Get the free Change to Interest-Only Repayments form. - ME Bank

Show details

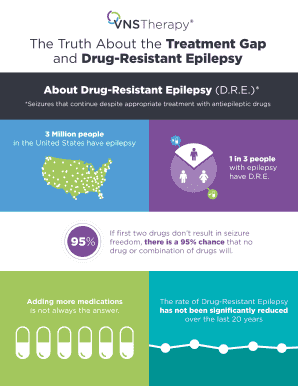

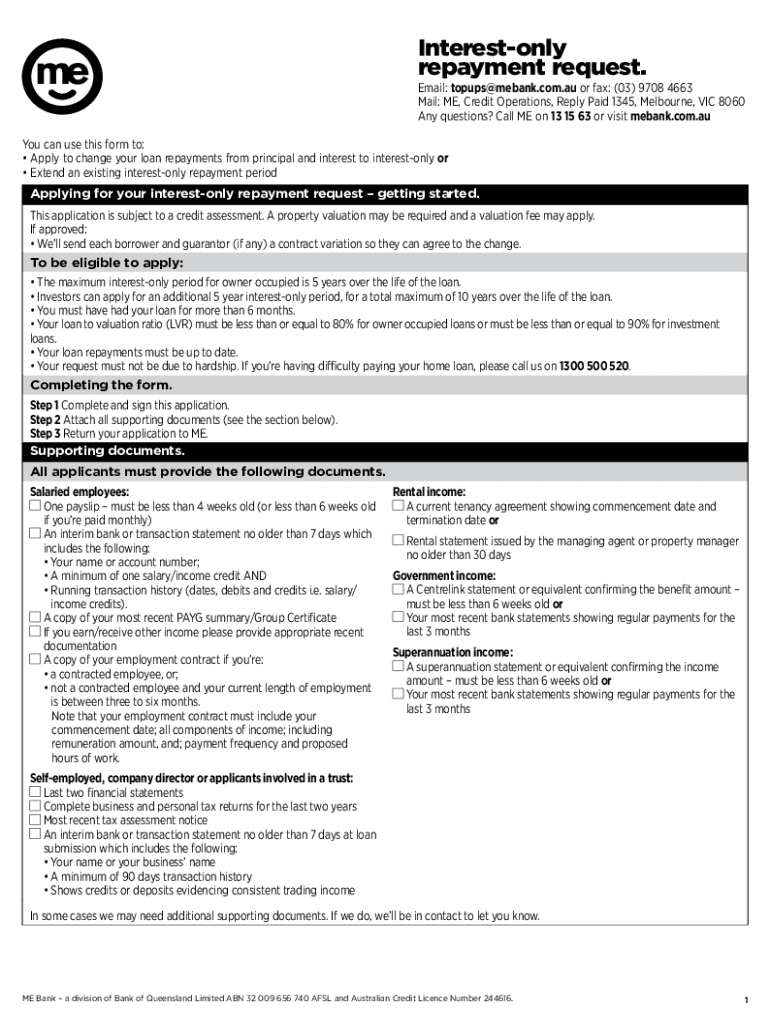

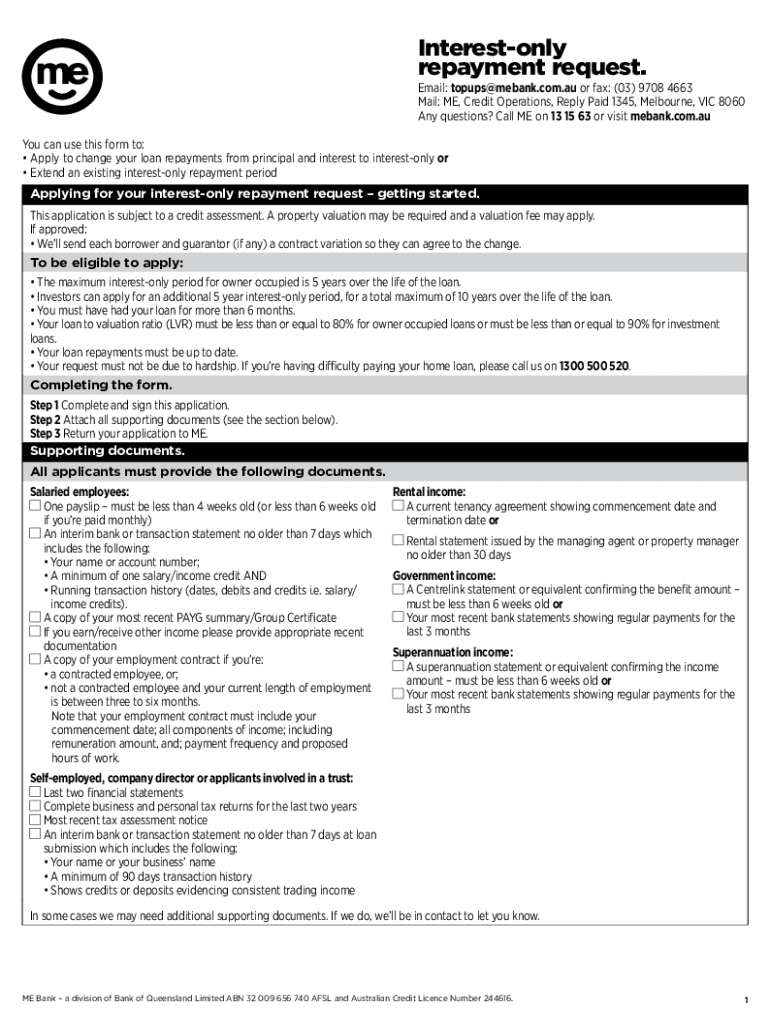

Interest only repayment request. Email: topups@mebank.com.au or fax: (03) 9708 4663 Mail: ME, Credit Operations, Reply Paid 1345, Melbourne, VIC 8060 Any questions? Call ME on 13 15 63 or visit mebank.com.AU

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign change to interest-only repayments

Edit your change to interest-only repayments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your change to interest-only repayments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing change to interest-only repayments online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit change to interest-only repayments. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out change to interest-only repayments

How to fill out change to interest-only repayments

01

To fill out a change to interest-only repayments, follow these steps:

02

Contact your lender or financial institution to inquire about the possibility of changing your repayment type to interest-only.

03

Provide the necessary information and documentation required by the lender, such as your loan account number, personal identification details, and financial statements.

04

Review and understand the terms and conditions associated with interest-only repayments, including any potential interest rate adjustments or other fees that may apply.

05

Complete the required application form provided by your lender, accurately filling in the relevant sections related to the change to interest-only repayments.

06

Submit the completed application form along with any additional requested documents to your lender.

07

Wait for confirmation from the lender regarding the approval or rejection of your request.

08

If approved, ensure that you understand the new repayment schedule and adjust your budget accordingly to accommodate the interest-only payments.

09

Keep track of any changes in your repayment obligations and stay in communication with your lender if you encounter any difficulties or have questions during the interest-only repayment period.

Who needs change to interest-only repayments?

01

Individuals who may benefit from changing to interest-only repayments include:

02

- Borrowers experiencing temporary financial hardship.

03

- Property investors looking to maximize their cash flow.

04

- Individuals with irregular income streams, such as freelancers or commission-based professionals.

05

- Homeowners facing specific life events that necessitate lower monthly loan commitments, such as starting a family or job loss.

06

- Borrowers seeking short-term financial flexibility or the ability to redirect funds towards other investments or expenses.

07

However, it is important to evaluate the potential long-term financial implications of interest-only repayments, as it may result in higher interest costs over time or prolonged debt repayment periods.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the change to interest-only repayments electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit change to interest-only repayments on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign change to interest-only repayments. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit change to interest-only repayments on an Android device?

You can edit, sign, and distribute change to interest-only repayments on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is change to interest-only repayments?

Change to interest-only repayments is when a borrower switches from making payments on both the principal and interest of a loan to only paying the interest for a certain period of time.

Who is required to file change to interest-only repayments?

Borrowers who wish to switch to interest-only repayments on their loan are required to file the change.

How to fill out change to interest-only repayments?

To fill out a change to interest-only repayments, borrowers typically need to contact their lender or loan servicer to request the change and complete any necessary paperwork.

What is the purpose of change to interest-only repayments?

The purpose of a change to interest-only repayments is to temporarily lower the borrower's monthly payments by only requiring them to pay the interest portion of the loan.

What information must be reported on change to interest-only repayments?

The information that must be reported on a change to interest-only repayments typically includes the borrower's personal information, loan details, and the requested start date for the interest-only payments.

Fill out your change to interest-only repayments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Change To Interest-Only Repayments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.