TN Motor Carrier Ad Valorem Tax Report General Instructions 2024 free printable template

Show details

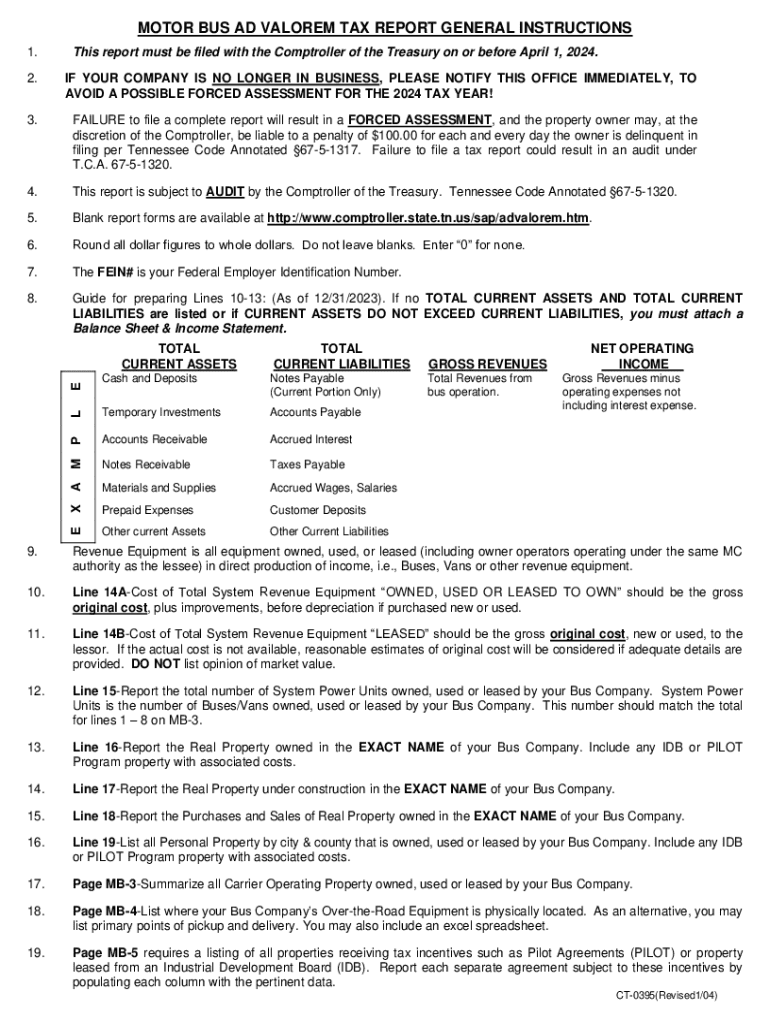

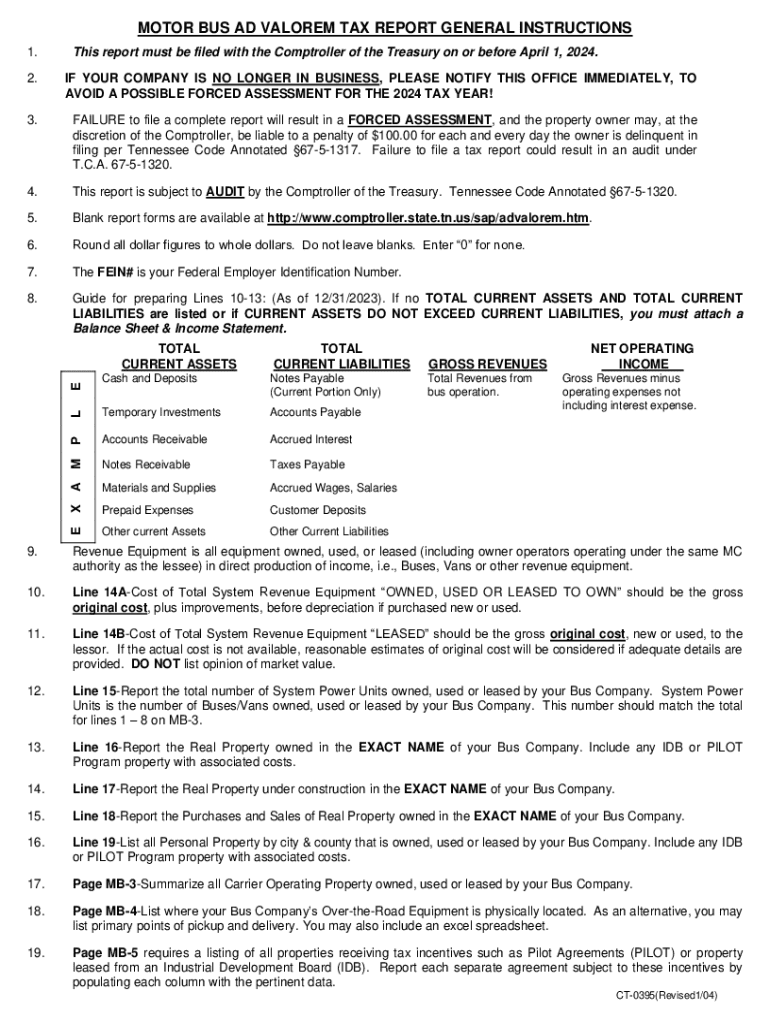

MOTOR BUS AD VALOR EM TAX REPORT GENERAL INSTRUCTIONS 1. This report must be filed with the Comptroller of the Treasury on or before April 1, 2024. This report is subject to AUDIT by the Comptroller

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN Motor Carrier Ad Valorem Tax

Edit your TN Motor Carrier Ad Valorem Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN Motor Carrier Ad Valorem Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN Motor Carrier Ad Valorem Tax online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TN Motor Carrier Ad Valorem Tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN Motor Carrier Ad Valorem Tax Report General Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN Motor Carrier Ad Valorem Tax

How to fill out TN Motor Carrier Ad Valorem Tax Report

01

Obtain the TN Motor Carrier Ad Valorem Tax Report form from the official state website or local tax office.

02

Fill in the carrier's name, address, and Vehicle Identification Number (VIN) for each vehicle being reported.

03

List the total value of each vehicle based on the state's valuation guidelines.

04

Calculate the total assessed value by applying the appropriate tax rate to the vehicle values listed.

05

Provide any necessary documentation to support the claim, such as purchase receipts or prior tax records.

06

Review the completed form for accuracy and completeness.

07

Submit the report by the designated filing deadline, along with any required payments.

Who needs TN Motor Carrier Ad Valorem Tax Report?

01

Motor carriers operating in Tennessee that own or lease vehicles.

02

Companies that are required to report and pay ad valorem taxes on their commercial vehicles.

03

Individuals or businesses that meet the state's criteria for motor carrier operations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax form for TennCare?

You can ask us to send you one for each person in your household who had coverage with us last tax year. How to ask for a 1095-B tells you how. The Frequently Asked Questions has answers to other questions you may have about the 1095-B health care tax document. CALL: TennCare Connect for free at 855-259-0701.

Does TN have a state tax form?

Tennessee does not tax individual's earned income, so you are not required to file a Tennessee tax return. Since the Hall Tax in Tennessee has ended. Starting with Tax Year 2021 Tennessee will be among the states with no individual income.

What taxes are ad valorem?

Ad Valorem is a tax imposed on the basis of value. The County levies an ad valorem property tax rate equal to one percent (1%) of the full assessed value.

What is an example of a valorem tax?

An example of the ad valorem tax is a local property tax, which is assessed annually on the value of an owner's residence and property. A homeowner's property tax is levied by local governments and could even be levied by county governments, municipalities, or local school districts.

Does TN have ad valorem tax?

All business tangible personal property is subject to an ad valorem tax under Tennessee law.

What is another name for ad valorem tax?

"Ad valorem" tax, most frequently referred to as property tax, relates to the tax that results when the net assessed value of a property is multiplied times the millage rate applicable to that property. This millage rate is usually expressed as a multiple of 1/1000 of a dollar.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in TN Motor Carrier Ad Valorem Tax?

The editing procedure is simple with pdfFiller. Open your TN Motor Carrier Ad Valorem Tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out the TN Motor Carrier Ad Valorem Tax form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign TN Motor Carrier Ad Valorem Tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out TN Motor Carrier Ad Valorem Tax on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your TN Motor Carrier Ad Valorem Tax, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is TN Motor Carrier Ad Valorem Tax Report?

The TN Motor Carrier Ad Valorem Tax Report is a form that motor carriers in Tennessee must file to report the value of their vehicles for tax purposes. It is used to assess the ad valorem tax on motor carriers operating within the state.

Who is required to file TN Motor Carrier Ad Valorem Tax Report?

Any motor carrier operating commercial vehicles in Tennessee that exceed a certain weight threshold is required to file the TN Motor Carrier Ad Valorem Tax Report. This includes businesses that use trucks and commercial vehicles for transporting goods.

How to fill out TN Motor Carrier Ad Valorem Tax Report?

To fill out the TN Motor Carrier Ad Valorem Tax Report, motor carriers must provide details such as the vehicle identification number (VIN), the type of vehicle, its year, make, model, and the assessed value for tax calculation. Accurate information must be entered, and the form should be submitted by the specified deadline.

What is the purpose of TN Motor Carrier Ad Valorem Tax Report?

The purpose of the TN Motor Carrier Ad Valorem Tax Report is to document the value of commercial vehicles for tax assessment. It ensures that motor carriers pay the appropriate ad valorem taxes based on the assessed value of their vehicles, contributing to state and local revenue.

What information must be reported on TN Motor Carrier Ad Valorem Tax Report?

The information that must be reported on the TN Motor Carrier Ad Valorem Tax Report includes the vehicle's VIN, year, make, model, the date of purchase, the value of the vehicle, and any applicable deductions or exemptions.

Fill out your TN Motor Carrier Ad Valorem Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN Motor Carrier Ad Valorem Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.