appraiser SIC Code8105231R000025827 05 BROWN CO C Green Bay 333 Packer land Dr 54303 Hoyland Commercial Printing 2759Sale

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fuel tax statistical report

Edit your fuel tax statistical report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fuel tax statistical report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fuel tax statistical report online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fuel tax statistical report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fuel tax statistical report

How to fill out fuel tax statistical report

01

Step 1: Gather all the necessary data and documents such as fuel purchase receipts and vehicle mileage records.

02

Step 2: Identify the reporting period, usually a specific time frame, for which you will be submitting the fuel tax statistical report.

03

Step 3: Calculate the total amount of fuel purchased during the reporting period by adding up the fuel quantities from the receipts.

04

Step 4: Determine the total mileage covered by your vehicles during the reporting period.

05

Step 5: Calculate the fuel mileage by dividing the total mileage covered by the total amount of fuel purchased.

06

Step 6: Organize the data in a proper format specified by the relevant authorities or the reporting guidelines.

07

Step 7: Fill out the fuel tax statistical report form by entering the calculated data in the appropriate sections.

08

Step 8: Review the completed report for accuracy and completeness.

09

Step 9: Submit the fuel tax statistical report to the designated authority by the specified deadline.

Who needs fuel tax statistical report?

01

Any individual or organization involved in the transportation or fuel industry may need to fill out a fuel tax statistical report.

02

Government agencies and regulatory bodies often require fuel tax statistical reports to monitor fuel consumption, assess tax compliance, and make informed policy decisions.

03

Transportation companies, trucking firms, logistics providers, and other businesses operating a fleet of vehicles need to submit these reports to ensure proper documentation and compliance with fuel tax regulations.

04

Independent truck drivers and individual vehicle owners may also be required to fill out fuel tax statistical reports if they meet certain criteria, such as crossing state lines or operating for commercial purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fuel tax statistical report without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your fuel tax statistical report into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in fuel tax statistical report?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your fuel tax statistical report to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit fuel tax statistical report in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fuel tax statistical report, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is fuel tax statistical report?

The fuel tax statistical report is a document that provides data on the amount of fuel purchased and used by a business for tax reporting purposes.

Who is required to file fuel tax statistical report?

Businesses that are involved in the sale or use of taxable fuels are typically required to file the fuel tax statistical report.

How to fill out fuel tax statistical report?

The fuel tax statistical report can be filled out by providing accurate information on the amount of fuel purchased, used, and sold during a specific reporting period.

What is the purpose of fuel tax statistical report?

The purpose of the fuel tax statistical report is to track the consumption and sale of taxable fuels in order to calculate the appropriate fuel tax owed.

What information must be reported on fuel tax statistical report?

Information such as the type of fuel purchased, the quantity of fuel purchased, and the dates of purchases and usage must be reported on the fuel tax statistical report.

Fill out your fuel tax statistical report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fuel Tax Statistical Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.