Get the free Tax Incentives - San Antonio

Show details

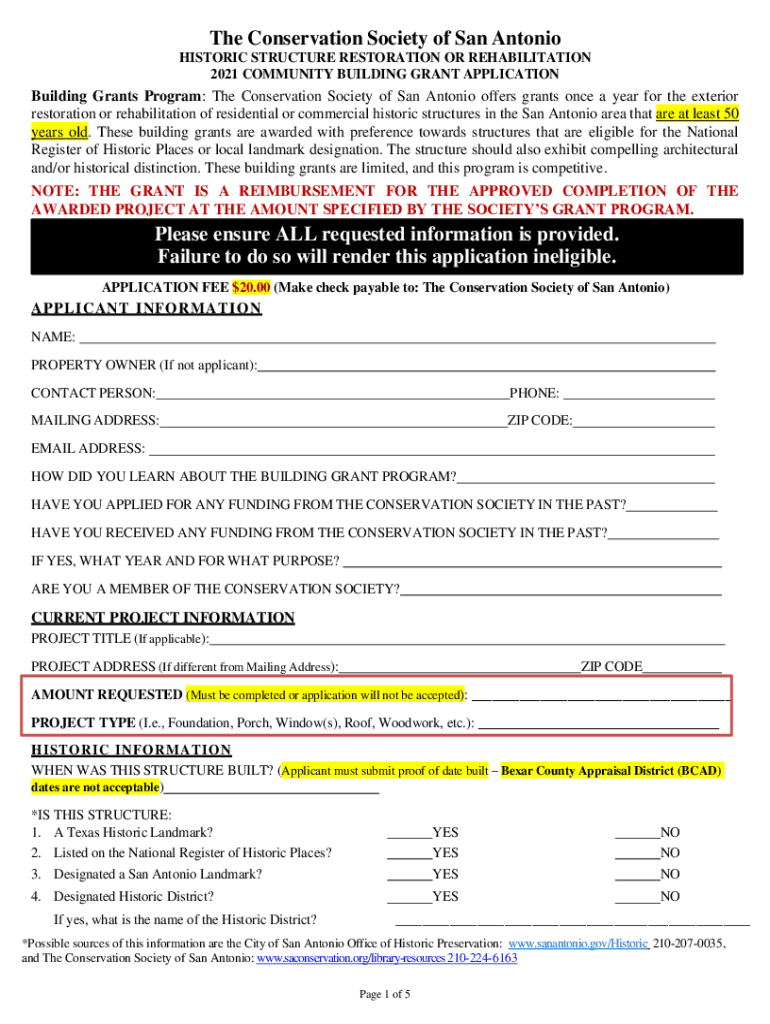

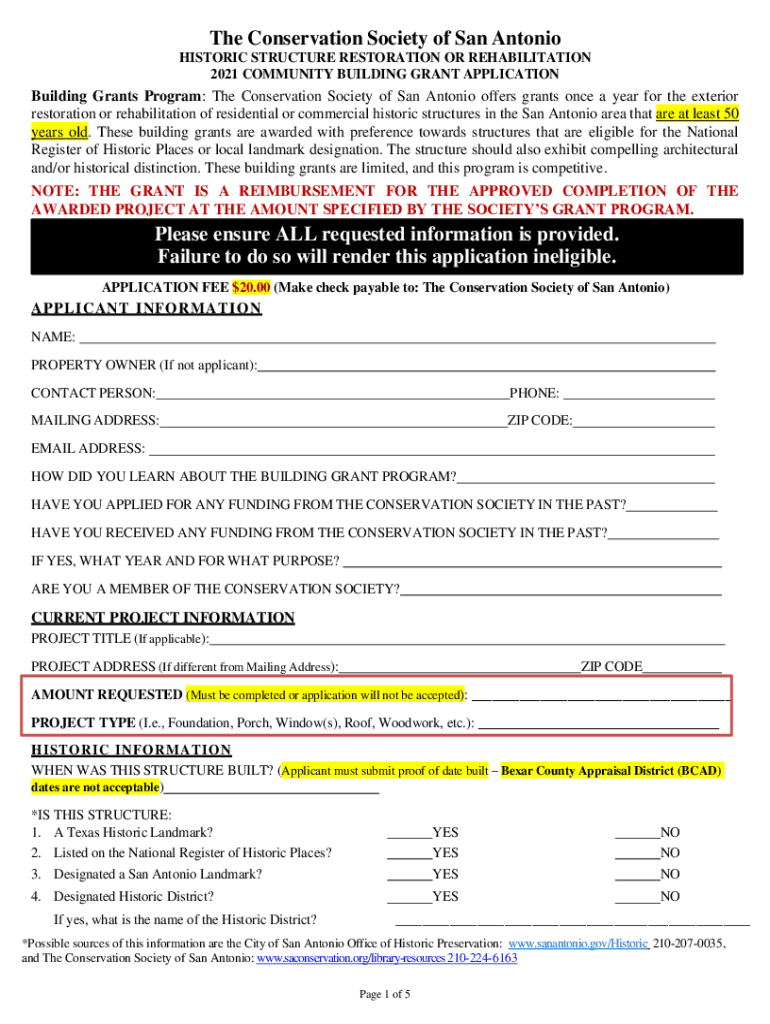

The Conservation Society of San Antonio HISTORIC STRUCTURE RESTORATION OR REHABILITATION 2021 COMMUNITY BUILDING GRANT APPLICATIONBuilding Grants Program: The Conservation Society of San Antonio offers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives - san

Edit your tax incentives - san form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives - san form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentives - san online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax incentives - san. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentives - san

How to fill out tax incentives - san

01

To fill out tax incentives, follow these steps:

02

- Gather all necessary and relevant financial documents, such as income statements, expense records, and receipts.

03

- Determine if you qualify for any specific tax incentives based on your business activity or personal circumstances.

04

- Research and understand the specific requirements and guidelines for each tax incentive you plan to claim.

05

- Fill out the appropriate tax forms accurately and completely, ensuring all relevant information is included.

06

- Double-check your calculations and review the completed forms for any errors or missing information.

07

- Attach any required supporting documents or proof of eligibility, as specified by the tax authorities.

08

- Submit the completed tax incentive forms and supporting documents to the relevant tax authority before the deadline.

09

- Track the status of your tax incentive claim and follow up with the tax authority if necessary.

10

- Keep copies of all submitted documents for future reference and record-keeping purposes.

Who needs tax incentives - san?

01

Tax incentives can be beneficial for various individuals and entities, including:

02

- Small business owners who want to reduce their tax burden and receive potential financial advantages.

03

- Startups and entrepreneurs who seek incentives to stimulate innovation, research, and development.

04

- Companies planning to invest in specific industries or regions to promote economic growth and job creation.

05

- Individuals or corporations engaged in eligible activities, such as renewable energy production, affordable housing development, or charitable contributions.

06

- Students, parents, or working individuals looking for education-related incentives or tax deductions.

07

- Governments aiming to attract foreign investments or retain domestic businesses through targeted incentives.

08

- Nonprofit organizations engaging in community services and seeking tax-exempt status or deductions for donations.

09

- Individuals or businesses facing financial hardships or certain circumstances that may warrant tax relief or incentives.

10

- Specific industries or sectors identified by government policies as needing support or encouragement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax incentives - san from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including tax incentives - san. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in tax incentives - san?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tax incentives - san to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I fill out tax incentives - san on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your tax incentives - san. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is tax incentives - san?

Tax incentives - san refer to specific tax breaks or reductions offered by the government to incentivize certain activities or behaviors such as investment in a particular sector or region.

Who is required to file tax incentives - san?

Businesses or individuals who meet the eligibility criteria set by the government and intend to benefit from the tax incentives - san are required to file for them.

How to fill out tax incentives - san?

To fill out tax incentives - san, individuals or businesses need to submit the necessary forms and documentation to the relevant tax authorities following the guidelines provided by the government.

What is the purpose of tax incentives - san?

The purpose of tax incentives - san is to stimulate economic growth, encourage investment, create job opportunities, and boost specific industries or regions.

What information must be reported on tax incentives - san?

The information required to be reported on tax incentives - san may include details of the activity or investment for which the incentives are being claimed, the amount of tax relief being sought, and any other supporting documents as specified by the government.

Fill out your tax incentives - san online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives - San is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.