IRS 941-X 2022 free printable template

Show details

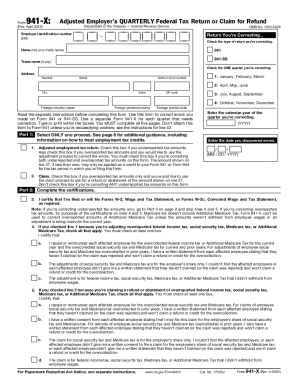

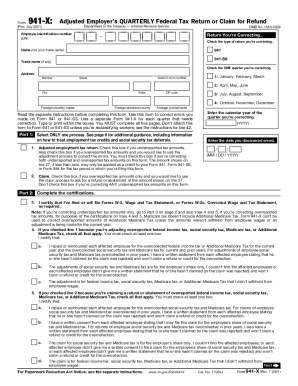

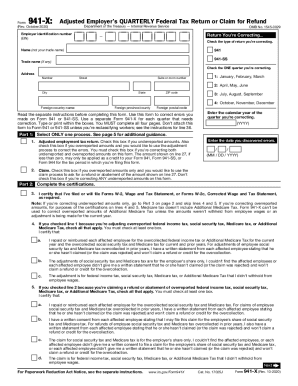

941-X Form Rev. April 2022 Adjusted Employer s QUARTERLY Federal Tax Return or Claim for Refund Department of the Treasury Internal Revenue Service Employer identification number EIN OMB No. 1545-0029 Return You re Correcting. Also check this box if you overreported tax amounts and you would like to use the adjustment process to correct the errors. You must check this box if you re correcting both underreported and overreported tax amounts on this form. The amount shown on line 27 if less than...zero may only be applied as a credit to your Form 941 Form 941-SS or Form 944 for the tax period in which you re filing this form. Claim. Check this box if you overreported tax amounts only and you would like to use the claim process to ask for a refund or abatement of the amount shown on line 27. Don t check this box if you re correcting ANY underreported tax amounts on this form. Enter the calendar year of the quarter you re correcting. Taxable social security wages Form 941 or 941-SS line 5a ...0. 124 Qualified sick leave wages Qualified family leave wages 941 or 941-SS line 5b Column 1 If you re correcting your employer share only use 0. 062. See instructions. 0062 Use line 9 only for qualified sick leave wages paid after March 31 2020 for leave taken before April 1 2021. Taxable Medicare wages tips Form 0. 029 Taxable wages tips subject to Additional Medicare Tax withholding Form 941 or 941-SS line 5d Section 3121 q Notice and Demand Tax due on unreported tips Form 941 or Tax...adjustments Form 941 or 941-SS lines 7 through 9 0. Use the amount in Column 1 when you prepare your Forms W-2 or Forms W-2c. Federal income tax withheld from wages tips and other Copy Column 3 here. Taxable social security wages Form 941 or 941-SS line 5a 0. 124 Qualified sick leave wages Qualified family leave wages 941 or 941-SS line 5b Column 1 If you re correcting your employer share only use 0. 062. See instructions. 0062 Use line 9 only for qualified sick leave wages paid after March 31...2020 for leave taken before April 1 2021. If any line doesn t apply leave it blank. Column 1 Total corrected amount for ALL employees Amount originally reported or as previously corrected for ALL employees Difference If this amount is a negative number use a minus sign. Tax correction Wages tips and other compensation Form 941 line 2. Use the amount in Column 1 when you prepare your Forms W-2 or Forms W-2c. Federal income tax withheld from wages tips and other Copy Column 3 here. Taxable social...security wages Form 941 or 941-SS line 5a 0. 124 Qualified sick leave wages Qualified family leave wages 941 or 941-SS line 5b Column 1 If you re correcting your employer share only use 0. For Paperwork Reduction Act Notice see the separate instructions. www.irs.gov/Form941X Cat. No. 17025J Form 941-X Rev. 4-2022 Correcting quarter Correcting calendar year YYYY Part 3 Enter the corrections for this quarter. If any line doesn t apply leave it blank. Column 1 Total corrected amount for ALL...employees Amount originally reported or as previously corrected for ALL employees Difference If this amount is a negative number use a minus sign. Tax correction Wages tips and other compensation Form 941 line 2. Use the amount in Column 1 when you prepare your Forms W-2 or Forms W-2c. Federal income tax withheld from wages tips and other Copy Column 3 here. I couldn t find the affected employees or each affected employee didn t give me a written consent to file a claim for the employee s share...of social security tax and Medicare tax The claim is for federal income tax social security tax Medicare tax or Additional Medicare Tax that I didn t withhold from d. For Paperwork Reduction Act Notice see the separate instructions. www.irs.gov/Form941X Cat. No. 17025J Form 941-X Rev. 4-2022 Correcting quarter Correcting calendar year YYYY Part 3 Enter the corrections for this quarter. If any line doesn t apply leave it blank. Column 1 Total corrected amount for ALL employees Amount originally...reported or as previously corrected for ALL employees Difference If this amount is a negative number use a minus sign. Tax correction Wages tips and other compensation Form 941 line 2. For refunds of employee social security tax and Medicare tax overcollected in prior years I also have a written statement from each affected employee stating that he or she hasn t claimed or the claim was rejected and won t claim a refund or credit for the overcollection. The claim for social security tax and...Medicare tax is for the employer s share only. I couldn t find the affected employees or each affected employee didn t give me a written consent to file a claim for the employee s share of social security tax and Medicare tax The claim is for federal income tax social security tax Medicare tax or Additional Medicare Tax that I didn t withhold from d. For Paperwork Reduction Act Notice see the separate instructions. www.irs.gov/Form941X Cat. No. 17025J Form 941-X Rev. 4-2022 Correcting quarter...Correcting calendar year YYYY Part 3 Enter the corrections for this quarter.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941-X

How to edit IRS 941-X

How to fill out IRS 941-X

Instructions and Help about IRS 941-X

How to edit IRS 941-X

Editing the IRS 941-X form is crucial for correcting any inaccuracies in your payroll tax reporting. To edit the form using pdfFiller, first upload your existing IRS 941-X document to the platform. Utilize the editing tools provided, which allow you to adjust text and numbers as needed. After making changes, save the form and ensure all data is accurate before finalizing it for submission.

How to fill out IRS 941-X

Filling out the IRS 941-X form requires careful attention to detail to amend previously filed Form 941. Start by entering your business information at the top of the form. Then, indicate the year and quarter you are amending. Follow the specific lines on the form to report corrected figures. If you are correcting employment tax amounts, ensure you also include explanations for the changes in the designated area.

About IRS 941-X 2022 previous version

What is IRS 941-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 941-X 2022 previous version

What is IRS 941-X?

IRS 941-X is the official form used to correct errors in previously filed Form 941, the Employer's Quarterly Federal Tax Return. Employers file Form 941 to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks, along with their portion of Social Security and Medicare tax. By filing the 941-X, employers can amend these returns to reflect corrected amounts.

What is the purpose of this form?

The purpose of IRS 941-X is to allow employers to rectify errors made on Form 941 that affect the accuracy of tax liabilities reported to the IRS. Common reasons for filing the 941-X include correcting pay periods, employee count, or changes in tax amounts withheld. By filing this amendment form, employers ensure compliance with federal tax laws and regulations, preventing future penalties.

Who needs the form?

Employers who have previously filed Form 941 and later discovered discrepancies in their payroll tax information need to file IRS 941-X. This form is particularly relevant for businesses with employees, whether they made errors in reporting wages, taxes withheld, or other essential data. Additionally, accountants and payroll processors managing tax obligations for businesses may also need to utilize this form for their clients.

When am I exempt from filling out this form?

There are specific scenarios in which an employer may be exempt from filing IRS 941-X. If there are no errors to correct on a previously filed Form 941, or if all tax liabilities were properly reported and paid, there is no need to submit a 941-X. Additionally, if only the numbers on line 1 or 2 of Form 941 are being amended but not affecting overall tax liability, a 941-X may not be necessary.

Components of the form

IRS 941-X includes several key components that employers must understand. The form consists of identifying information such as the employer's name, address, and Employer Identification Number (EIN). It also includes sections for reporting corrected amounts for wages, taxes withheld, and adjustments. An explanation section allows filers to describe the reasons for the amendments being made.

What are the penalties for not issuing the form?

Failing to file IRS 941-X when corrections are needed can result in significant penalties. Employers may face fines for underreported tax liabilities and may be liable for interest accruing on unpaid taxes. Additionally, the IRS may audit an employer's tax filings, leading to further scrutiny and penalties. It is crucial to amend errors promptly to maintain compliance and avoid these potential consequences.

What information do you need when you file the form?

When filing IRS 941-X, an employer should have specific information ready, including the previously reported amounts from Form 941 that will be amended. This includes verified figures for wages, taxes withheld, and any other adjustments. It is also necessary to clearly articulate the reason for the corrections in the explanation section of the form.

Is the form accompanied by other forms?

IRS 941-X is primarily a standalone form for correcting previously filed Form 941. However, in certain cases, it may need to be accompanied by supporting documents that provide evidence or explanation for the corrections being made. For example, if there were discrepancies related to employee classifications, relevant payroll reports may need to be attached.

Where do I send the form?

The destination for sending the IRS 941-X depends on the employer's location and whether the form is filed on paper or electronically. Employers filing on paper should refer to the instructions on the form to determine the correct mailing address, which varies by state. If filing electronically, use the approved IRS e-file provider's platform to ensure prompt submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy, efficient, and resourceful! Exactly what I needed.

First time using and the program is 'user friendly' which I love!

See what our users say