TN Motor Carrier Ad Valorem Tax Report General Instructions 2022 free printable template

Show details

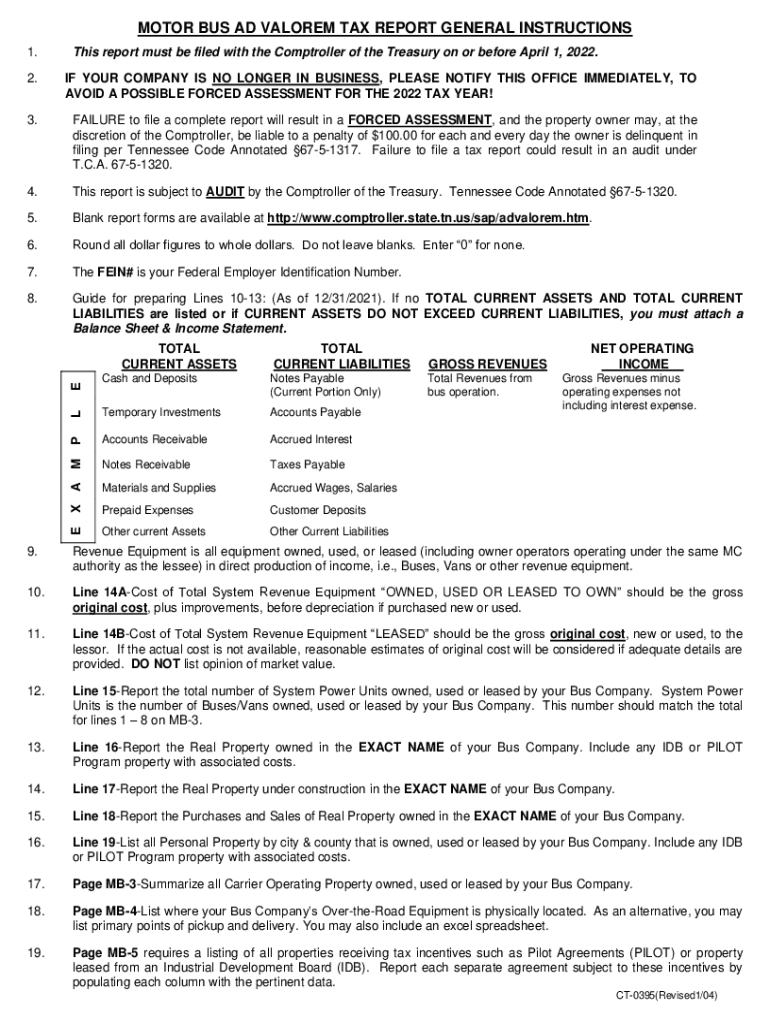

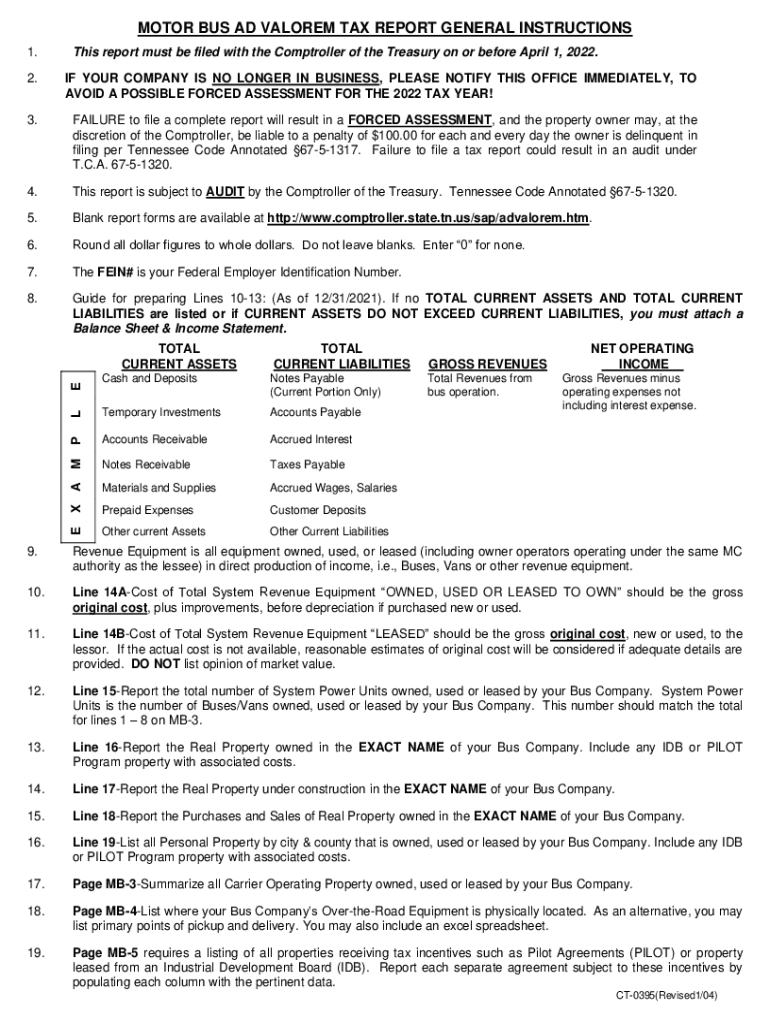

MOTOR BUS AD VALOR EM TAX REPORT GENERAL INSTRUCTIONS 1. This report must be filed with the Comptroller of the Treasury on or before April 1, 2022. This report is subject to AUDIT by the Comptroller

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN Motor Carrier Ad Valorem Tax

Edit your TN Motor Carrier Ad Valorem Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN Motor Carrier Ad Valorem Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN Motor Carrier Ad Valorem Tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TN Motor Carrier Ad Valorem Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN Motor Carrier Ad Valorem Tax Report General Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN Motor Carrier Ad Valorem Tax

How to fill out TN Motor Carrier Ad Valorem Tax Report

01

Obtain the TN Motor Carrier Ad Valorem Tax Report form from the Tennessee Department of Revenue website or your local tax office.

02

Fill in your business name, address, and contact information at the top of the form.

03

Provide the vehicle identification numbers (VINs) for all vehicles you own that are subject to ad valorem tax.

04

Enter the purchase price or fair market value of each vehicle.

05

Calculate the total value of all vehicles by summing the individual values.

06

Indicate any exemptions that may apply to your vehicles, if applicable.

07

Review the form for accuracy, ensuring all required fields are complete.

08

Submit the completed form to the appropriate local tax office or the Department of Revenue by the due date.

Who needs TN Motor Carrier Ad Valorem Tax Report?

01

Any motor carrier operating commercial vehicles in Tennessee that are subject to ad valorem tax needs to complete the TN Motor Carrier Ad Valorem Tax Report.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax form for TennCare?

You can ask us to send you one for each person in your household who had coverage with us last tax year. How to ask for a 1095-B tells you how. The Frequently Asked Questions has answers to other questions you may have about the 1095-B health care tax document. CALL: TennCare Connect for free at 855-259-0701.

Does TN have a state tax form?

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

What taxes are ad valorem?

Ad Valorem is a tax imposed on the basis of value. The County levies an ad valorem property tax rate equal to one percent (1%) of the full assessed value.

What is an example of a valorem tax?

An example of the ad valorem tax is a local property tax, which is assessed annually on the value of an owner's residence and property. A homeowner's property tax is levied by local governments and could even be levied by county governments, municipalities, or local school districts.

Does TN have ad valorem tax?

All business tangible personal property is subject to an ad valorem tax under Tennessee law.

What is another name for ad valorem tax?

"Ad valorem" tax, most frequently referred to as property tax, relates to the tax that results when the net assessed value of a property is multiplied times the millage rate applicable to that property. This millage rate is usually expressed as a multiple of 1/1000 of a dollar.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TN Motor Carrier Ad Valorem Tax in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your TN Motor Carrier Ad Valorem Tax and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete TN Motor Carrier Ad Valorem Tax online?

Completing and signing TN Motor Carrier Ad Valorem Tax online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit TN Motor Carrier Ad Valorem Tax online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your TN Motor Carrier Ad Valorem Tax to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is TN Motor Carrier Ad Valorem Tax Report?

The TN Motor Carrier Ad Valorem Tax Report is a document required by the state of Tennessee to assess and collect ad valorem taxes on property owned by motor carriers operating in the state.

Who is required to file TN Motor Carrier Ad Valorem Tax Report?

Motor carriers that operate commercial vehicles in Tennessee and own taxable property are required to file the TN Motor Carrier Ad Valorem Tax Report.

How to fill out TN Motor Carrier Ad Valorem Tax Report?

To fill out the TN Motor Carrier Ad Valorem Tax Report, you must provide information about the motor carrier’s business, details of owned vehicles, equipment, and the assessed value of the property.

What is the purpose of TN Motor Carrier Ad Valorem Tax Report?

The purpose of the TN Motor Carrier Ad Valorem Tax Report is to facilitate the assessment of ad valorem taxes on personal property owned by motor carriers, ensuring compliance with state tax laws.

What information must be reported on TN Motor Carrier Ad Valorem Tax Report?

The report must include the motor carrier's name, address, vehicle identification numbers, descriptions of the vehicles and equipment, purchase dates, and the assessed value of all taxable property.

Fill out your TN Motor Carrier Ad Valorem Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN Motor Carrier Ad Valorem Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.