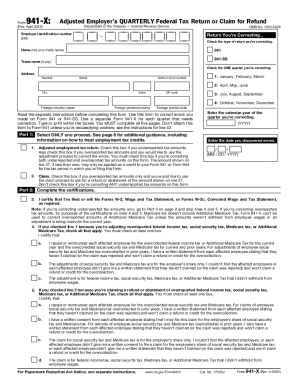

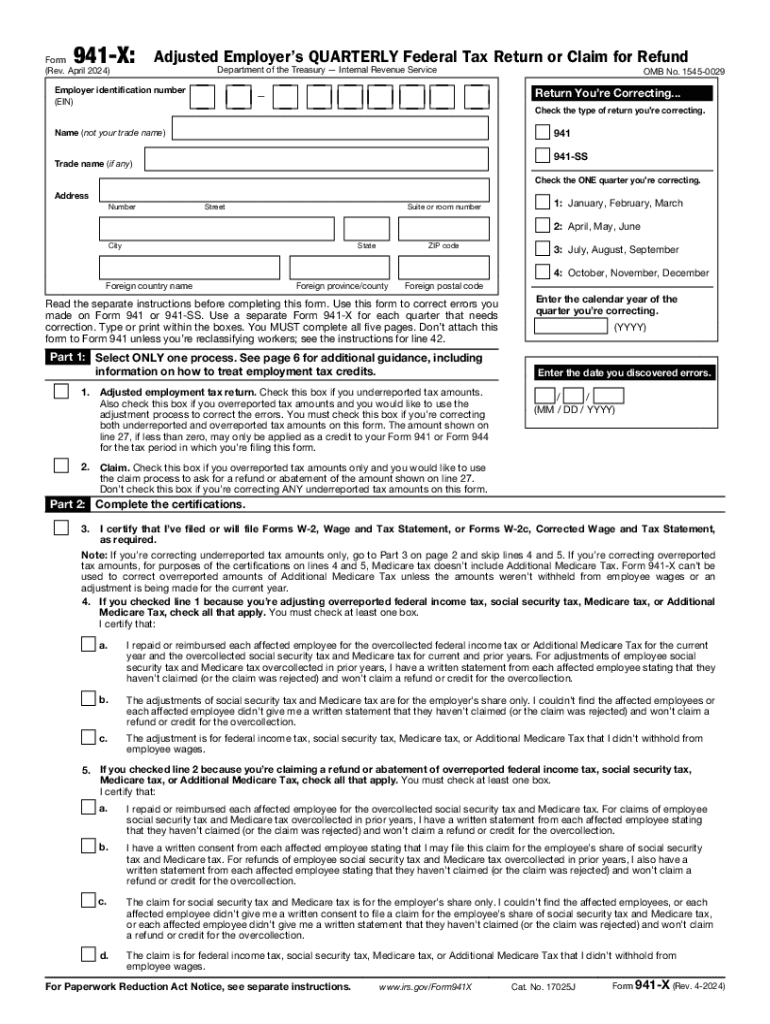

IRS 941-X 2024 free printable template

Instructions and Help about IRS 941-X

How to edit IRS 941-X

How to fill out IRS 941-X

About IRS 941-X 2024 previous version

What is IRS 941-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

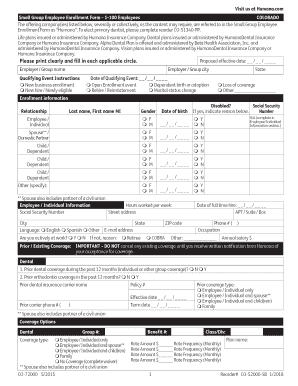

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941-X

How can I correct mistakes after filing IRS 941-X?

After filing IRS 941-X, if you realize there's an error, you can submit another IRS 941-X form to correct the information. Ensure that you indicate the specific lines that need correction and provide a clear explanation for the changes. It's essential to keep a record of all amendments for your files.

What should I do if my IRS 941-X submission is rejected?

If your IRS 941-X is rejected, review the specific rejection codes provided by the IRS. Common issues include incorrect identification information or missing signatures. Correct the errors based on the feedback and resubmit the form promptly to avoid further complications.

What types of e-signatures are accepted for the IRS 941-X?

For the IRS 941-X, e-signatures are permitted if they comply with IRS guidelines. Ensure that any electronic signature method used meets security and authenticity requirements to confirm the identity of the signer. Always refer to the latest IRS updates for specific requirements.

How can I verify the status of my IRS 941-X filing?

To check the status of your IRS 941-X filing, you can use the IRS online tools available for tracking submissions. Additionally, consider maintaining confirmation of e-filed submissions or any correspondence received from the IRS. This tracking can help you monitor the processing of your amendment.

What steps should I take if I receive an IRS notice regarding my 941-X?

If you receive an IRS notice concerning your 941-X, read the notice carefully to understand the issue raised. Prepare any documentation that supports your position and respond in a timely manner, following the instructions provided in the notice. If necessary, consult with a tax professional to navigate complex issues.

See what our users say